When you stack DeFi protocols like Lego bricks, you’re not just building something new-you’re building a house of cards. One broken piece can bring down the whole structure. That’s the reality of composability risks in blockchain systems. It sounds powerful: take a lending protocol, plug it into a dex, feed its tokens into a yield aggregator, and layer on insurance. But every connection is a potential fault line. And when one fails, it doesn’t just stop-it spreads.

What Composability Actually Means in Blockchain

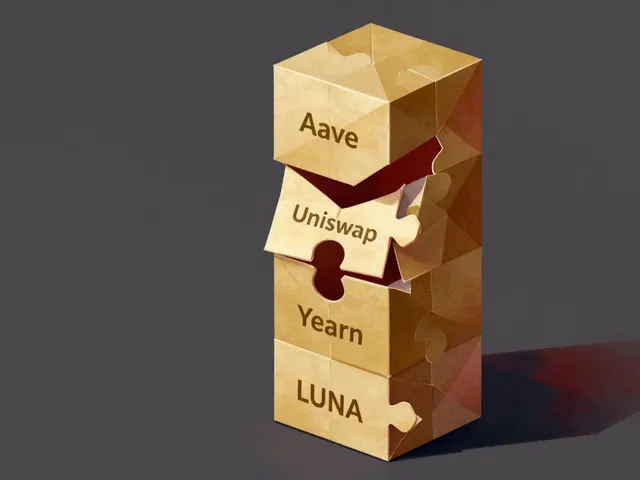

Composability is the idea that smart contracts can talk to each other, reuse each other’s code, and combine functions like building blocks. A user can deposit ETH into Aave, use that as collateral to borrow DAI, swap the DAI on Uniswap, then stake the resulting LP tokens in Yearn for yield-all in one transaction. That’s the dream: permissionless innovation, no middlemen, maximum flexibility. But here’s the catch: every time a contract calls another, it’s trusting it. Not just the code, but its uptime, its security, its behavior under stress. If one contract has a bug, gets hacked, or just gets overwhelmed by traffic, every system that depends on it starts to wobble. That’s not a theoretical risk. It’s happened. Repeatedly.Cascading Failures: How One Crash Becomes a Chain Reaction

A cascading failure isn’t just multiple things breaking. It’s one thing breaking, then forcing others to break because they’re forced to react. Think of it like a traffic jam that starts with one car braking, then ten cars behind it slam their brakes, then a truck can’t stop in time, and suddenly you’ve got a 20-car pileup-even though only one car was the original problem. In blockchain, this often happens through:- Price oracles going offline or feeding bad data

- A liquidity pool getting drained by a flash loan attack

- A staking contract freezing due to a reentrancy bug

- A token’s value collapsing, triggering margin calls across multiple protocols

Why Blockchain Makes Cascades Worse

Traditional systems have firewalls, rate limits, human oversight, and rollback procedures. Blockchains? They’re automated, immutable, and global. Once a transaction is confirmed, you can’t undo it. No CEO can call a meeting. No engineer can hit pause. Here’s what makes blockchain cascades uniquely dangerous:- No circuit breakers: Most DeFi protocols don’t have manual shutdown switches. Even if they did, who would pull the lever? No central authority.

- Global, 24/7 exposure: Markets never sleep. A failure in Asia can trigger panic in Europe before the U.S. even wakes up.

- Smart contract dependencies: One contract might call 10 others. Each of those calls 3 more. You’re not just trusting one piece of code-you’re trusting a web of them.

- Flash loan exploits: Attackers can borrow millions in seconds, manipulate prices, trigger liquidations, and vanish-all before the system even registers something’s wrong.

Real-World Examples: When the Dominoes Fell

In 2021, the Harvest Finance exploit didn’t just steal $24 million-it exposed how a single flawed oracle implementation could be weaponized across multiple protocols. Harvest used a price feed from a single source. Attackers manipulated that feed, tricked the system into thinking a token was worth 100x more than it was, borrowed against fake collateral, and drained the vault. In 2023, a minor bug in a popular ERC-20 token’s transfer function caused a ripple across 17 DeFi apps. The bug didn’t let tokens be transferred if the sender had a zero balance. But some yield aggregators were automatically rebalancing positions-even if the user’s balance was temporarily zero due to pending transactions. The system kept trying to move tokens that couldn’t move. Thousands of transactions failed. Gas fees spiked. Wallets got stuck. Users couldn’t withdraw. The whole ecosystem slowed to a crawl for 14 hours. These aren’t edge cases. They’re symptoms of a system designed for speed, not safety.How to Spot a Composability Risk Before It’s Too Late

You don’t need to be a cryptographer to see the warning signs. Here’s what to look for:- Too many dependencies: If a protocol calls more than 5 external contracts, it’s getting risky. Each one is a potential single point of failure.

- Single-source oracles: If a protocol relies on one price feed-especially from a centralized source-it’s vulnerable. Look for protocols that use multiple oracles with consensus mechanisms.

- No pause or emergency functions: Even if you don’t want to use them, the option to pause withdrawals or trading during a crisis is a basic safety net. If it’s missing, treat the protocol like a car without brakes.

- High TVL with low liquidity: If a protocol has $500 million locked up but only $20 million in actual trading volume, it’s a sitting duck for a flash loan attack.

- Unaudited or outdated code: If the last audit was over a year ago, or if the contract hasn’t been updated since 2021, assume it’s a ticking bomb.

What Can Be Done? Building Resilience Into Composability

Composability isn’t the problem. The problem is building it without resilience. Here’s how the most secure protocols are adapting:- Gradual exposure: Instead of letting new contracts go live with full access, they start with limited functions-like a beta test. Only after weeks of monitoring do they unlock full composability.

- Failure isolation: Some protocols now use “sandboxes” where external calls are simulated before being executed on-chain. If a call would trigger a cascade, it’s blocked before it even starts.

- Dynamic circuit breakers: Protocols like Aave and Compound now monitor volatility thresholds. If a token’s price swings more than 15% in 5 minutes, withdrawals are temporarily paused. Not to stop users-but to give the system time to stabilize.

- Decentralized monitoring: Projects like Chainlink and The Graph now offer decentralized alerting systems that notify users when a dependency starts acting strangely-before it breaks.

The Future: Can We Have Both Innovation and Safety?

The next wave of blockchain innovation-cross-chain lending, AI-driven yield strategies, tokenized real-world assets-will rely even more on composability. But the risks are growing faster than the safeguards. The industry is starting to wake up. Standards like EIP-7212 (emergency pause functions) and ERC-6372 (dependency transparency) are gaining traction. Some DeFi aggregators now show a “risk score” for each protocol based on its connections, audit history, and oracle setup. But adoption is slow. Most users still chase the highest APY without looking under the hood. And that’s the real danger. The next big cascade won’t come from a hacker. It’ll come from a user who just wanted to earn 20% and didn’t realize they were betting on a house of cards.What You Should Do Right Now

If you’re using DeFi:- Never put more into a protocol than you’re willing to lose-especially if it’s layered with other protocols.

- Use tools like DeFiLlama or Rekt to check if a protocol has been exploited before.

- Avoid protocols that rely on a single token or oracle unless you understand exactly how it works.

- Keep a portion of your assets in simple, non-composable wallets. Not everything needs to be earning yield.

What is composability in blockchain?

Composability in blockchain means smart contracts can interact and combine with each other like building blocks. For example, a lending protocol can feed assets into a decentralized exchange, which then feeds into a yield aggregator-all in one seamless flow. This enables rapid innovation but also creates hidden dependencies where a failure in one contract can trigger failures in others.

Can a single smart contract cause a blockchain-wide crash?

Yes. A single contract with a bug, poor security, or reliance on a vulnerable oracle can trigger cascading failures. For example, the 2022 LUNA/UST collapse started with a broken price peg, but because dozens of DeFi protocols used LUNA as collateral, the failure spread rapidly, wiping out over $40 billion in value across the ecosystem.

How are cascading failures different from regular hacks?

A hack is a targeted attack-someone exploits a vulnerability to steal funds. A cascading failure is a chain reaction: one system fails, and because others depend on it, they fail too-even if they’re secure. It’s not about theft; it’s about systemic collapse triggered by interdependence.

Are there any blockchain protocols designed to prevent cascading failures?

Yes. Protocols like Aave, Compound, and Curve now include dynamic circuit breakers that pause trading or withdrawals during extreme volatility. Some also use multi-oracle price feeds and dependency monitoring tools to detect risky interactions before they happen. These are still emerging, but they’re becoming standard in top-tier DeFi.

Should I avoid DeFi because of these risks?

No-but be smarter. You don’t need to avoid DeFi. You need to avoid blindly stacking high-risk protocols. Stick to well-audited, transparent projects with multiple safeguards. Keep a portion of your assets in simple wallets. Understand what you’re connected to. Composability is powerful, but only if you know how to use it safely.

Ryan Depew

Bro, this whole DeFi thing is just a casino with smart contracts. You think you're investing, but you're just betting on someone else's buggy code. I've seen 3 projects collapse in 6 months because one oracle glitched. No one checks the dependencies. Everyone just chases APY like it's free money.

And don't even get me started on the 'decentralized' nonsense. If your protocol needs 12 external calls to work, it's not decentralized-it's a house of spaghetti code.

Adam Lewkovitz

Y’all act like this is some new problem. Remember 2018? Crypto was a graveyard of broken smart contracts. Now it’s just flashier. Same garbage, different branding.

Stop pretending this is innovation. It’s reckless. And if you’re using Yearn or Aave without reading the audit, you’re not a degenerate-you’re just dumb.

tim ang

Yo I just started learning this stuff and honestly this post made me pause. I was about to dump my ETH into some 40% APY pool. Now I’m checking DeFiLlama first. Thanks for the wake-up call 😅

Melissa Contreras López

You know what’s beautiful? That we’re even having this conversation. We’re building a new financial system from scratch, and yeah, it’s messy. But look how far we’ve come-from Bitcoin to cross-chain yield strategies in under 15 years.

Let’s not throw the baby out with the bathwater. The fixes are coming. People are waking up. And honestly? The ones who survive this chaos will be the architects of the next decade.

Stay curious. Stay cautious. But don’t quit.

Nadia Silva

The fact that you’re still calling this 'innovation' is proof you’ve never studied real financial systems. Wall Street had circuit breakers, collateral haircuts, and regulators. This? This is a toddler playing with dynamite and calling it 'disruption.'

And don’t even mention 'decentralization'-you’re all just trusting a few Ethereum devs who didn’t even finish college. Pathetic.

MICHELLE REICHARD

Wow. So the solution to cascading failures is… more complexity? You want to add sandboxes, dynamic circuit breakers, dependency monitoring? That’s not safety. That’s centralization with extra steps.

Real decentralization means no safety nets. If you can’t handle that, go back to your bank account. You’re not ready for crypto.

Julene Soria Marqués

Okay but did anyone else notice the author didn’t mention the real villain: MEV bots? They’re the ones triggering liquidations faster than humans can react. All this 'composability risk' talk is just distraction. The real issue is that miners and bots are gaming the system for profit.

Fix the MEV, not the contracts.

Ashok Sharma

This is a very thoughtful analysis. In India, we are seeing more retail investors enter DeFi without understanding the risks. Many believe that because something is on blockchain, it is safe. This post is a necessary reminder that technology does not replace due diligence.

Simple advice: Always check the audit report, verify the team, and never invest more than you can afford to lose.

Matthew Kelly

Love this breakdown. I used to think DeFi was magic. Now I see it as a Rube Goldberg machine made of smoke and mirrors 😅

Just last week I pulled my funds out of a 'high-yield' pool after seeing it called 7 other contracts. One of them was audited in 2021. No thanks.

Adam Fularz

Composability? More like com-pose-ability to fail. This isn’t innovation. It’s financial malpractice disguised as open source.

And don’t give me that 'it’s permissionless' crap. Permissionless doesn’t mean riskless. It means you’re the one holding the bag when it blows up.

Linda Prehn

So let me get this straight… you’re telling me that if one token crashes, every single protocol that touches it collapses? And there’s no off switch? No CEO to call? No human to fix it?

Then why the hell are we still doing this?

It’s not finance. It’s a horror movie and we’re all stuck in the theater

george haris

Just read this whole thing while sipping coffee. Honestly? This is the most clear-headed take I’ve seen in months.

What really hit me was the LUNA example. It wasn’t a hack. It was a domino effect. That’s terrifying. And it’s going to happen again. Probably sooner than we think.

What’s the one thing we can all do today? Stop chasing yield. Start reading contracts.

David Zinger

Oh wow so now we’re pretending this is a 'systemic risk' problem? Bro it’s just capitalism with more emojis. You think banks are safe? They crashed in 2008 and got bailed out. This? This is the people’s version. No bailouts. No handouts. Just consequences.

And honestly? I like it. Let the weak get wiped out. The strong survive. That’s how evolution works.

steven sun

im just here for the 25% apy and if it goes to 0 i just move to the next one. no stress. crypto is not for the faint hearted. if you cant handle a 50% drop you shouldnt be here

Paru Somashekar

Excellent analysis. As a financial technologist, I have reviewed several DeFi protocols. The greatest risk is not the code-it is the assumption that users understand the risks. Most users do not read the terms, do not understand oracle mechanisms, and do not monitor their positions.

Education must precede adoption. Without it, these failures are inevitable.

Heather Crane

I just want to say-thank you for writing this with so much care. 🌱

It’s easy to get swept up in the hype, but this post reminded me that true innovation isn’t about how fast you can stack protocols-it’s about how deeply you understand the risks.

I’m going to pause my yield farming this week and just hold in cold storage. Sometimes, the bravest move is to step back.

Chidimma Catherine

As a Nigerian, I see so many young people here investing their life savings into DeFi because they think it’s the only way out of poverty. This post should be mandatory reading.

It’s not about stopping them. It’s about helping them see the traps before they fall in. Thank you for speaking truth.

Nathan Drake

What if the real problem isn’t composability… but the illusion of control?

We think we’re building systems. But we’re really just creating dependencies we can’t see, governed by code we don’t understand, in a system that can’t be stopped.

Maybe the question isn’t how to make it safer… but whether we should be building it at all.

Taylor Mills

Everyone’s acting shocked. Newsflash: this was predictable. The entire DeFi space is built on the assumption that users are rational, that oracles are infallible, and that code is perfect.

None of those are true. So why are we surprised when it all implodes?

It’s not a bug. It’s a feature of the design.