Crypto Mining Energy Use: Why It Matters and What’s Really Happening

When you hear about crypto mining energy use, the total electricity consumed by computers solving cryptographic puzzles to validate blockchain transactions. Also known as blockchain power consumption, it’s not just a technical detail—it’s a real-world issue affecting grids, climate goals, and whether mining can even stay profitable. Bitcoin mining alone uses more electricity than entire countries like Argentina or the Netherlands. But not all mining is the same. The energy footprint of ASIC mining, a type of mining using specialized hardware built only for one task: hashing Bitcoin blocks is wildly different from GPU mining, using standard graphics cards to mine altcoins like Monero or Litecoin.

Most people think all crypto mining is energy-hungry, but that’s not true. Bitcoin, which relies on proof-of-work and ASICs, is the big outlier. It needs massive farms, cheap power, and cooling systems just to break even. Meanwhile, coins like Monero still run on GPUs, which are less efficient than ASICs but far less concentrated. A single home miner with a few GPUs can still make money without needing a warehouse full of machines. The real question isn’t whether mining uses energy—it’s whether that energy is wasted, renewable, or just unavoidable.

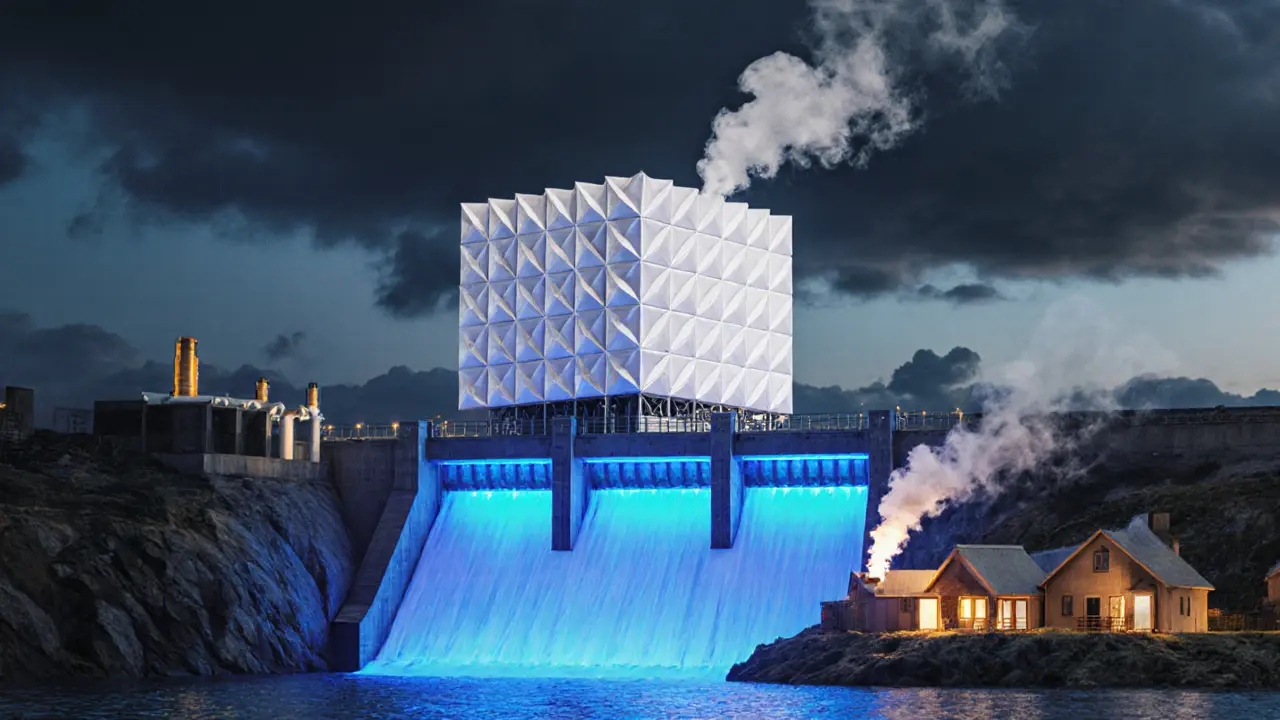

And it’s not just about the machines. Where the power comes from matters just as much. In places like Texas, Kazakhstan, and parts of Canada, miners are turning to stranded natural gas, hydroelectric dams, or excess wind power that would otherwise go unused. Some miners even flare methane from landfills just to power their rigs. That’s not green, but it’s better than burning coal. Meanwhile, in countries with strict emissions rules, mining is being pushed out—or forced to go underground, literally, by using geothermal heat or nuclear-powered facilities.

What you’ll find in these posts isn’t just data on kilowatt-hours. You’ll see real comparisons: how much power a Bitcoin miner uses versus a Litecoin miner, why GPU mining still makes sense in 2025, and how the rise of ASICs has made home mining nearly impossible for Bitcoin. You’ll also see how regulatory pressure is changing the game—some countries ban mining outright, while others offer tax breaks to miners who use renewable sources. This isn’t about fearmongering. It’s about understanding what’s real, what’s hype, and where the actual opportunities still exist.