Crypto Mining Energy Calculator

Calculate Your Crypto Mining Impact

Energy Impact Analysis

Sweden's energy targets require 85% emissions reduction by 2030. Crypto mining at scale directly conflicts with this goal.

Based on Sweden's 2023 data:

Bitcoin transaction: 707 kWh

Visa transaction: 0.0023 kWh

Bitcoin uses 300,000x more energy than Visa per transaction.

Sweden doesn’t ban cryptocurrency. But if you’re running a Bitcoin mining rig there, you’re fighting an uphill battle. The country isn’t stopping people from owning crypto - it’s making it nearly impossible to mine it at scale. Why? Because the energy use doesn’t match Sweden’s climate goals.

Why Sweden Sees Crypto Mining as a Climate Threat

In 2023, Sweden’s Financial Supervisory Authority (FI) and Financial Stability Council (FSC) sounded the alarm: Bitcoin mining was using up enough electricity to power 200,000 homes annually. That’s not just a number - it’s a direct conflict with Sweden’s pledge to cut emissions by 85% by 2030. The problem isn’t just how much power is used, but that it’s used for something that doesn’t deliver public value like heating, transport, or healthcare. The numbers are stark. Bitcoin’s global energy use in 2023 hit 143 TWh - more than Sweden or Norway consume as a country. Each Bitcoin transaction uses about 707 kWh. Compare that to a Visa transaction: 0.0023 kWh. That’s over 300,000 times more energy. And while Sweden gets 84% of its electricity from renewable or nuclear sources, adding crypto mining still increases total demand. That means more infrastructure, more strain on the grid, and more pressure on the environment - even if the energy isn’t fossil-based.China’s Ban Forced Mining to Sweden - and It Didn’t Go Well

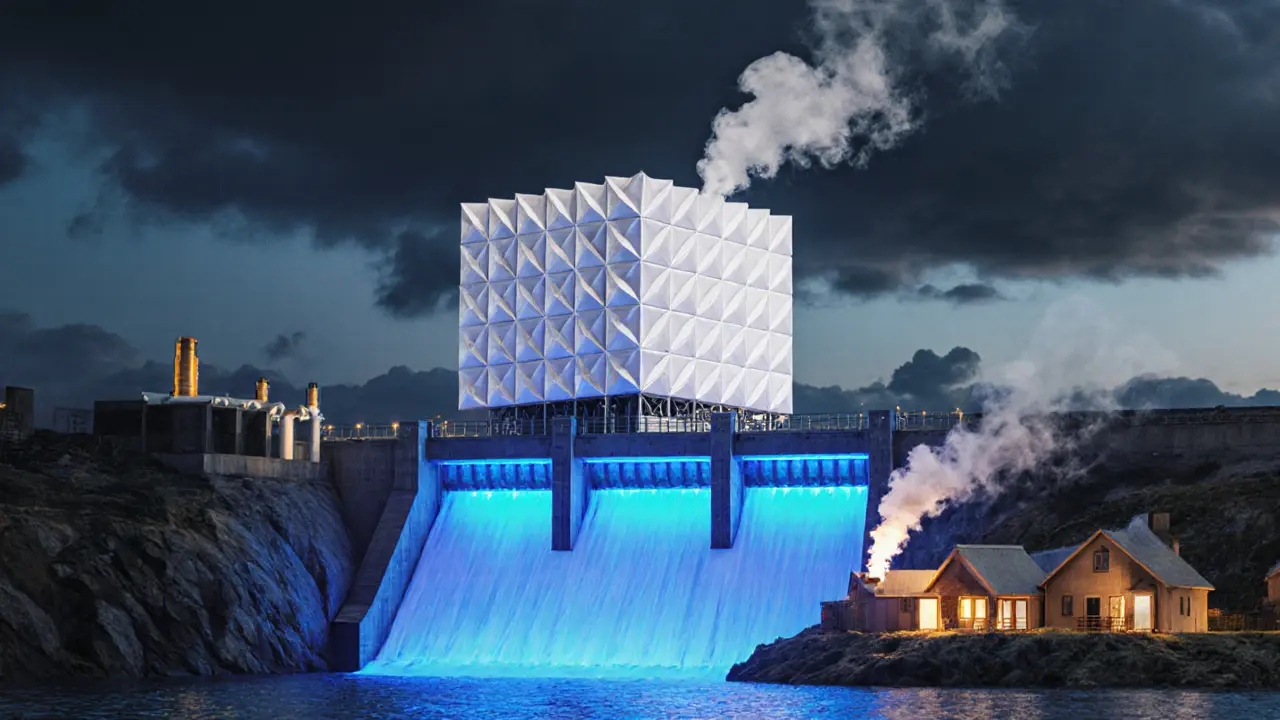

When China cracked down on crypto mining in 2021, operators didn’t disappear. They moved. And Sweden, with its cheap, clean electricity and cold climate (perfect for cooling servers), became a magnet. Between April and August 2022, mining energy use jumped by several hundred percent. Data centers popped up in Norrbotten and Västerbotten, often near hydroelectric plants. But here’s the catch: Sweden’s grid wasn’t built for 24/7 industrial loads from mining rigs. Municipalities like Boden and Kiruna started seeing local power shortages. Residents complained about blackouts during winter peaks. The government realized: this wasn’t just a tech trend. It was a strain on public infrastructure.Sweden’s Rules Are Harsher Than Most of Europe

While Germany and France only require crypto firms to register, Sweden demands full environmental impact assessments. Since 2024, any mining operation over 0.5 MW must submit quarterly reports showing exactly where their power comes from and how much CO2 it emits. They must also register with FI - a process that takes 4 to 6 months, compared to 1 to 2 months in Portugal or Estonia. Local governments added their own rules. Boden capped new mining facilities at 5 MW. Kiruna requires proof that 90% of energy is renewable. And banks? Many have quietly cut off services to mining companies, even if they use 100% hydro power. One operator in Norrbotten told Reddit he lost his business account without warning or explanation. Sweden ranks 47th out of 50 countries in crypto-friendliness, according to the 2024 Crypto Regulatory Index. Switzerland? Third. Germany? Eighteenth. Sweden? Last in the Nordic region.

But Not Everyone Agrees - And Some Are Finding Workarounds

Critics say Sweden’s approach misses the point. Dr. Per Jansson from KTH Royal Institute of Technology points out that mining rigs can act as energy buffers. In Boden, a pilot project showed mining farms could drop power use by 90% within 15 minutes when the grid was overloaded. That’s not a burden - it’s a stabilizer. The Swedish Blockchain Association argues that instead of banning mining, Sweden should regulate the financial side: tax profits, track transactions, enforce anti-money laundering rules. That’s what most countries do. And some companies are adapting. EcoChain, a Stockholm startup, switched from Bitcoin mining to Ethereum staking after Ethereum moved to proof-of-stake in 2022. Their energy use dropped by 99.95%. They’re now profitable on transaction fees alone.The Shift: From Ban to Transparency

Sweden’s initial push for an EU-wide Bitcoin mining ban failed. But they didn’t back down - they pivoted. In January 2025, Sweden passed the Crypto-Asset Environmental Transparency Act. Now, every large mining facility must broadcast real-time energy consumption and source data online. No more hidden operations. The government also dropped 18.4 million USD into waste heat recovery. In Luleå, a mining center now pipes excess heat into nearby housing districts. It recovers 65% of the heat - enough to warm 1,200 homes. That turns a climate liability into a public good. The Swedish Energy Agency now expects mining energy use to drop below 0.8 TWh by 2025 - down from 1.5 TWh in 2023. Why? Ethereum’s switch to proof-of-stake, rising electricity prices, and the exodus of miners.

Miners Are Leaving - And Sweden’s Crypto Scene Is Changing

A 2024 survey of 47 Swedish mining companies showed 68% plan to move out by 2026. Norway is the top destination - 42% are heading there, attracted by cheap hydropower and no regulatory friction. Germany and the U.S. follow. Sweden’s share of the Nordic crypto market has dropped from 38% in 2022 to 27% in 2025. Norway’s share jumped to 34%. Crypto exchanges in Sweden now have average Trustpilot ratings of 2.8 out of 5 - down from 4.2. Users complain about withdrawal limits and invasive KYC checks. But Sweden’s blockchain scene isn’t dying. It’s just changing focus. Stockholm now hosts 37% of all Nordic blockchain startups - and almost none of them are mining. They’re building enterprise ledgers, supply chain trackers, and digital identity tools. Kista Science City has 120 blockchain firms - and not one of them runs a Bitcoin rig.What’s Next for Sweden’s Crypto Policy?

Sweden isn’t giving up on crypto. It’s giving up on energy-intensive crypto. The 2025 Strategic Plan from FI makes it clear: they’re moving toward a Swiss-style model. No bans. Just rules that reward low-energy outcomes. Starting July 2025, all crypto service providers under the EU’s MiCA regulation must disclose environmental impacts - a rule Sweden helped push through. Sweden’s new tool? Carbon pricing for high-energy mining. Instead of shutting down operations, they’ll make them pay for the extra load on the grid. The goal isn’t to kill blockchain. It’s to make sure it doesn’t cost the planet. Sweden’s message is simple: if you want to mine here, prove you’re part of the solution - not the problem.Is Bitcoin mining illegal in Sweden?

No, Bitcoin mining is not illegal in Sweden. But it’s heavily regulated. Any mining operation over 0.5 MW must register with the Financial Supervisory Authority, submit detailed environmental impact reports, and publicly disclose real-time energy use. Many banks have stopped serving mining firms, and local municipalities impose strict limits on power connections.

Why does Sweden care more about crypto energy use than other countries?

Sweden has one of the cleanest electricity grids in the world - 84% from renewable or nuclear sources. But even clean energy has limits. The country’s climate goals require reducing total energy demand, not just switching sources. Sweden focuses on absolute consumption, not just the source. Other countries like the U.S. or Norway focus on whether the energy is renewable; Sweden asks, ‘Why use this much at all?’

Can I still mine crypto in Sweden legally?

Yes, but only under strict conditions. Small-scale operations (under 0.5 MW) face fewer hurdles. For larger setups, you need FI registration, environmental assessments, real-time energy reporting, and proof of renewable energy use in some areas. Many operators are switching to proof-of-stake or relocating to Norway and Germany instead.

What happened to the Bitcoin mining boom in Sweden?

The boom collapsed after 2022. After China’s ban pushed miners to Sweden, energy use spiked to 1.5 TWh annually. Public backlash, banking restrictions, and new regulations forced many out. By 2025, mining energy use had dropped by 40%. Most surviving operations are either small, using waste heat, or switched to proof-of-stake.

Is Ethereum mining still a problem in Sweden?

No. Ethereum switched from proof-of-work to proof-of-stake in September 2022. Its energy use dropped by 99.95%. Mining Ethereum on traditional rigs no longer exists. Today, Ethereum operations in Sweden are limited to staking - which uses minimal power and isn’t targeted by Sweden’s restrictions.

How does Sweden’s approach compare to Norway’s?

Norway welcomes crypto mining. It has abundant hydropower, no registration requirements for miners, and no public opposition. Norway hosts about 1.5% of global Bitcoin mining. Sweden, in contrast, has made mining expensive, slow, and socially unpopular. The result? Norway’s crypto market share has grown while Sweden’s has shrunk.

Kris Young

Sweden’s approach makes sense. Energy isn’t infinite, even if it’s clean. Mining Bitcoin for no real purpose? That’s just wasteful.

LaTanya Orr

It’s not about banning tech it’s about choosing what kind of future we want. Do we build systems that serve people or just chase digital ghosts?

Ashley Finlert

Sweden is not merely regulating mining-it is redefining progress. In a world drowning in excess, they’ve chosen restraint as a moral act. To them, sustainability isn’t a buzzword-it’s a covenant with the next generation. The grid isn’t a utility; it’s a sacred trust.

Chris Popovec

They’re using climate as an excuse to crush innovation. The real agenda? Centralized control. You think they don’t want you owning crypto? They’re scared. They know decentralized money kills their power. This isn’t about energy-it’s about tyranny. 143 TWh? That’s less than the US military uses. Hypocrites.

Marilyn Manriquez

Sweden’s policy reflects a profound commitment to collective responsibility. The prioritization of societal well-being over speculative enterprise is not only commendable-it is necessary. Let us learn from their example.

taliyah trice

So they just made it too hard to mine? Kinda harsh but I guess if it’s killing the planet...

Charan Kumar

Sweden is doing right thing. Why waste electricity on something that does nothing? We have real problems in India. Power cuts every day. This is not about crypto. This is about priorities

Peter Mendola

They’re punishing innovation. 99.95% drop in ETH energy use? Then why punish Bitcoin? This isn’t policy. It’s prejudice. 😒

Terry Watson

Wait-so Sweden’s grid is so fragile that a few mining rigs can cause blackouts? But they still run nuclear plants and hydropower dams? That’s like banning bicycles because a few kids crashed into a bus. It’s not about energy-it’s about control. And honestly? I’m impressed they’re this bold.

Sunita Garasiya

Oh wow Sweden banned mining because it uses too much electricity? Next they’ll ban Netflix because it buffers too much. At least Bitcoin creates value. What does your solar panel do besides sit there looking pretty?

Mike Stadelmayer

Kinda wild how things turned out. China kicks out miners, Sweden says come on in, then says wait no actually don’t. Guess you can’t win. But hey-waste heat warming homes? That’s actually kind of genius.

Norm Waldon

This is why I hate Europe. They think they’re morally superior but they’re just weak. You think Norway doesn’t mine? They’re just better at hiding it. Sweden’s rules? A joke. The real crypto revolution is happening where people still have guts.

neil stevenson

Love the waste heat thing 🤯 Like a giant space heater that pays for itself. Sweden’s not anti-crypto-they just don’t want it to be dumb.

Samantha bambi

I think Sweden’s strategy is brilliant. They didn’t ban it-they made it responsible. That’s leadership. And the fact that they’re turning waste into warmth? That’s innovation with heart.

Jack Richter

Yeah whatever. I don’t care.

sky 168

Proof-of-stake is the future. Why fight the inevitable?

sammy su

Sweden gets it. If you’re gonna use power, make it count. Heating homes with mining heat? That’s not just smart-it’s kind. And yeah, I miss Bitcoin mining but this feels right.

jack leon

Sweden didn’t kill crypto-they forced it to evolve. Like a dragon being asked to breathe fire… but only if it warms the village. Now that’s a myth worth rewriting.

Chris G

143 TWh is nothing compared to global data centers. Sweden is playing politics not energy policy

Phil Taylor

Sweden thinks it’s the moral police of the world. Meanwhile, the UK and US are building nuclear-powered data centers. The real villains are the ones pretending they care while doing nothing.

diljit singh

Sweden is too rich to understand real problems. We have 1.3 billion people without electricity. You’re banning mining because it uses too much? You’re a joke

Abhishek Anand

The true philosophical dilemma lies not in energy consumption but in the ontological value of decentralized trust. Is a machine that validates transactions without authority more or less real than a central bank? Sweden has chosen bureaucracy over beingness

vinay kumar

Why not just let the market decide? Sweden is acting like a parent who says no to everything

Leisa Mason

They call it sustainability but it’s just control dressed up in green. And don’t get me started on that heat recovery scam. It’s a PR stunt to make people feel better about killing innovation

Rob Sutherland

It’s funny how we fear energy use in crypto but never question the energy behind streaming cat videos 24/7. Maybe we need to ask not how much energy it uses-but why we think we need it at all.

Tim Lynch

Sweden’s not against crypto. It’s against the illusion that infinite growth is sustainable. They’re asking: What are we really building? And who benefits? That’s not regulation. That’s wisdom.

andrew casey

While the regulatory framework implemented by Sweden is indeed rigorous, it is also commendably principled. The alignment of technological advancement with ecological stewardship represents a paradigmatic shift in governance, one that other jurisdictions would do well to emulate.

Lani Manalansan

I think it’s beautiful that Sweden turned a problem into a solution. Heating homes with mining waste? That’s not just clever-it’s kind. And honestly? I’m proud of them.