When people hear Blockchain technology is a decentralized ledger that records transactions in a tamper‑proof way, they often picture Bitcoin or other cryptocurrencies. In 2025 the reality is far richer: dozens of sectors are tapping blockchain applications to cut waste, boost trust, and open new business models. Below you’ll find the most impactful use cases, why they work, and practical tips for deciding if the technology fits your own challenges.

Why blockchain works across industries

Three core traits make blockchain a universal enabler:

- Decentralization: No single party controls the data, so participants can collaborate without a trusted intermediary.

- Transparency: Every change is visible on the ledger, which deters fraud and simplifies audits.

- Security: Cryptographic hashing guarantees data integrity, while permissioned networks restrict access to authorized actors.

When these attributes align with a sector’s pain points-like counterfeit goods, siloed patient records, or opaque voting-blockchain becomes a natural solution.

Supply chain and logistics

Traceability is the holy grail of modern supply chains. Companies such as IBM Food Trust and VeChain have built permissioned networks that let growers, processors, and retailers record each hand‑off on an immutable ledger. The result? Faster recalls, reduced counterfeit risk, and consumer confidence.

Real‑world example: Walmart uses blockchain to verify the origin of leafy greens within seconds, cutting the time to trace a batch from seven days to under two minutes.

Key benefits for logistics firms:

- End‑to‑end visibility from farm to fork.

- Automated smart‑contract payments once delivery milestones are met.

- Reduced paperwork and manual reconciliation.

Healthcare & medical records

Patient data is highly sensitive and notoriously fragmented. Platforms like Medicalchain store encrypted health records on a blockchain, giving patients the private key to grant or revoke access.

Benefits include:

- Improved data privacy - only authorized clinicians can read the record.

- Streamlined insurance claims because the same immutable proof can be shared with payers.

- Lower error rates as duplicate or outdated information disappears.

Hospitals that piloted blockchain‑based EHRs reported up to a 30 % reduction in administrative overhead.

Digital identity and e‑governance

Self‑sovereign identity lets individuals own their personal data. Projects such as SelfKey issue verifiable credentials that can be presented to banks, employers, or government portals without exposing unnecessary details.

Countries are catching on: Estonia’s e‑residency program runs on a blockchain‑backed identity layer, while India’s Aadhaar‑linked blockchain pilots aim to curb identity theft.

In voting, a blockchain‑based system records each ballot as a cryptographic hash, making tampering practically impossible and enabling instant, public audit trails.

Finance, tokenization and CBDCs

Beyond crypto, financial services are using blockchain for tokenized assets, cross‑border payments, and central bank digital currencies (CBDCs). The platform RealT lets investors buy fractional shares of real‑estate properties, turning illiquid assets into tradable tokens.

Stablecoins such as USDC provide dollar‑backed on‑chain liquidity, while the European Central Bank’s digital euro project demonstrates how sovereign institutions can issue secure, instant settlements.

Advantages for banks and fintechs:

- Near‑instant settlement reduces foreign‑exchange risk.

- Programmable money enables automatic compliance and royalties.

- Inclusion of unbanked populations through mobile‑first blockchain wallets.

Insurance automation

Insurance claims often get tangled in paperwork and fraud. By moving policy data onto a blockchain, insurers can verify coverage and trigger payouts automatically via smart contracts.

Example: A crop‑insurance provider records satellite‑derived yield data on a ledger; if the yield falls below a threshold, the smart contract releases compensation without a human adjuster.

Key outcomes:

- Transparent underwriting-auditors can trace every risk factor.

- Reduced fraud-tampered claims are instantly detectable.

- Faster settlement-customers receive money in hours, not weeks.

Media, NFTs and rights management

Content creators struggle with piracy and delayed royalties. Non‑fungible tokens (NFTs) on the Ethereum network certify ownership of digital art, music, or video clips, while smart contracts split revenue automatically each time the work is streamed or resold.

Platforms like OpenSea have become marketplaces where artists list tokenized works and collectors verify provenance with a single click.

Benefits include:

- Clear provenance-buyers see the full ownership history.

- Instant royalty enforcement-creators earn a percentage on every secondary sale.

- Reduced piracy-blockchain‑registered works can be distinguished from illicit copies.

Energy, IoT and Decentralized Physical Infrastructure Networks (DePIN)

Blockchain + IoT creates peer‑to‑peer energy markets. Homeowners with solar panels can record meter readings on a ledger and sell excess kilowatt‑hours directly to neighbors, bypassing traditional utilities.

DePIN projects such as Helium reward users for providing wireless coverage, turning physical assets into on‑chain economic incentives.

Advantages:

- Immutable audit of generation and consumption data.

- Dynamic pricing based on real‑time supply‑demand.

- New revenue streams for asset owners.

Emerging trends: AI, gaming and Blockchain‑as‑a‑Service (BaaS)

Decentralized AI (DeAI) platforms are marrying machine‑learning models with token economics, letting data contributors earn crypto for training sets while the model itself runs on a trustless network.

In gaming, the shift from “play‑to‑earn” to “play‑to‑own” means in‑game items are minted as NFTs, guaranteeing true ownership across titles.

Enterprises hesitant to build from scratch can tap BaaS offerings from cloud giants (e.g., Azure Blockchain Service) to spin up private ledgers in weeks rather than months.

Challenges and a quick‑start checklist

While the hype has settled, practical hurdles remain:

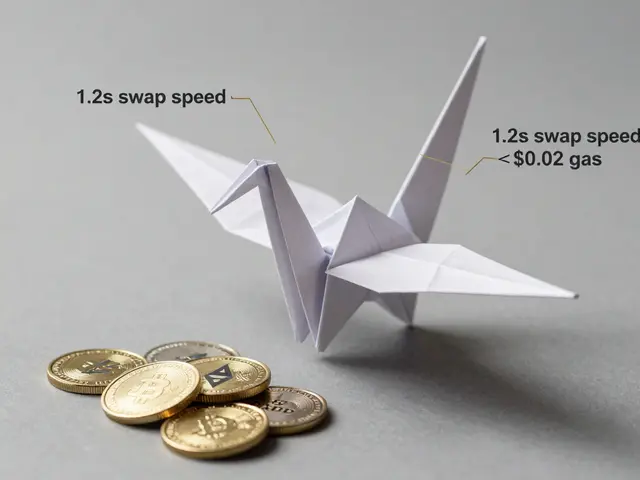

- Scalability - public chains still struggle with high‑throughput use cases.

- Regulatory uncertainty - especially around tokenized assets and CBDCs.

- Integration complexity - legacy systems need adapters or middleware.

- Talent gap - skilled blockchain developers are scarce and pricey.

Before you dive in, run through this checklist:

- Define the problem you’re solving. Does it involve trust, traceability, or automation?

- Choose a permissioned vs. public network based on data sensitivity.

- Map existing data flows and pinpoint integration points.

- Prototype with a BaaS platform to validate speed and cost.

- Plan for governance - who controls node participation and key management?

Answering these questions will keep projects from turning into costly experiments.

Comparison of blockchain benefits by sector

| Industry | Primary Benefit | Leading Platform | Typical Use‑Case |

|---|---|---|---|

| Supply Chain | Traceability & fraud reduction | IBM Food Trust | Real‑time product provenance |

| Healthcare | Secure patient data sharing | Medicalchain | EHR interoperability |

| Digital Identity | Self‑sovereign credentials | SelfKey | Verified KYC for banking |

| Finance & Tokenization | Fractional ownership | RealT | Real‑estate token sales |

| Insurance | Automated claims processing | Etherisc | Crop‑loss payout triggers |

| Media & NFTs | Royalty automation | OpenSea | Digital art resale royalties |

| Energy & IoT | Peer‑to‑peer trading | Helium | Solar‑energy micro‑grid markets |

| AI & Gaming | Token‑incentivized data/model sharing | Fetch.ai | Decentralized AI training |

Frequently Asked Questions

Can small businesses benefit from blockchain, or is it only for large enterprises?

Yes. Small firms can adopt permissioned ledgers or BaaS services to automate invoicing, trace supply‑chain provenance, or manage digital identities without building expensive infrastructure.

What is the difference between public and permissioned blockchains?

Public chains (e.g., Ethereum) allow anyone to read and write transactions, fostering openness but requiring higher security measures. Permissioned chains restrict participation to known entities, offering faster throughput and privacy-ideal for enterprises like banks or healthcare providers.

How does tokenization differ from traditional asset ownership?

Tokenization creates a digital representation of a physical asset on a blockchain. Each token is a verifiable piece of ownership that can be transferred instantly, unlike conventional deeds that require paperwork and escrow services.

Are blockchain‑based health records compliant with GDPR and HIPAA?

When designed as permissioned, encrypted ledgers, blockchain solutions can meet GDPR’s “right to be forgotten” by storing only hashes on‑chain while keeping personal data off‑chain. HIPAA compliance hinges on proper access controls and audit trails, which many platforms now provide.

What are the main risks of integrating blockchain into existing systems?

Key risks include scalability bottlenecks, regulatory changes, and the need for skilled developers. Conduct a pilot, monitor performance, and keep an exit strategy if the technology proves too costly.

Scott McCalman

Wow, this post just blew my mind-blockchain is literally everywhere now! 🚀 From farm-to-table tracking to tokenized real estate, the hype has finally turned into real, gritty utility. I love how the author broke down each sector with concrete examples, especially the Walmart lettuce traceability. It’s like every industry finally woke up and realized decentralization isn’t just a buzzword. If you ask me, the next big wave will be cross‑industry data marketplaces built on these very protocols. 😎

Elizabeth Chatwood

totally agree this is where the industry’s heading

Tom Grimes

The healthcare bit really hit home for me because I’ve seen patients struggle with paperwork for years. Simple blockchains can lock away records safely, and doctors can just pull up the data when needed. It also means insurance companies can verify claims instantly, cutting down on fraud. I think the biggest hurdle is getting hospitals to adopt the tech, but the payoff is massive. If you can reduce a 30% admin load, that’s a win for everyone.

Paul Barnes

Sure, but don’t forget the regulatory nightmare that comes with storing health data on a chain. Even permissioned networks aren’t immune to government overreach.

John Lee

I hear you, Paul, but I think the benefits outweigh the risks if we build proper governance layers. Imagine a hybrid model where patients hold the keys but regulators get audit logs. That could bridge trust gaps and accelerate adoption.

Jireh Edemeka

Ah, the classic "blockchain will fix everything" narrative-how original. While the examples are compelling, most companies will still need to wrestle with legacy integration. If you can’t get your old ERP to talk to a new ledger, you’re stuck. Still, kudos for highlighting real‑world pilots instead of just hype.

del allen

Totally! :) It’s about time we see some actual use‑cases instead of just token talk.

Tiffany Amspacher

Reading this feels like stepping into a sci‑fi novel where the future is already here. The way blockchain weaves into identity, energy, even AI is almost poetic. I can’t help but wonder what philosophical implications this has for our sense of ownership. Still, the drama of the tech world never quits-every week there’s a new ‘revolution.’ Let’s just hope the hype doesn’t drown the real progress.

James Williams, III

Great points, Tiffany. From a tech ops perspective, the BaaS options you mentioned cut deployment time dramatically-think weeks vs. months. Also, the interoperability layers for IoT devices are key to making those peer‑to‑peer energy markets scalable.

PRIYA KUMARI

This article is spot on, but let’s not ignore the massive energy consumption of many public chains. Tokenization is great until you realize the carbon footprint of every transaction. We need stricter sustainability standards before we hand over critical infrastructure to these networks.

Jessica Pence

Agreed-environmental impact must be a priority. Some newer proof‑of‑stake solutions are promising, though adoption is still slow.

johnny garcia

Esteemed community, the discourse presented herein underscores the imperative for rigorous governance frameworks. Without such structures, the allure of decentralization may yield unintended consequences. Let us proceed with both enthusiasm and prudence. 😊

Andrew Smith

Well said, Johnny. I’m optimistic that we’ll strike the right balance soon.

Ryan Comers

All this blockchain talk is just another globalist agenda trying to control our finances. 🇺🇸 We need to protect national sovereignty.

Prerna Sahrawat

While I understand the concerns raised about national sovereignty, it is essential to recognize that blockchain technology, at its core, is a neutral tool that transcends borders and can be harnessed for a myriad of beneficial applications. First, the immutable nature of distributed ledgers provides an unprecedented level of transparency, which can significantly deter corruption and fraud in both public and private sectors. Second, by enabling peer‑to‑peer transactions without intermediaries, blockchain can reduce transaction costs, thereby fostering greater economic inclusion for underserved populations. Third, the tokenization of assets, whether real estate, intellectual property, or commodities, democratizes access to investment opportunities that were historically reserved for a privileged few. Fourth, the integration of blockchain with Internet of Things devices creates new marketplaces for renewable energy, allowing individuals to sell excess power directly to neighbors, promoting sustainability. Fifth, in healthcare, blockchain ensures patient data integrity while granting patients full control over who accesses their records, thereby enhancing privacy without sacrificing interoperability. Moreover, the development of decentralized identity solutions can streamline KYC processes, reducing bureaucratic bottlenecks while preserving user autonomy. Additionally, blockchain‑based smart contracts automate complex business logic, eliminating the need for cumbersome paperwork and reducing the likelihood of human error. It is also noteworthy that many central banks are exploring digital currencies on permissioned blockchains, which could improve the efficiency of monetary policy transmission. While concerns about energy consumption are valid, the industry is rapidly shifting toward more eco‑friendly consensus mechanisms such as proof‑of‑stake and hybrid models. Finally, the collaborative nature of open‑source blockchain development encourages a global community of innovators to contribute, fostering a culture of shared knowledge and rapid iteration. In light of these multifaceted benefits, it would be myopic to dismiss blockchain solely on the basis of geopolitical anxieties; instead, we should focus on establishing robust regulatory frameworks that safeguard national interests while embracing technological progress.

Joy Garcia

Interesting take, Prerna. I guess we’ll just have to watch how regulators shape the future. Still, the tech’s potential is undeniably exciting.

mike ballard

From a cultural perspective, blockchain is reshaping how we think about ownership and trust. 🌍 It’s a global conversation, and every voice matters.