When you hear "Dinero" in the crypto world, you might assume it’s one coin. But it’s not. There are at least two completely different projects using the same name, and they serve totally different purposes. One is a stablecoin built for institutional DeFi users. The other is a privacy-focused mining coin with almost no trading activity. Confusion is common - and it’s costing people money. Let’s cut through the noise.

There Are Two Dineros - And They’re Not the Same

The name "Dinero" comes from the Spanish word for "money," which makes it a tempting pick for crypto projects. But that’s where the similarity ends. The two main versions are:

- DINERO - A stablecoin backed by ETH and pxETH, developed by Redacted Cartel

- DIN - A mineable cryptocurrency with anonymous transaction features, promoted at dinerocoin.org

They don’t share code, teams, or goals. Mixing them up is like thinking "Tesla" and "Tesla Energy" are the same thing. They’re related, but not interchangeable.

The Dinero Stablecoin (DINERO): Built for DeFi Yield

The more prominent Dinero project is the DINERO stablecoin, launched by Redacted Cartel a decentralized autonomous organization (DAO) known for building advanced DeFi infrastructure on Ethereum. Unlike USDT or USDC, DINERO isn’t just pegged to the dollar - it’s designed to earn yield while you hold it.

Here’s how it works:

- Each DINERO is backed by a mix of Ethereum (ETH) and pxETH - a liquid restaking token from Pirex Finance

- pxETH earns interest from Ethereum staking, and that yield is passed back to DINERO holders

- The protocol also holds USDC as a buffer to stabilize price during volatility

- It’s over-collateralized, meaning there’s more backing than the total supply of DINERO

This isn’t a simple stablecoin. It’s a yield-generating asset built for DeFi power users. If you’re staking ETH and want to earn more without moving your assets, DINERO gives you a way to lock up value and still generate returns.

As of February 2026, DINERO trades around $0.0081 - far below its intended $1 peg - due to low liquidity and bearish market sentiment. It’s not listed on major exchanges like Crypto.com or Binance, which limits access. But on decentralized platforms like Uniswap, it still sees consistent trading volume ($90K+ in 24 hours), mostly from DeFi traders looking to hedge or earn yield.

What Makes DINERO Different From Other Stablecoins?

Most stablecoins are either:

- Centralized (USDT, USDC) - backed by cash or reserves held by a company

- Over-collateralized crypto (DAI) - backed by crypto locked in smart contracts

DINERO takes a third path: yield-optimized collateral. It doesn’t just hold ETH - it holds ETH that’s already being staked (via pxETH). That means:

- No need to manually stake ETH yourself

- Yield is automatically generated

- Redacted Cartel’s governance system helps manage risk

This design makes DINERO a rare hybrid: a stablecoin that behaves like a yield-bearing asset. It’s not for casual holders. It’s for people who already understand DeFi and want to squeeze more value out of their ETH.

The Other Dinero: DIN - The Mining Coin

Then there’s DIN, a completely separate project with its own website: dinerocoin.org. This one claims to be "A New Digital Currency, Based On Bitcoin And Dash," promising anonymous, instant payments.

Here’s what we know about DIN:

- Current price: ~$0.00056535

- 24-hour price surge: +89.39%

- 24-hour trading volume: just $13.77

- Total supply: 100 million DIN (8.94 million in circulation)

The massive price spike looks impressive - until you see the volume. That’s a classic pump-and-dump signal. With trading volume under $15, it’s easy for a few wallets to move the price. There’s no real liquidity. No major exchange listings. No active development updates since 2023.

It’s positioned as a privacy coin, competing with Monero and Zcash. But those two have years of development, strong communities, and real adoption. DIN? It’s a low-volume token with no clear roadmap. If you’re looking for anonymous payments, DIN isn’t a practical option.

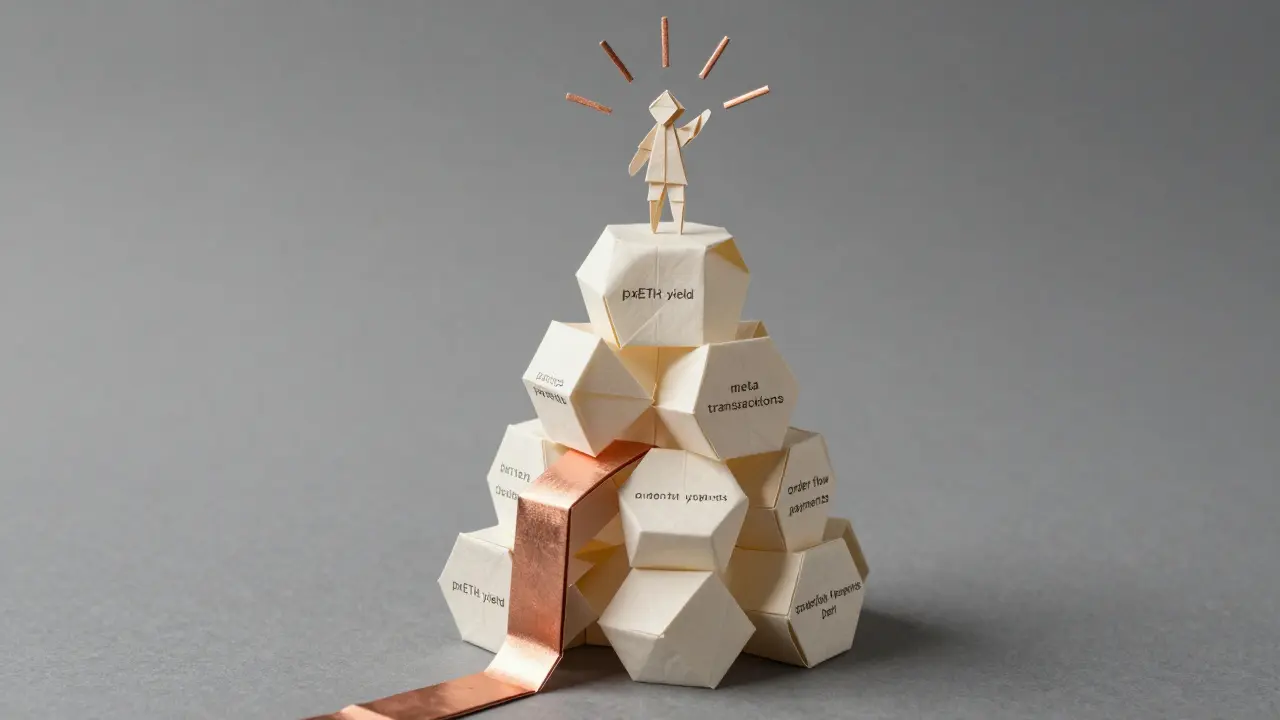

Dinero.xyz: The Yield Layer Behind the Scenes

Beyond the tokens, there’s another layer: Dinero.xyz a suite of DeFi tools designed to maximize yield for Ethereum-based assets, especially liquid restaking protocols.

This isn’t a coin. It’s infrastructure. Dinero.xyz helps users earn more from pxETH by optimizing how staking rewards are distributed. Think of it like a smart savings account that automatically reinvests your interest.

Why does this matter? Because pxETH is one of the highest-yielding Ethereum liquid staking tokens. If you’re holding ETH and want to maximize returns without giving up liquidity, Dinero.xyz’s tools are part of the ecosystem that makes that possible - even if you never directly touch DINERO.

What’s Next for Dinero?

Redacted Cartel has big plans for the DINERO stablecoin:

- Meta transactions: Pay gas fees in DINERO instead of ETH - reducing friction for users

- Private transactions: Use pxETH’s block space to anonymize transfers

- Order flow payments: Allow decentralized exchanges to pay users in DINERO for trade execution

If these features launch successfully, DINERO could become a core utility token within Redacted Cartel’s ecosystem - linking it to other assets like Btrfly and boosting its long-term value.

But here’s the reality: The stablecoin market is dominated by USDT and USDC. DAI is the only major decentralized competitor with real adoption. DINERO is still a niche product - powerful, but not yet mainstream.

Should You Buy Dinero?

It depends on what you want.

If you’re a DeFi user: DINERO might be worth exploring if you’re already using Ethereum staking and want to earn yield without moving your assets. But only if you’re comfortable with low liquidity and price instability. Don’t expect it to hit $1 anytime soon.

If you’re looking for privacy: Skip DIN. It’s not a serious player. Monero, Zcash, or even privacy-focused Bitcoin layers like Mimblewimble are better options.

If you’re a retail trader: Avoid both. The trading volumes are too thin. You won’t be able to exit easily. And with no exchange listings, you’re stuck on decentralized platforms with higher slippage.

Final Thoughts

Dinero isn’t one coin. It’s two very different projects - one with serious DeFi engineering behind it, the other a low-volume mining token with little traction. The stablecoin (DINERO) has real technical innovation and ties to a growing DeFi ecosystem. The mining coin (DIN) is a speculative gamble with no clear future.

If you’re serious about crypto, don’t just look at the name. Look at the tech, the team, the liquidity, and the use case. Otherwise, you’re chasing a name - not a value.

Is Dinero (DINERO) a good investment?

It depends. The DINERO stablecoin is designed for DeFi users who want yield from ETH-backed assets, not for casual investors. It’s not pegged to $1 and trades below that value due to low liquidity. It’s not a "get rich quick" asset. The DIN mining coin is speculative, with minimal trading volume and no clear roadmap. Neither is a safe bet for beginners.

Where can I buy Dinero (DINERO)?

DINERO is not listed on major exchanges like Binance, Coinbase, or Crypto.com. You can trade it on decentralized exchanges like Uniswap using ETH or USDC, but liquidity is low. Be cautious of slippage and high fees. The DIN mining coin is only available on small, obscure DEXs and carries high risk.

Is Dinero (DINERO) a stablecoin?

Yes - but not like USDT or USDC. The DINERO stablecoin is algorithmically backed by ETH and pxETH, and it’s designed to earn yield while maintaining a $1 peg. However, as of early 2026, it trades at $0.0081 due to low demand and market conditions. It’s a yield-bearing stablecoin, not a traditional one.

What’s the difference between DINERO and DIN?

DINERO is a DeFi stablecoin backed by Ethereum assets, developed by Redacted Cartel. DIN is a mineable cryptocurrency with privacy features, promoted on dinerocoin.org. They have no shared technology, team, or purpose. Confusing them is like mixing up Bitcoin and a meme coin with "Bitcoin" in the name.

Is Dinero (DINERO) associated with Ethereum?

Yes. The DINERO stablecoin is built on Ethereum and uses ETH and pxETH as collateral. It relies on Ethereum’s staking infrastructure and smart contracts. The Dinero.xyz yield tools also operate entirely on Ethereum. The DIN mining coin, however, is not on Ethereum - it runs on its own chain.