Digital Currency Comparison Tool

This interactive tool compares three major forms of money:

- Fiat Money: Government-backed traditional currency

- Cryptocurrency: Decentralized digital assets

- Central Bank Digital Currency (CBDC): Digital version of fiat issued by central banks

Fiat Money

Traditional currency backed by government authority. Used in everyday transactions with low volatility and wide acceptance.

Stable CentralizedCryptocurrency

Decentralized digital assets using blockchain technology. Offers peer-to-peer transactions with high volatility and global accessibility.

Volatility DecentralizedCBDC

Digital version of fiat currency issued by central banks. Combines the stability of fiat with the efficiency of digital transactions.

Stable Government-backedKey Features Comparison Table

| Feature | Fiat | Crypto | CBDC |

|---|---|---|---|

| Intermediaries | Banks, payment processors | None - peer-to-peer | State-run platform |

| Typical Fee | 0.5-3% | 0.0001-0.01% | Usually free or minimal |

| Settlement Time | 1-5 days (international) | Minutes-hours | Seconds-minutes |

| Volatility | Low | High | Low (pegged to fiat) |

| Regulation | Well-defined | Varies by jurisdiction | Government-backed |

| Energy Use | Moderate | High (Proof-of-Work) | Low (Proof-of-Stake) |

Use Cases

Fiat Money

- Everyday purchases

- Stable value transactions

- Universal acceptance

Use Cases

Cryptocurrency

- Cross-border payments

- Store of value

- Smart contract applications

Conclusion: Each form of money has unique advantages. Fiat offers stability and wide acceptance, crypto provides flexibility and global access, and CBDCs aim to combine the best of both worlds. Understanding these differences helps you make informed decisions about how you use and store money in the digital age.

People keep hearing the phrase "digital currency" and wonder if it will really replace the cash and bank notes we use every day. The truth is, the shift isn’t a sudden knockout-it’s a gradual remix of how we store, move, and think about money. In this guide you’ll see the key differences, the real‑world impacts, and why both systems are likely to live side by side for a while.

Quick Takeaways

- Fiat money is backed by government authority; digital currency runs on blockchain code.

- Cryptocurrencies like Bitcoin use decentralised networks, while CBDCs are state‑run digital versions of fiat.

- Transaction fees and speeds differ: banks add intermediaries, blockchains cut them out.

- Volatility is high for most crypto, but stablecoins and CBDCs aim for steadier values.

- Regulation, energy use, and privacy are the biggest hurdles shaping the future.

What Is Fiat currency is government‑issued legal tender not backed by a physical commodity?

Think of the dollar, euro or yen you keep in your wallet. Those are fiat currencies - they exist because a government says they do and because everyone trusts that claim. Central banks, like the Federal Reserve, control how much money is printed, set interest rates, and try to keep inflation in check. This centralized control gives stability and universal acceptance, but it also creates a single point of failure. When a government prints too much money, you can see prices rise fast - that’s inflation.

What Is Cryptocurrency is a digital asset that uses cryptographic techniques and blockchain technology to secure transactions?

Cryptocurrency flips the script. Instead of a central authority, power is spread across a network of computers. The most famous example, Bitcoin is the first decentralized cryptocurrency launched in 2009, introduced a new way to verify transactions using a public ledger called a blockchain. No one can print more Bitcoin than the 21 million hard cap programmed into its code, which gives it a built‑in scarcity.

How Blockchain is a distributed ledger that records transactions across many computers Powers Digital Money

Every crypto transaction is a tiny entry in this ledger. The ledger lives on thousands of nodes, so tampering with it would require rewiring the whole network - practically impossible. This trust‑less model means you don’t need a bank to confirm a payment; the network does it for you, usually within minutes. Blockchains also support Smart contracts are self‑executing contracts with the terms directly written into code, which automate complex agreements without a middleman.

Consensus Mechanisms: Proof‑of‑Work is a consensus algorithm that requires miners to solve computational puzzles vs. Proof‑of‑Stake is a consensus method where validators lock up coins to propose new blocks

Bitcoin relies on Proof‑of‑Work (PoW). Miners race to solve math problems, consuming a lot of electricity. That’s why Bitcoin’s energy footprint is often debated. Newer chains, like Ethereum is a programmable blockchain that switched to Proof‑of‑Stake in 2022, use PoS, which dramatically cuts power use because validators are chosen based on how many coins they lock up, not how hard they can compute.

Trust, Value and Money Creation

With fiat, value comes from legal tender status and the confidence that governments will honor it. Central banks can create more money at will, which can be both a tool for stimulus and a risk for inflation. Crypto, on the other hand, gets its value from code and network effects. The supply rules are baked into the protocol, so no one can simply print more. This transparency can be reassuring, but it also means price swings are common because market sentiment drives demand.

Comparing Everyday Use: Fees, Speed, and Accessibility

| Feature | Fiat (Bank Transfer) | Cryptocurrency | CBDC |

|---|---|---|---|

| Intermediaries | Banks, payment processors | None - peer‑to‑peer | State‑run platform, often with gateway apps |

| Typical fee | 0.5‑3% for cross‑border | 0.0001‑0.01% (varies by network) | Usually free or minimal |

| Settlement time | 1‑5days (int’l) | Minutes‑hours (depends on congestion) | Seconds‑minutes |

| Volatility | Low | High | Low (pegged to fiat) |

| Regulation | Well‑defined | Varies by jurisdiction | Government‑backed |

The table shows why many people still rely on fiat for everyday purchases - it’s stable and accepted everywhere. Crypto shines for borderless transfers and for those who want to avoid traditional banks, while CBDCs aim to combine the best of both worlds.

Privacy and Transparency

Bank transfers leave a paper trail that regulators can follow. Crypto transactions are public on the blockchain, but they only show cryptographic addresses, not personal names. That makes them pseudonymous rather than truly anonymous. Some users appreciate the extra privacy, while governments worry it can aid illicit activity. CBDCs will likely sit somewhere in the middle, offering digital convenience while still giving authorities traceability.

Security Risks

Physical cash can be stolen, and bank accounts can be hacked. Crypto wallets are secured by private keys - lose the key, lose the money forever. On the flip side, a well‑managed wallet is practically unforgeable. The biggest threats in the crypto world are phishing scams, exchange hacks, and user mistakes. Traditional banking suffers from systemic risks like bank runs, but it also benefits from insurance schemes and government backstops.

Energy Use and the Environment

Proof‑of‑Work networks consume a lot of electricity because miners run powerful computers 24/7. Bitcoin’s annual consumption is comparable to a small country’s power usage. Proof‑of‑Stake and newer consensus models drastically cut that demand, which is why many newer projects tout their "green" credentials. Traditional banking does have an environmental footprint - think of office buildings, data centers and card manufacturing - but it’s spread across many sectors and generally lower per transaction.

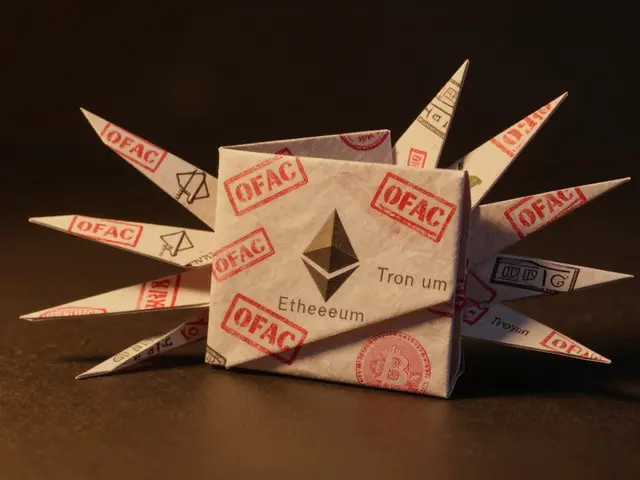

Regulatory Landscape

Governments have clear rules for fiat: they set interest rates, require banks to hold reserves, and enforce anti‑money‑laundering (AML) laws. Crypto regulation is a patchwork. Some countries embrace it, others ban it outright. This uncertainty slows institutional adoption. CBDCs are a direct response: central banks create a digital version of their fiat, keeping control while offering a modern user experience. China’s digital yuan and the EU’s digital euro are leading examples.

Future Outlook: Coexistence, Not Replacement

The headline that "digital currency will kill cash" is an overstatement. What’s happening is a blending of ecosystems. Traditional banks are adding crypto custody services, fintech apps let you buy Bitcoin alongside a checking account, and central banks are testing digital tokens. Most experts agree we’ll see a tiered system:

- Everyday purchases: fiat and CBDCs will dominate because of stability and universal acceptance.

- Cross‑border payments and store‑of‑value: crypto and stablecoins will keep growing, especially where local currencies are volatile.

- Programmable money (smart contracts, automated escrow): blockchain platforms like Ethereum will lead the charge.

In short, the shift to digital currency is reshaping finance, but the old system isn’t disappearing overnight. Understanding the strengths and limits of each helps you decide where to put your money, how to move it, and what risks to watch.

Frequently Asked Questions

Is a digital currency the same as cryptocurrency?

Not exactly. All cryptocurrencies are digital, but not every digital currency is a crypto. Central Bank Digital Currencies (CBDCs) are digital versions of fiat money, issued and regulated by governments, while cryptocurrencies like Bitcoin run on decentralized blockchains without a central authority.

Can I use Bitcoin to buy groceries?

Only a few retailers accept Bitcoin directly. Most people convert crypto to fiat via an exchange before spending it, or they use crypto‑debit cards that automatically swap the coins behind the scenes.

Are CBDCs safer than cryptocurrencies?

CBDCs inherit the backing of the issuing central bank, so they share the same safety net as fiat (e.g., deposit insurance). Cryptocurrencies lack such guarantees and rely purely on market dynamics and the security of the underlying protocol.

What’s the biggest environmental worry with digital money?

Proof‑of‑Work blockchains need massive computing power, leading to high electricity consumption. Switching to Proof‑of‑Stake or other low‑energy consensus methods reduces the impact, and many new projects prioritize sustainability from the start.

Will cash disappear completely?

Unlikely in the near term. Cash remains useful in regions with limited internet, for privacy‑seeking users, and during power outages. Digital options will grow, but cash will probably stick around for decades.

angela sastre

Love this breakdown! I work at a small shop that started taking crypto last year, and honestly? The fees are insane low compared to credit card processors. Customers love it too, especially the ones who send money home to family overseas. No more waiting 5 days for a wire to clear. Just sayin'.

Aniket Sable

bitcoin is cool but i cant use it to buy chai at my local stall lol

John Dixon

Oh wow, another 'digital currency is the future' fairy tale. Let me guess-next you’ll tell me that blockchain will solve climate change and my cat will start paying taxes. Bitcoin’s energy use is criminal, and CBDCs are just surveillance with a UI upgrade. Wake up.

Steve Roberts

Actually, the article’s wrong. Cash isn’t ‘sticking around for decades’-it’s dying because governments hate untrackable money. CBDCs are the endgame, and they’ll ban cash entirely when they can. You think privacy matters? Wait till your ‘spending score’ drops because you bought too much coffee.

Edwin Davis

Let’s be real-this whole crypto thing is a foreign scam. America built the dollar, and we don’t need some decentralized nonsense from Silicon Valley bros. We need strong, sovereign, American-backed money. Not some code running on a server in Estonia.

Brody Dixon

Just wanted to say thank you for writing this without hype. I’ve been scared of crypto because I didn’t understand it, but now I get why people use it for remittances and why CBDCs might help the unbanked. No need to pick sides-let both evolve.

Mike Kimberly

It’s worth noting that the environmental impact of traditional banking is rarely discussed in these debates. The physical infrastructure-vaults, armored trucks, paper currency production, ATMs, branch maintenance-collectively consumes far more resources than many assume. Even Bitcoin mining, while energy-intensive, is increasingly powered by stranded or renewable sources, especially in regions like Texas and Quebec. The narrative is incomplete without this context.

Santosh harnaval

CBDCs are just digital cash. Crypto is digital gold. Both have their place. No need to fight.

Will Atkinson

So… we’re all just dancing around the real question: who controls the ledger? Governments? Corporations? Or the people? I’m not anti-tech-I’m anti-centralized control. If my money’s gonna be digital, let me own the keys. Not the Fed. Not Meta. Not some bank in Delaware.

Laura Herrelop

They’re not just replacing cash-they’re preparing for the Great Reset. CBDCs will enable negative interest rates, rationing, and behavioral control. You think you’re choosing to use digital money? No. You’ll be forced. Look at China’s social credit system. This is step one. Don’t be fooled by the ‘convenience’.

Patrick Rocillo

bro i just use crypto to buy my weed and pay my rent and honestly it’s smoother than venmo 😎💸

Jessica Smith

Anyone who thinks crypto isn’t a Ponzi scheme is either brainwashed or lying to themselves. The only thing more delusional than Bitcoin maximalists is the Fed pretending they’re not printing money into oblivion. Both are frauds. Just different flavors of the same dumpster fire.

Nisha Sharmal

India’s digital rupee is already working better than your ‘crypto’ nonsense. We don’t need American blockchain hype. We have 1.4 billion people who need real solutions, not speculative gambling.

emma bullivant

It’s funny how we call it ‘digital currency’ as if it’s the first time money changed form… but money has always been a shared belief. Cowrie shells, gold, paper notes, now bits. The only thing that’s real is trust. And trust… is fragile.

Ralph Nicolay

Given the current regulatory ambiguity surrounding digital assets, it is imperative that financial institutions and policymakers prioritize the establishment of a unified, legally enforceable framework to ensure systemic stability, consumer protection, and the integrity of monetary sovereignty.

monica thomas

Could you clarify the distinction between a stablecoin and a CBDC? I understand both are pegged to fiat, but is the issuer the only difference? Or is there a technical distinction in how they’re settled?

Karla Alcantara

My grandma uses cash. My cousin in Nigeria uses crypto to get paid from clients in the US. I use my bank app. We all coexist. No need to pick a side. Money’s just a tool. Use what works for your life.

Michael Hagerman

WHEN DID WE STOP TRUSTING HUMANS AND START TRUSTING CODE??!?!? THIS IS A PSYCHOTIC SHIFT. ONE DAY YOU’LL BE LOCKED OUT OF YOUR ACCOUNT BECAUSE AN ALGORITHM DECIDED YOU SPENT TOO MUCH ON TACOS. I’M NOT JOKING. I’M NOT JOKING. I’M NOT JOKING.

Petrina Baldwin

Cash is dead. Get over it.

Claymore girl Claymoreanime

You call this a ‘simple guide’? This reads like a Bloomberg PR draft written by a grad student who thinks ‘blockchain’ is a verb. If you don’t mention the 2023 FTX collapse or the fact that 90% of crypto is wash trading, you’re not informing-you’re indoctrinating. And the table? The fees for CBDCs are ‘usually free’? Have you met the IRS? They’ll charge you in compliance fees before you even touch the app.