Bitcoin environmental impact: Energy use, mining, and what really matters

When people talk about the Bitcoin environmental impact, the total energy consumed by the Bitcoin network and its resulting carbon emissions. Also known as Bitcoin’s carbon footprint, it’s often misunderstood as pure waste—but the reality is more complex. Bitcoin doesn’t just use power; it uses electricity in a very specific way: to secure a global, decentralized ledger through proof of work. Every time a new block is added, thousands of machines compete to solve a math problem. That competition demands energy—real, measurable, grid-connected electricity.

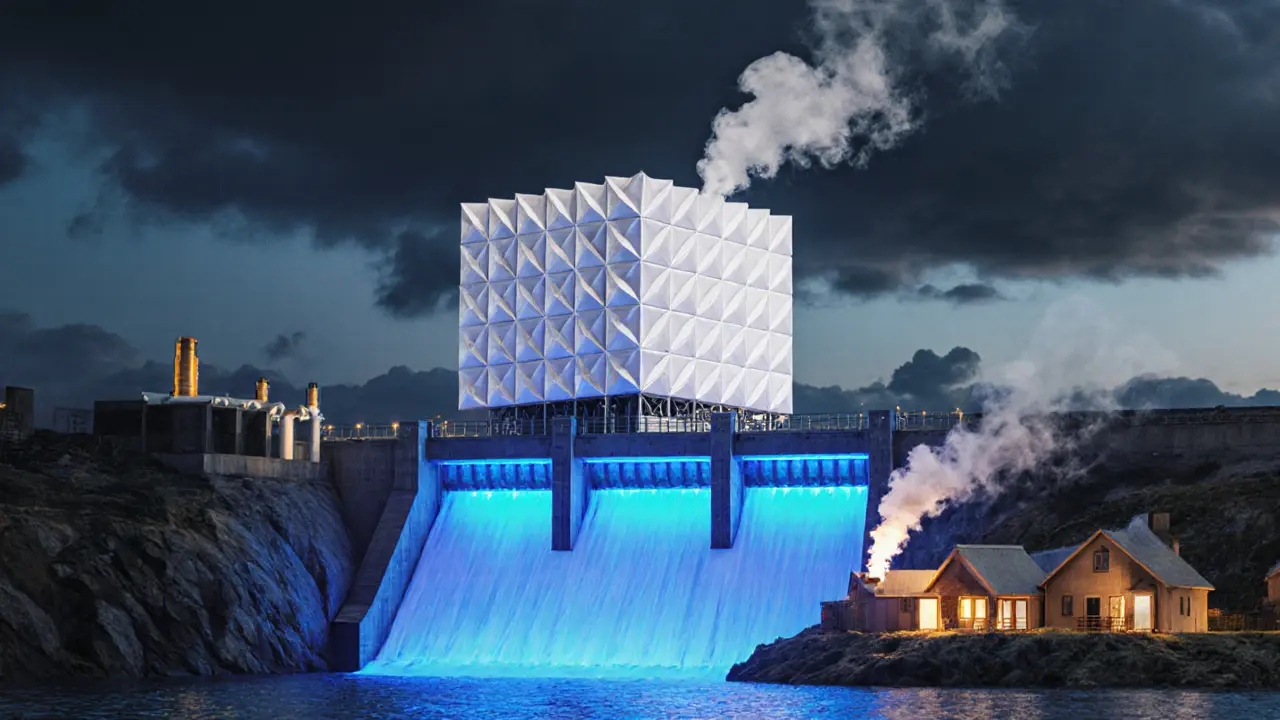

That energy doesn’t come from coal plants everywhere. In fact, over 50% of Bitcoin mining now runs on renewable or stranded energy sources, according to the Cambridge Centre for Alternative Finance. Think hydro power in Quebec, geothermal in Iceland, flared gas from oil fields in Texas, or excess wind power in rural China that would’ve gone unused. Miners aren’t just power consumers—they’re price-sensitive buyers who move to where electricity is cheapest and most abundant. That’s why mining has pushed infrastructure into places like Texas and Kazakhstan: not because they’re eco-friendly, but because they’re cheap.

Compare that to Bitcoin mining, the process of validating transactions and securing the Bitcoin network using specialized hardware and massive computational power. Also known as crypto mining, it’s the engine behind Bitcoin’s security. It’s not just about machines—it’s about economics. ASIC miners are expensive, loud, and hot. They only run if the price of Bitcoin covers their electricity and hardware costs. That means miners are constantly optimizing: upgrading hardware, switching locations, even shutting down during peak grid demand. They don’t waste power—they chase efficiency.

And then there’s the proof of work, the consensus mechanism Bitcoin uses to agree on transaction history without a central authority. Also known as PoW, it’s the reason Bitcoin is so hard to attack. Other blockchains use proof of stake, which uses far less energy. But proof of work isn’t just about energy—it’s about trust. No one can fake Bitcoin’s history without spending billions in real-world electricity. That’s the trade-off: energy for immutability.

So when you hear "Bitcoin uses more energy than Argentina," ask: compared to what? The global banking system? Gold mining? The internet itself? Bitcoin’s energy use is visible and trackable. Most other systems hide their footprint behind corporate reports and opaque supply chains. Bitcoin’s ledger doesn’t lie. And while the debate continues, the miners themselves are adapting—building solar farms next to their rigs, using biogas from landfills, and partnering with utilities to absorb excess power.

What you’ll find in the posts below isn’t just alarmist headlines. You’ll see real data on where Bitcoin mining happens, how hardware efficiency has improved over time, and why some altcoins actually use more energy per transaction. You’ll learn how regulators are trying to control mining, how miners are responding, and what the future might look like if Bitcoin keeps growing. This isn’t about being for or against Bitcoin. It’s about understanding what’s actually happening—and why the numbers don’t tell the whole story.