When Bitcoin launched in 2009, no one knew if it would work. Could a network of strangers agree on who owned what money-without a bank, without a central authority? The answer was Proof of Work. It wasn’t elegant. It wasn’t efficient. But it was stubbornly secure. Miners raced to solve math puzzles using brute-force computing power. The first to solve it got to add the next block-and a reward of 50 BTC. That simple rule kept Bitcoin alive. It also burned through more electricity than entire countries. By 2024, Bitcoin’s network used about 110 terawatt-hours per year. That’s more than Argentina. And it was just the beginning.

Proof of Work: The Original, But Not the Last

Proof of Work (PoW) solved the Byzantine Generals Problem-the idea that a group of distrustful parties must agree on a single plan, even if some are lying or failing. Bitcoin’s version required miners to find a hash with a specific number of leading zeros. This meant guessing random numbers over and over until one worked. The harder the puzzle, the more energy it took. The more energy it took, the more secure the network became. But security came at a cost. Bitcoin could only process about 7 transactions per second. Compare that to Visa, which handles 24,000 per second. And the environmental toll? Critics called it unsustainable. Supporters argued that mining could use stranded or wasted energy-like flared gas or hydro surplus. But the truth was, most mining still relied on coal-heavy grids in places like Kazakhstan and China. By 2022, pressure mounted. Investors, regulators, and even miners themselves started asking: Is there a better way?Proof of Stake: The Quiet Revolution

Proof of Stake (PoS) didn’t need more computers. It needed more coins. Instead of racing to solve puzzles, validators were chosen based on how much cryptocurrency they locked up-or “staked.” The more you staked, the higher your chance of being selected to propose or verify the next block. If you tried to cheat? Your stake got slashed. You lost money. That’s the core incentive: act honestly, or pay the price. Ethereum’s switch to PoS in September 2022 changed everything. Before, Ethereum used PoW and consumed as much energy as the Netherlands. After? Energy use dropped by 99.9%. That wasn’t a tweak. It was a total overhaul. And it worked. The network stayed live. Transactions kept flowing. Over $60 billion in value stayed locked in DeFi protocols. No major attacks. No crashes. Just cleaner, cheaper, faster. PoS also opened the door to new possibilities. Validators could now run on regular laptops. No need for warehouse-sized mining farms. This made participation easier for everyday users. But it also created new risks. What if a few wealthy holders control most of the stake? Could they dominate block production? That’s the “rich get richer” problem. And then there’s the “nothing at stake” issue-where validators might support multiple competing chains because it costs them nothing. Developers solved these with careful design: random selection, long lock-up periods, and slashing rules that punish bad behavior.Tendermint and PBFT: Speed Over Scale

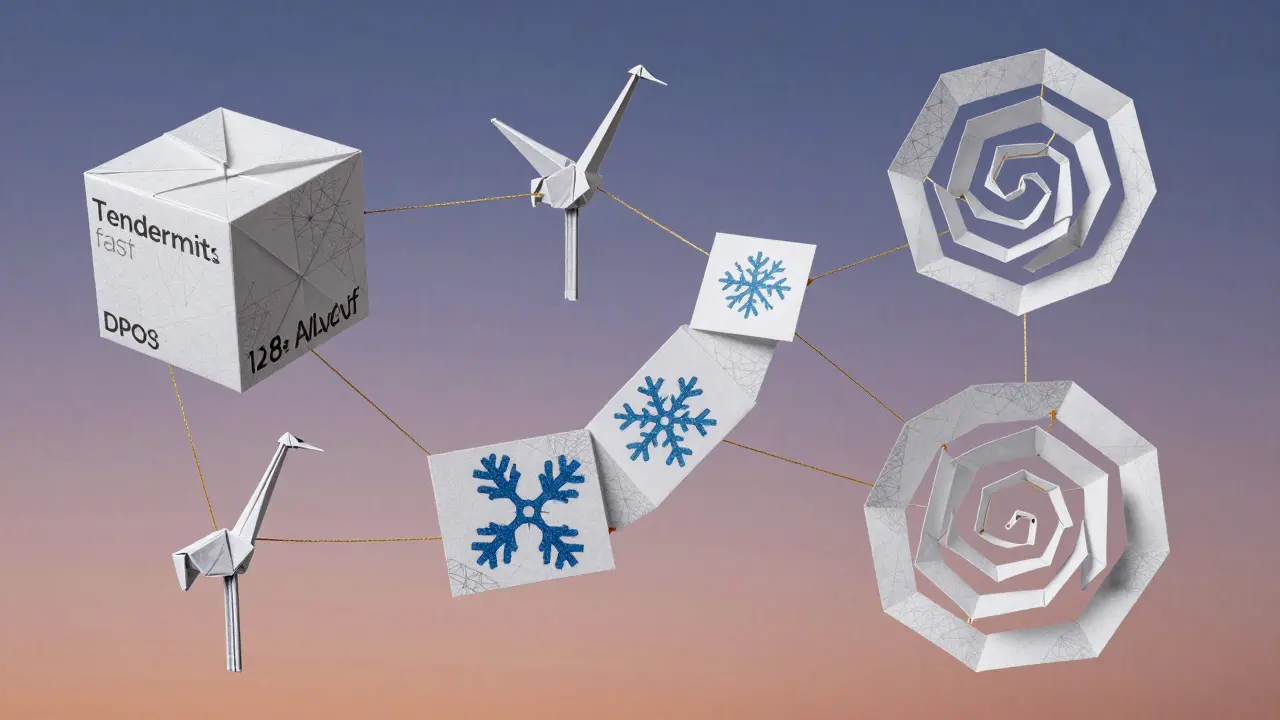

Not every blockchain needs to be public. Some, like enterprise ledgers or private financial systems, know who the participants are. That’s where Practical Byzantine Fault Tolerance (PBFT) shines. PBFT works with a fixed set of validators. As long as two-thirds of them are honest, the network reaches consensus-even if up to one-third are malicious. Tendermint, built in 2014, took PBFT and made it faster. It cut down the steps needed to agree on a block. Instead of multiple rounds of voting, it streamlined the process. The result? Consensus in 1-3 seconds. Throughput of up to 10,000 transactions per second. That’s why Cosmos, launched in 2019, chose Tendermint as its backbone. Cosmos isn’t just one chain-it’s a whole ecosystem of interconnected blockchains, all talking to each other. That kind of speed and finality is impossible with PoW. But PBFT has limits. It doesn’t scale well with hundreds or thousands of validators. The more nodes, the slower the communication. That’s why it’s mostly used in permissioned or semi-permissioned networks. Public blockchains need openness. PBFT needs control. They don’t always mix.

Delegated Proof of Stake: Democracy with a Catch

What if you could vote for who runs your blockchain? That’s the idea behind Delegated Proof of Stake (DPoS). Token holders elect a small group of validators-called delegates or block producers-to handle consensus on their behalf. EOS, one of the first big DPoS chains, elected 21 producers. Block times were under half a second. Throughput? Up to 4,000 transactions per second. It sounded perfect. Fast. Democratic. Efficient. But real-world use exposed flaws. Voters often didn’t pay attention. Big players bought votes. Small holders got ignored. Some delegates formed cartels, sharing rewards and blocking competitors. Governance became a power struggle, not a public forum. And when a validator went offline or acted maliciously, recovery was slow. DPoS traded decentralization for speed-and sometimes, it paid too high a price.Avalanche and Hashgraph: New Ways to Agree

Then came the outsiders. Avalanche, launched in 2020, didn’t try to improve PoW or PoS. It invented a new way. Instead of asking every node to vote, it randomly sampled small groups. Each sample asked: “Is this transaction valid?” If enough said yes, the next round sampled again. Confidence built like a snowball. Finality in under two seconds. Throughput over 4,500 TPS. And it worked with thousands of nodes-not just dozens. Hashgraph, created in 2016, used a different trick: “gossip about gossip.” Nodes randomly share transaction data with others, who then share what they heard. This creates a full history of communication. Virtual voting then determines consensus without every node sending votes. Hashgraph claims over 250,000 TPS and sub-5-second finality. Hedera, which uses Hashgraph, processes over 10,000 TPS with fees under $0.0001 per transaction. These systems are fast. They’re efficient. But they’re young. No one knows how they’ll hold up under a coordinated, multi-year attack. They haven’t been battle-tested like Bitcoin’s PoW. That’s why many investors still treat them as experimental.The Rise of Hybrid and Specialized Consensus

The future isn’t one algorithm. It’s combinations. Ethereum’s transition wasn’t just PoS-it was a hybrid called Casper FFG. It blended PoW’s security with PoS’s efficiency during the transition. Later, HotStuff simplified PBFT into something more scalable. These aren’t just upgrades. They’re adaptations. Newer systems are splitting consensus from data availability. LazyLedger, for example, lets block producers focus only on ordering transactions. The actual data is stored separately, verified by light clients using fraud proofs. This cuts resource needs dramatically. It’s like having a police officer confirm a crime happened without reading every witness statement. Enterprise chains use PBFT variants because they need compliance, audit trails, and predictable performance. DeFi needs speed and low fees. NFT platforms need finality. Gaming chains need instant responses. No single algorithm fits all.

What’s Next? Quantum, Interoperability, and Green Consensus

The next frontier isn’t just speed. It’s survival. Quantum computers could break the cryptographic signatures used in most blockchains. Researchers are already testing post-quantum algorithms-ones based on lattice math or hash functions that even quantum machines can’t crack easily. The transition will take years. But it’s starting now. Interoperability is another big push. Blockchains need to talk to each other. Cross-chain bridges are fragile. Consensus protocols that can verify data across chains-without trusting third parties-are being built. Cosmos’s IBC protocol is one example. Polkadot’s relay chain is another. And then there’s carbon. Some PoS chains now run entirely on renewable energy. Others buy carbon offsets. A few even claim to be carbon-negative. As regulations tighten, especially in the EU and U.S., energy use will become a legal issue-not just an ethical one.Choosing the Right Algorithm

So which one should you care about?- If you want maximum security and don’t mind slow speeds and high energy: Proof of Work (Bitcoin).

- If you want efficiency, low cost, and scalability: Proof of Stake (Ethereum, Solana).

- If you need instant finality and know your validators: Tendermint/PBFT (Cosmos, private chains).

- If you want speed and democratic voting: DPoS (EOS, TRON)-but watch for centralization.

- If you need extreme throughput and don’t mind novelty: Avalanche or Hashgraph (Hedera).

Final Thoughts

The evolution of consensus algorithms isn’t just about technology. It’s about values. PoW valued security above all else. PoS values sustainability. Tendermint values speed. DPoS values participation. Avalanche values scalability. Each reflects a different vision of what blockchain should be. The future won’t be ruled by one winner. It’ll be shaped by many-each serving different needs. The real innovation isn’t in replacing old systems. It’s in mixing them, adapting them, and making them fit the world we live in.What was the first consensus algorithm used in blockchain?

The first consensus algorithm used in blockchain was Proof of Work (PoW), introduced by Satoshi Nakamoto in the Bitcoin whitepaper in 2008. It required miners to solve complex mathematical puzzles to validate transactions and add new blocks to the chain. This mechanism secured Bitcoin’s network by making attacks economically impractical due to the massive computational power required.

Why did Ethereum switch from Proof of Work to Proof of Stake?

Ethereum switched from Proof of Work to Proof of Stake in September 2022 to drastically reduce energy consumption-by about 99.9%-and improve scalability. PoW required massive computing power, making Ethereum’s environmental footprint unsustainable. PoS allowed validators to secure the network by locking up ETH instead of running energy-hungry hardware, while maintaining security through economic penalties for dishonest behavior.

Is Proof of Stake more secure than Proof of Work?

Proof of Stake is not inherently more secure than Proof of Work, but it achieves security differently. PoW relies on computational power-attacking it requires controlling over 50% of global mining hash rate, which is expensive and visible. PoS relies on economic stakes-attacking it requires owning over 50% of the total cryptocurrency supply, which would be costly and self-defeating, as it would crash the value of the attacker’s own holdings. Both have strong security models, but PoS is more energy-efficient and scalable.

What are the main drawbacks of Delegated Proof of Stake?

Delegated Proof of Stake (DPoS) faces criticism for centralization. Since only a small number of elected validators handle consensus, power concentrates in the hands of a few. Wealthy stakeholders can buy votes, and delegates may form cartels to share rewards. Voter apathy also reduces true decentralization, as most token holders don’t participate in elections. This makes DPoS less resistant to collusion and governance manipulation compared to open validator systems.

Can consensus algorithms be quantum-resistant?

Yes, researchers are actively developing quantum-resistant consensus algorithms by replacing current cryptographic signatures with post-quantum alternatives like lattice-based or hash-based cryptography. While the consensus logic itself isn’t directly vulnerable to quantum attacks, the digital signatures used to authorize transactions are. Transitioning to quantum-safe signatures will be essential for long-term blockchain security, especially as quantum computing advances toward practical use.

Which consensus algorithm is best for enterprise use?

Practical Byzantine Fault Tolerance (PBFT) and its variants, like Tendermint, are best for enterprise use. These algorithms work in permissioned networks where participants are known and trusted. They offer fast finality, low latency, and predictable performance-all critical for supply chain tracking, banking, and government ledgers. Unlike public blockchains, enterprises don’t need open participation; they need compliance, auditability, and control.