When you stake cryptocurrency, you’re not just locking up your coins-you’re earning rewards. But how much? And why do some platforms say 5% APY while others say 5% APR? The difference isn’t just jargon. It’s staking rewards-and whether they’re compounding or not.

What APY Really Means for Your Staked Crypto

APY stands for Annual Percentage Yield. It’s the real number you should care about when comparing staking options. Unlike APR (Annual Percentage Rate), which ignores compounding, APY includes it. That means if your rewards are automatically reinvested-like they are on most platforms today-APY tells you exactly how much you’ll earn over a year.Let’s say you stake $1,000 in Ethereum at 5% APY. If rewards compound daily, you’ll end up with about $1,051.27 after a year. That’s $51.27 in earnings. But if it were 5% APR, you’d only get $50. The extra $1.27 comes from your rewards earning their own rewards. Over time, that adds up.

APY is the industry standard because most staking services-whether it’s Coinbase, Kraken, or a DeFi protocol like Lido-auto-reinvest your rewards. You don’t have to do anything. So if a platform quotes you APR, ask: Are rewards compounded? If yes, then APY is the number you need to compare.

The Math Behind APY (No Calculator Needed)

You don’t need to be a mathematician to get this. Here’s the formula in plain terms:APY = (1 + (nominal rate ÷ number of compounding periods))number of compounding periods - 1

Let’s break it down with a real example. Suppose a network offers a 7% nominal rate and compounds rewards monthly. That’s 12 times a year.

- 7% = 0.07

- 0.07 ÷ 12 = 0.005833

- 1 + 0.005833 = 1.005833

- 1.00583312 = 1.0723

- 1.0723 - 1 = 0.0723

So 7% nominal rate = 7.23% APY.

Now imagine staking $3,000. At 7% APR, you’d earn $210 in a year. At 7.23% APY? You’d earn $216.87. That’s $6.87 more-just because the rewards were reinvested each month. Over five years? That’s over $100 extra. Compounding isn’t magic. It’s math.

How Staking Rewards Are Actually Calculated

Your total rewards depend on three things: how much you stake, how long you stake it, and the APY. But it’s not as simple as multiplying your balance by the APY.Take Ethereum. Let’s say ETH is trading at $1,811.16. You stake 3 ETH ($5,433.48). The network offers a 3% APY. Here’s how the math works:

- 3 ETH × 0.03 = 0.09 ETH earned per year

- 0.09 ETH × $1,811.16 = $163.00 (annual reward in USD)

- Monthly: $163 ÷ 12 = $13.58

But wait-this assumes the price of ETH stays the same. It won’t. If ETH drops to $1,500, your $163 reward is now worth $135. If it rises to $2,000? Your reward is worth $180. APY doesn’t predict price. It only predicts how many tokens you’ll earn.

That’s why smart stakers track both token rewards and USD value separately. Your APY might stay steady, but your dollar returns can swing with the market.

Why APY Changes-And Why It’s Not Guaranteed

You’ll often see staking platforms say “estimated APY” or “EAY” (Estimated Annual Yield). That’s not a marketing trick. It’s honesty.APY isn’t fixed like a bank CD. It changes because of:

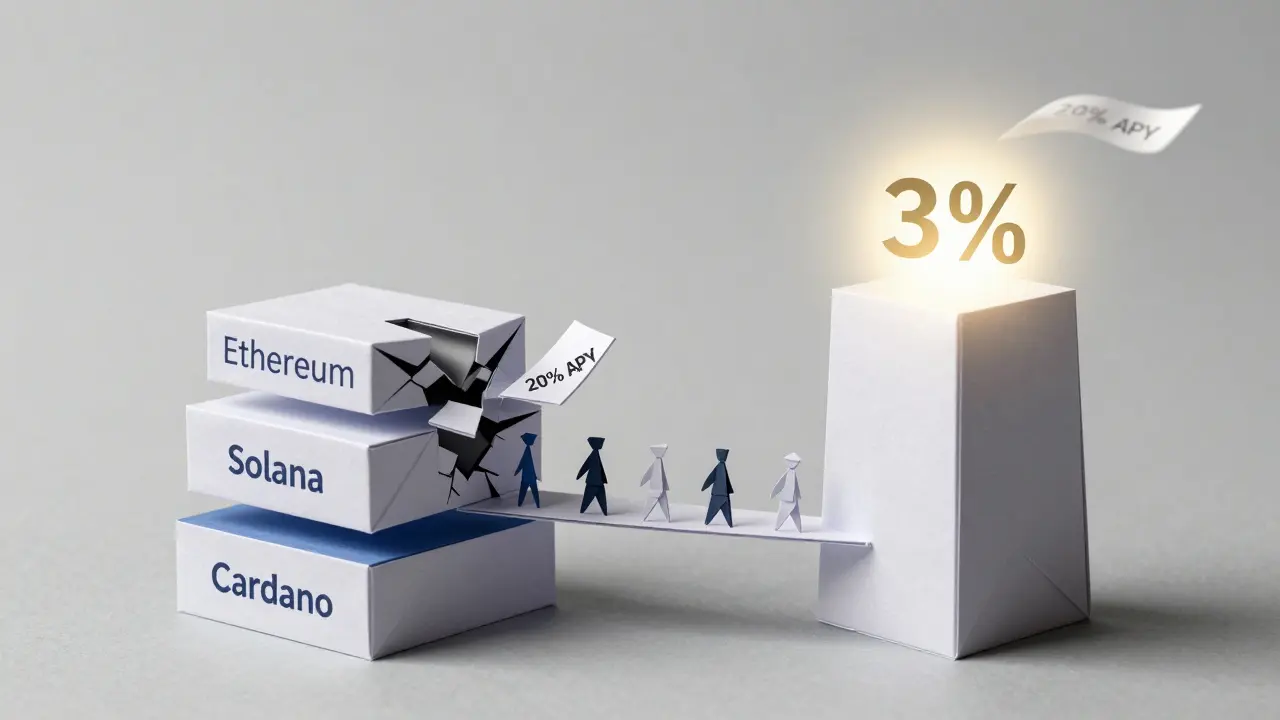

- Network activity: More people staking = lower rewards per validator. Fewer stakers = higher rewards. Ethereum’s APY dropped from over 10% in 2022 to around 3% in 2025 as more users joined.

- Governance votes: Network upgrades can change how much is paid out. For example, a vote could reduce rewards to fund development.

- Validator performance: If the node you’re staked with goes offline, you lose rewards. Some platforms guarantee uptime, others don’t.

- Platform fees: Exchanges like Binance or Kraken take a cut. A 5% APY from a third-party platform might be 4.2% after fees.

That’s why you should never assume your APY will stay the same. Check your staking dashboard monthly. If your rewards drop unexpectedly, it’s probably because the network changed-not because you did something wrong.

APY vs APR: Which One Should You Trust?

Here’s a quick way to tell which you’re looking at:| Feature | APY | APR |

|---|---|---|

| Compounding? | Yes | No |

| Used by | DeFi protocols, auto-compounding pools | Centralized exchanges, fixed-term staking |

| Real-world return | Higher | Lower |

| Example: 5% rate | ~5.12% with daily compounding | Exactly 5% |

| Best for | Long-term holders | Short-term stakers who withdraw rewards |

If you’re staking for more than a few months, APY is the only number that matters. If you’re withdrawing rewards every week, APR might be close enough. But if you’re letting your rewards grow? Always go with APY.

How to Use a Staking Calculator

You don’t have to do the math by hand. Most wallets and platforms have built-in staking calculators. But here’s what to look for in a good one:- Input: Amount staked, APY, compounding frequency (daily, monthly)

- Output: Estimated annual and monthly rewards in both tokens and USD

- Option to adjust for fees

- Shows difference between APY and APR

For example, input $5,000 at 4.5% APY, daily compounding, 12 months. A good calculator will show you:

- Final balance: $5,229.20

- Total earned: $229.20

- APR equivalent: 4.40%

That’s the power of compounding. Even a 0.1% difference in APY can mean hundreds of dollars over a year.

What to Watch Out For

Not all staking is created equal. Here are the traps most beginners fall into:- High APY = High risk: If a platform offers 20% APY on a new token, it’s probably unsustainable-or a scam. Real networks like Ethereum, Solana, or Cardano rarely exceed 5-7%.

- Lock-up periods: Some staking locks your coins for 21 days, 90 days, or longer. You can’t sell if the market crashes.

- Slashing risk: On some networks, if your validator misbehaves, you lose part of your stake. This is rare on big platforms but common on self-run nodes.

- Token volatility: Your rewards might be worth less tomorrow than today. APY doesn’t protect you from price drops.

Stick to well-established networks and reputable platforms. Avoid anything that sounds too good to be true.

Final Tip: Track Your Real Returns

Don’t just look at your staking dashboard. Use a crypto portfolio tracker like Koinly or CoinTracker. Import your staking rewards and see your actual profit after taxes and price changes. Many people think they’re earning 5%-but after ETH drops 30%, they’re down overall. APY tells you how many tokens you earn. Your portfolio tells you if you’re really ahead.Is APY guaranteed in crypto staking?

No, APY is an estimate. It can change based on network conditions, how many people are staking, or even governance votes. Always check your staking dashboard regularly for updates.

Should I choose APY or APR when staking?

Always choose APY if rewards are auto-compounded-which they are on most platforms. APR is only useful if you withdraw rewards every period and don’t reinvest them.

Does APY include platform fees?

Usually not. The APY shown on exchanges like Coinbase or Kraken is often after their fee. But on DeFi protocols, you need to subtract the fee manually. Always read the fine print.

Can I lose money even with staking rewards?

Yes. If the price of your staked coin drops more than your rewards earn, you’ll lose money in USD terms. Staking earns you tokens, not guaranteed dollar profits.

How often should I check my staking APY?

Check it at least once a month. Network-wide changes can happen quickly-especially on newer blockchains. If your APY drops suddenly, it’s likely due to increased staking activity, not a problem with your account.

Becky Chenier

APY vs APR always trips people up. I used to think they were the same until I lost $80 on a staking pool that advertised 6% APR but said nothing about compounding. Now I always check the fine print.

It’s not just about the number-it’s about how the math works behind it.

Staci Armezzani

For beginners, here’s the easiest way to remember: if you’re leaving your rewards to grow, APY is your friend. If you’re cashing out every week, APR might be close enough. But honestly? Just assume everything compounds unless stated otherwise.

Most platforms do it automatically, so APY is the only number that matters for long-term holders.

Tracey Grammer-Porter

I love how this post breaks it down without jargon. I’m not a math person but I finally get why APY is higher than APR now.

Also, the part about ETH dropping in value even if your staking rewards go up? That hit me hard. I thought I was making money until I checked my portfolio tracker last month.

Turns out I was down 15% overall. APY doesn’t care about your bank balance.

sathish kumar

It is imperative to note that the concept of Annual Percentage Yield, as applied to decentralized financial systems, is fundamentally distinct from conventional banking metrics due to the non-linear nature of blockchain-based compounding.

Furthermore, the volatility inherent in cryptocurrency asset pricing introduces a significant dissonance between token-denominated yields and fiat-denominated returns, which must be meticulously accounted for in any rational investment framework.

jim carry

OMG I CAN’T BELIEVE PEOPLE STILL GET TRICKED BY APR!!

IT’S 2025. WHY ARE YOU STILL USING CENTRALIZED EXCHANGES THAT DON’T COMPOUND?!

YOU’RE LEAVING MONEY ON THE TABLE LIKE A NOOB. I SAW A GUY LOSE $12K LAST YEAR BECAUSE HE THOUGHT 5% APR WAS THE SAME AS 5.1% APY. IT’S NOT EVEN A DEBATE. IT’S MATH. MATH, PEOPLE!

Don Grissett

APY my ass. Everyone knows the real yield is what you get after fees, taxes, and when the coin crashes. I’ve seen people brag about 8% APY on some random altcoin and then cry when it drops 60%.

Staking ain’t a savings account. It’s gambling with extra steps.

And don’t even get me started on slashing. You think you’re earning? Nah. You’re just waiting for your coins to vanish.

Katrina Recto

APY is the only metric that matters if you’re holding long term. Period.

Stop overthinking it. Just check the compounding frequency and move on.

Charlotte Parker

Oh wow, so we’re pretending crypto staking is like a bank CD now? That’s cute.

Next you’ll tell me APY is ‘guaranteed’ and that ‘math’ protects us from collapse.

Remember when Ethereum’s APY was 15% and now it’s 3%? That’s not math. That’s a Ponzi adjusting its payout rate.

At least back in the day, we called it what it was: yield farming with extra steps and no FDIC.

Calen Adams

Bro, if you’re not using a DeFi aggregator like Yearn or Beefy, you’re literally leaving 10–15% of your potential yield on the table.

Auto-compounding is non-negotiable. And if you’re staking on an exchange, you’re paying 20–30% in hidden fees. The APY they show? That’s the net number after their cut.

But if you’re self-custodial? You can get 0.5–1% extra by optimizing your validator setup.

It’s not magic. It’s just knowing where to look.

Valencia Adell

Let me guess-you think this APY stuff makes you rich?

Let me tell you what actually happens: you stake your ETH, it drops 40%, your rewards cover 5% of the loss, and you’re still down $2K.

Then you panic-sell, lose another 15%, and blame the ‘market’.

APY doesn’t protect you. It just makes you feel smart while your portfolio bleeds.

Staking is a trap for the emotionally attached.

Jessie X

APY is the number you use to compare. But the real question is who’s paying it?

If it’s a big exchange, they’re probably borrowing your coins to lend out elsewhere.

If it’s a DeFi protocol, your funds are in a pool that could get hacked.

APY doesn’t tell you the risk. It just tells you the reward.

And reward without risk awareness is just a fantasy.

Frank Heili

Here’s a pro tip: always calculate your APY using the exact compounding frequency. Some platforms say ‘daily’ but compound every 12 hours. Others say ‘monthly’ but only pay out every 30 days.

Use a staking calculator with adjustable parameters. Don’t trust the platform’s number.

And if they don’t disclose the compounding schedule? Run.

Jennah Grant

Most people don’t realize that APY is just a marketing tool. The real yield is what you get after fees, slippage, gas costs, and tax events.

On Ethereum, if you’re staking via a pool like Lido, you’re getting stETH, which trades at a discount sometimes.

So your APY might be 3%, but your actual return is 2.5% because your stETH is worth less than ETH.

It’s not just APY. It’s APY + tokenomics + liquidity risk.

Dennis Mbuthia

Look, I’m not some crypto bro, but I’ve been staking since 2021, and I’ve seen it all. APY? APR? Who cares? You want to make money? Don’t stake anything that’s not on Coinbase or Kraken. Everything else is a scam waiting to happen. And don’t even think about DeFi-those guys don’t even have a phone number. You think they care if you lose your money? No. They’ll just launch another token and take your gas fees.

Stick to the big guys. They’re regulated. Sort of. And they don’t vanish overnight.

Also, if someone says ‘7% APY’ on a coin you’ve never heard of? That’s not a yield. That’s a red flag with a neon sign.

Dave Lite

Just wanted to say thanks for this breakdown 🙏

I used to think APY and APR were the same until I read this. Now I use a calculator before I stake anything.

Also, I just found out my Kraken rewards are compounded daily-so my 4.8% APY is actually giving me ~4.9% real return. That extra 0.1% adds up over time!

And yes, I track my USD value too. My ETH rewards are worth way less now than when I staked. APY doesn’t fix that 😅

Veronica Mead

The notion that APY is a reliable indicator of return is not only misleading but ethically questionable in the context of unregulated financial instruments.

One must consider the systemic risks inherent in proof-of-stake consensus mechanisms, including validator collusion, centralization of stake, and regulatory uncertainty.

It is irresponsible to encourage laypersons to treat staking as a passive income strategy when the underlying infrastructure lacks legal safeguards.

APY is not yield-it is a speculative illusion.

Mollie Williams

It’s funny how we treat APY like it’s a law of nature, when really it’s just a number generated by code running on servers we can’t see.

What if the algorithm changes tomorrow? What if the network decides to reduce rewards to fund a new feature? What if the ‘compounding’ is just a simulation?

We’re not earning interest. We’re participating in a social contract that could be rewritten at any moment.

APY gives us the illusion of control. But we’re still just nodes in a machine we didn’t build.

Surendra Chopde

Very good explanation. I am from India and many people here think staking is like fixed deposit. But they forget that crypto price can go down.

APY is good for token growth, but USD value matters more for daily life.

Thank you for clear breakdown. I will share this with my friends.

Tiffani Frey

One thing this post doesn’t mention: tax implications.

Every time your staking rewards compound, in the U.S., that’s a taxable event.

So if you’re earning $10/month in ETH rewards and they auto-reinvest, the IRS sees that as $10 of income every month-even if you never sell.

That can add up to hundreds in taxes over a year. APY doesn’t tell you that. Your accountant does.

Tre Smith

Let me be the one to say it: APY is meaningless if you don’t know who’s behind the staking pool.

Are you staking with a legitimate validator? Or a front for a rug pull?

Is the protocol audited? Is the code open source? Or is it a Discord group with a whitepaper written in Google Translate?

APY is just the sugar coating on a poison pill. Look past the number. Look at the architecture.

Most people get rekt not because of APY-they get rekt because they didn’t do their homework.

Ritu Singh

They told you APY is about math... but what if the math is rigged?

What if the ‘compounding’ is just a lie fed by algorithms controlled by Wall Street?

What if your ‘rewards’ are just synthetic tokens created by a central entity pretending to be decentralized?

They want you to believe in APY so you don’t ask why your coins are locked... why you can’t withdraw... why the ‘network’ keeps changing the rules.

They don’t want you to know. They want you to calculate. To trust. To wait.

But the real yield? It’s not in your wallet.

It’s in their bank account.

kris serafin

APY is everything 🚀

Just staked 5 SOL at 7.2% APY with daily compounding-my wallet’s been growing like a weed 🌱

Also, always use a calculator with fees included. I lost $40 last month because I forgot to subtract the 1% platform cut.

Now I double-check everything. APY isn’t magic, but it’s the closest thing we got 😎

Jordan Leon

There’s a deeper layer here: APY is a metric designed for human psychology, not economic truth.

It gives us the comfort of a number, but hides the instability beneath.

We are conditioned to chase yields like animals chasing fruit-ignoring the storm clouds.

Perhaps the real question isn’t how to calculate APY, but whether we should trust any system that promises steady returns in a volatile, unregulated space.

Rahul Sharma

Very clear explanation. I am from India. Many people here think staking is risk-free like bank interest.

But I know crypto price can change fast. So I only stake in ETH and SOL. Never in new tokens.

APY is good, but safety is better.

Thank you for this post. I will use calculator before staking next time.

Becky Chenier

That’s actually a great point about taxes. I forgot that compounding = taxable income.

Now I’m using Koinly to track every reward event. It’s a pain, but better than a surprise IRS letter.

APY tells you how many tokens you get. Taxes tell you how much of it you keep.

Dave Lite

Also, if you’re on Kraken or Coinbase, they handle the tax reporting for you (mostly).

DeFi? You’re on your own. I had to file 120+ transactions last year. 😅

But honestly? Worth it. Even after taxes, I’m up 20% on my staking since 2023.