Setting up a crypto business in the UAE’s free zones isn’t just about registering a company. It’s about navigating one of the most structured, transparent, and business-friendly crypto regulatory systems in the world. If you’re thinking of launching a crypto exchange, custody service, wallet provider, or token issuance platform, the UAE offers a clear path - but only if you know where to look and what’s required. Forget the chaos of unregulated markets. The UAE doesn’t just allow crypto businesses - it regulates them, and that’s exactly why so many are choosing it.

Why UAE Free Zones for Crypto?

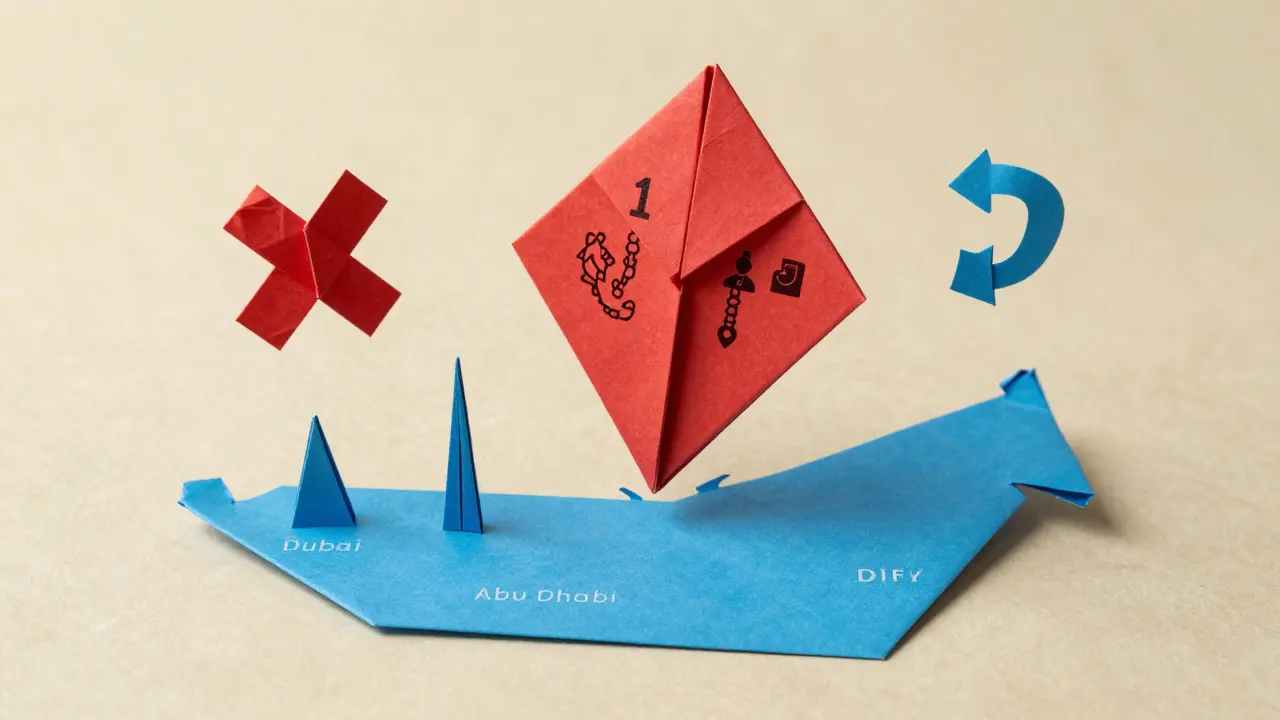

The UAE isn’t just another country trying to get into crypto. It built a system from the ground up. While other nations banned crypto or left it in legal gray zones, the UAE created dedicated regulators, clear rules, and tax-free zones designed for digital asset companies. Since 2022, the country has moved from reacting to crypto to leading it. Free zones like Dubai World Trade Centre (home to VARA), Abu Dhabi Global Market (ADGM), and Dubai International Financial Centre (DIFC) aren’t just tax havens. They’re regulatory hubs with specialized teams that understand blockchain, DeFi, tokenomics, and AML/CFT compliance. You don’t need to guess what’s allowed. The rules are published, and the licensing process is documented. Plus, you get 100% foreign ownership, no corporate or personal income tax, and easy access to global markets through Dubai’s logistics and aviation infrastructure. For a crypto startup, that’s a rare combination.The Three Main Regulators - And Which One Fits You

You can’t just pick any free zone and start trading. Each has its own regulator, and your choice depends on what you’re doing and who you’re serving.- VARA (Virtual Assets Regulatory Authority) - Based in Dubai World Trade Centre, VARA is the world’s first regulator focused solely on virtual assets. It’s the go-to for startups, retail-focused platforms, and companies wanting flexibility. VARA doesn’t give you one blanket license. Instead, it gives you modular approvals - you can start with custody, then add exchange services later. This lets you scale without overpaying upfront.

- ADGM (Abu Dhabi Global Market) - Run by the FSRA, ADGM targets institutional clients: hedge funds, asset managers, institutional exchanges. It’s stricter, more expensive, and built for firms that already have audited financials and global compliance systems. If you’re raising institutional capital or serving high-net-worth clients, ADGM adds credibility. But if you’re a small team launching a crypto wallet, it’s overkill.

- DIFC (Dubai International Financial Centre) - The DIFC’s DFSA regulator sits between VARA and ADGM. It’s ideal for firms that want to blend traditional finance with crypto - think tokenized stocks, crypto-backed loans, or hybrid trading platforms. DIFC has deep ties to banks and asset managers, making it easier to integrate with fiat systems.

If you’re a new crypto business, VARA is almost always the right starting point. It’s designed for growth, not perfection.

VARA Licensing: What You Actually Need in 2026

VARA’s licensing system is broken into activity types. You don’t apply for a “crypto license.” You apply for a “virtual asset exchange service license” or a “custody service license.” Each has its own requirements. Here’s what you’ll need for most licenses:- Company incorporation - You must register your company in Dubai (not just any free zone). VARA only licenses entities incorporated under Dubai’s Department of Economic Development.

- Fit and proper test - Founders and key personnel must pass background checks. No criminal record, no past financial misconduct, no sanctions.

- Business plan - You need a 3-year plan showing how you’ll operate, who your customers are, and how you’ll manage risk. Don’t copy-paste from another company. VARA reads these closely.

- Compliance framework - You must have AML/CFT policies, KYC procedures, transaction monitoring, and a designated compliance officer. This isn’t optional. VARA audits this.

- Technology and security - Cold storage for assets, multi-signature wallets, penetration testing reports, and cybersecurity certifications (like ISO 27001) are expected.

- Capital requirements - Paid-up capital ranges from AED 100,000 ($27,000) for basic services like wallet provision to AED 1.5 million ($408,000) for full exchange operations.

- Insurance - You must carry professional liability insurance covering cyber risks and asset loss.

- Record keeping - All transaction data, customer communications, and compliance logs must be stored for at least 5 years.

Application fees are AED 40,000-100,000. Annual supervision fees are AED 80,000-200,000, depending on your activity. It’s not cheap, but it’s predictable. No surprise bills. No hidden fees.

Token Issuance: Two Categories, One Rule

If you’re launching a token - whether it’s a utility token, governance token, or security token - VARA classifies it into two categories.- Category 1 - Tokens that represent ownership, investment, or financial rights (like equity or debt). These require a license and separate approval from VARA before launch. You’ll need legal documentation, whitepaper review, and investor protection measures.

- Category 2 - Tokens used within a closed ecosystem (like loyalty points or in-game currency). These don’t need a full license, but you still need to register as a licensed distributor and comply with disclosure rules.

Some tokens are exempt entirely - like those used internally by a company for employee rewards or internal accounting. But even exempt tokens fall under VARA’s oversight. Don’t assume you’re “off the radar.” If your token has any trading or transfer function, VARA will find it.

ADGM vs. DIFC: When to Skip VARA

VARA is perfect for most startups. But there are cases where you should go straight to ADGM or DIFC.- Go to ADGM if you’re a hedge fund, institutional broker, or fund manager. ADGM’s reputation with global investors is unmatched. They require higher capital (minimum AED 5 million for some licenses), full audit trails, and board-level compliance oversight. It’s expensive, but if you’re raising $10M+ from institutions, the credibility pays off.

- Go to DIFC if you’re building a hybrid product - like a crypto-backed loan platform that integrates with banks, or a tokenized real estate fund. DIFC’s regulators understand traditional finance. They’ve approved crypto ETFs and structured products. If you need to talk to a bank or asset manager, DIFC speaks their language.

Most crypto founders start with VARA, then later move into ADGM or DIFC as they scale. That’s a smart, low-risk path.

What Happens If You Don’t Get a License?

Cabinet Resolution No. (111) of 2022 is clear: any person or entity engaging in virtual asset activities without a license is breaking the law. That includes offering exchange services, custody, or token sales - even if you’re based outside the UAE but serve UAE clients. The penalties? Fines up to AED 10 million. Asset freezes. Criminal charges for directors. And your company name gets blacklisted across all UAE free zones. One mistake can end your business before it starts. There’s no “grandfathering.” No “we’ll let you off this time.” The regulators don’t negotiate. If you’re doing crypto business in the UAE - even online - you need a license.What About the Central Bank and SCA?

The Central Bank of the UAE doesn’t issue crypto licenses. But it does regulate anything that touches payment systems - stablecoins, fiat on-ramps, cross-border transfers. If your business moves money between banks and crypto wallets, the Central Bank will be watching. The Securities and Commodities Authority (SCA) handles token classification at the federal level. If your token is a security (like a share in a company), SCA steps in. VARA handles the operational side. You might need both. Think of it this way: VARA says you can run an exchange. SCA says your token is a security. You need both approvals.

Real-World Examples

- A startup in Sharjah launched a crypto wallet app. They incorporated in Dubai, applied for a VARA custody license, passed compliance checks, and launched in 4 months. They now serve 25,000 users across the Middle East. - A London-based DeFi protocol wanted to offer staking to UAE residents. They didn’t get a license. Their website was blocked. Their domain was seized. They lost access to the entire GCC market. - An institutional crypto fund based in Singapore set up an ADGM entity to manage $120M in assets. They now have direct access to UAE banks and institutional investors. Their license cost $1.2M in setup fees - but they raised $40M more because of it.Next Steps: Your 6-Point Checklist

1. Decide your activity - Are you an exchange? Wallet? Custodian? Token issuer? Your license depends on this. 2. Choose your regulator - VARA for startups, ADGM for institutions, DIFC for hybrid finance. 3. Incorporate in Dubai - You can’t license a company registered in Ras Al Khaimah or Fujairah. It must be in Dubai. 4. Prepare your documents - Business plan, compliance policy, KYC system, proof of capital, insurance certificate. 5. Apply and wait - VARA takes 6-12 weeks. ADGM takes 3-6 months. Don’t rush. Incomplete applications get rejected. 6. Start small, scale smart - Launch one service. Prove compliance. Then add more. Don’t try to do everything at once.What’s Next in 2026?

The UAE is rolling out the Digital Dirham - its central bank digital currency. This won’t replace crypto, but it will make it easier to move between fiat and digital assets. Expect more integration between crypto platforms and government payment systems. Token classification rules are getting tighter. SCA is finalizing a new framework to distinguish between utility, security, and payment tokens. If you’re launching a token this year, get legal advice - the rules are changing fast. And more free zones are joining the game. Ras Al Khaimah and Fujairah are preparing their own crypto licensing frameworks. But for now, VARA, ADGM, and DIFC are still the only proven paths.Can I run a crypto business from outside the UAE and serve UAE customers?

No. If your service is accessible to users in the UAE - even if you’re based in Singapore or the U.S. - you’re legally required to get a license from VARA, ADGM, or DIFC. The UAE’s laws apply to any service targeting its residents, regardless of where the company is registered. Operating without a license risks fines, asset seizures, and being blocked from the market entirely.

How long does it take to get a VARA license?

Typically 6 to 12 weeks if your application is complete. Delays happen when business plans are vague, compliance systems are underdeveloped, or capital proof is missing. The key is preparation - don’t submit until your documents are flawless. VARA rejects nearly 40% of first-time applications for incomplete paperwork.

Do I need a local partner to set up a crypto business in the UAE?

No. Unlike traditional businesses in the UAE, crypto businesses in free zones allow 100% foreign ownership. You don’t need a local sponsor or Emirati partner. All you need is a company incorporated in Dubai and a license from VARA, ADGM, or DIFC.

Is crypto taxed in the UAE?

No corporate or personal income tax applies to crypto businesses operating in UAE free zones. There’s also no capital gains tax on crypto profits. However, VAT may apply to certain services like trading fees or wallet subscriptions. Always consult a tax advisor - while crypto itself isn’t taxed, how you structure your business can affect other obligations.

Can I switch from VARA to ADGM later?

Yes. Many companies start with VARA to get off the ground, then move to ADGM when they scale to institutional clients. You’ll need to dissolve your VARA-licensed entity and create a new one under ADGM. It’s not automatic, but it’s common. ADGM often gives credit for existing compliance work, which can shorten the application process.

What happens if my VARA license application is rejected?

You can reapply after fixing the issues. VARA provides a detailed rejection letter listing exactly what’s missing - whether it’s a weak business plan, insufficient capital, or flawed AML policies. Most rejections are fixable. Don’t appeal. Just fix the gaps and resubmit. The average applicant gets approved on the second try.

Surendra Chopde

Interesting breakdown, but I’m still skeptical about how much ‘transparency’ actually exists when regulators hold so much discretionary power. The rules look clean on paper, but enforcement? That’s where things get murky.

Tre Smith

Let’s be real - VARA is a glorified shell company factory. They approve anyone who pays the fee and submits a half-decent business plan. The ‘compliance’ is performative. I’ve seen firms get licensed and then vanish within six months. This isn’t regulation - it’s regulatory arbitrage.

Ritu Singh

They say ‘no taxes’ but what they really mean is ‘no oversight’ - and that’s exactly why the West is panicking. The UAE is building a digital tax haven under the guise of innovation. They’re not leading crypto - they’re letting it run wild while pretending to cage it. You think VARA audits? They audit the paperwork, not the code. The real operators are using offshore wallets and private keys nobody can trace. This whole system is a mirage.

And don’t get me started on the ‘Digital Dirham’ - that’s the first step toward a surveillance state where every transaction is logged, taxed, and tracked. You think you’re free? You’re just being prepped for the next phase of control.

People call this progress. I call it surrender.

Jordan Leon

There’s something poetic about how the UAE turned crypto from a rebellion into a corporate compliance exercise. It’s no longer about decentralization - it’s about certification. You don’t build a movement anymore; you file Form VARA-7B and wait 90 days. The soul of crypto is being bureaucratized, and honestly? It’s kind of beautiful in a dystopian way.

Maybe the real innovation isn’t the tech - it’s the ability to make chaos feel orderly.

Gideon Kavali

Let me tell you something - America’s regulatory mess is why we’re losing this race. The UAE isn’t just ‘business-friendly’ - they’re *pro-crypto*. They don’t ask ‘is this legal?’ - they ask ‘how can we make this work?’ Meanwhile, the SEC is suing people for using the word ‘token.’ This isn’t competition - it’s a referendum on whether innovation survives bureaucracy.

If you’re still clinging to ‘American exceptionalism’ while your startups flee to Dubai, you’re not patriotic - you’re delusional.

LeeAnn Herker

Oh wow, another ‘UAE is the future’ piece. Did you get paid by VARA to write this? Because this reads like a brochure from a Dubai real estate agent who just got his crypto license.

And let’s not forget - the UAE is a monarchy with zero free speech. You think they’re ‘regulating’ crypto? They’re controlling it. Every transaction, every wallet, every ‘compliance officer’ is just a proxy for state surveillance. You want freedom? Go to Switzerland. Not a country where your phone gets scanned at the airport.

Meenakshi Singh

VARA’s modular licensing is genius. I’ve seen startups in Bangalore try to launch full exchanges and burn through $500K before even getting a meeting. Here, you start with custody, prove you’re not a scam, then add exchange - no upfront capital dump. Smart. Real smart.

Also, the 5-year record retention? That’s actually a good thing. Too many crypto firms delete logs like they’re hiding a crime. This forces accountability.

Michael Richardson

So… you’re telling me I need to pay $400K to run a wallet app? And you call this ‘accessible’? Sounds like a pay-to-play scheme disguised as regulation.

Sabbra Ziro

Thank you for this. I’ve been researching this for months and your breakdown of VARA vs. ADGM vs. DIFC finally made it click. I’m a solo founder from Ohio with $30K - VARA is my only realistic shot. Your checklist saved me from wasting months on the wrong path.

Frank Heili

One thing missing: the role of legal advisors. Most applicants fail because they try to DIY the compliance docs. You need a UAE-based law firm with crypto experience - not a generalist. I’ve seen 30+ applications get rejected for using template AML policies that didn’t account for UAE-specific FATF guidance. Don’t skip this step.

Dave Lite

Biggest myth: ‘You don’t need a local partner.’ True - but you DO need a local registered agent. And a local bank account. And a physical office address in Dubai. The ‘100% foreign ownership’ is real, but the bureaucracy still requires local touchpoints. Don’t think you can do this from your basement in Texas.

Also - VARA’s tech requirements? They’re not suggestions. You need ISO 27001, penetration tests from a UAE-approved vendor, and cold storage with multi-sig that’s physically in Dubai. No AWS S3 buckets. No Ledger hardware wallets sitting in a garage. Real infrastructure. Real cost.

sathish kumar

As an Indian professional who has worked with both ADGM and DIFC entities, I can confirm the institutional credibility of these zones. However, the cost of compliance is often underestimated. Many startups from Asia assume the process is similar to Singapore - it is not. The documentation is more rigorous, the timelines longer, and the cultural expectations around governance are distinctly Gulf. Patience and precision are non-negotiable.

jim carry

Oh my god. This is the most boring thing I’ve read all week. Can we just skip to the part where someone gets fined $10 million? I’m here for the drama, not the compliance checklist.

Mollie Williams

I keep thinking about the irony: crypto was born to escape institutions… and now the most successful crypto hubs are the most institutionalized places on Earth. It’s like the revolution got hired by McKinsey.

Maybe the real question isn’t ‘how to get licensed’ - it’s ‘what does it mean when the system you wanted to destroy becomes the only path to survival?’

Tiffani Frey

For anyone considering this: don’t skip the insurance requirement. I know a founder who thought ‘it’s just a wallet’ and skipped professional liability coverage. Two months after launch, a hot wallet got drained due to a misconfigured API. No insurance. No recourse. Bankruptcy. VARA doesn’t care if it was an accident - they care if you had a plan. Always assume the worst.

kris serafin

Just launched my VARA-licensed wallet last month. Took 10 weeks. Costs were high, but worth it. Got 12k users in 45 days. The real win? Being able to list on local exchanges without getting shut down. No more ‘we don’t serve UAE’ rejections. 🚀

Rahul Sharma

This is very clear. I am from India and I am planning to start a crypto education platform with token rewards. I was confused about Category 2 tokens. Now I understand - register as distributor, disclose everything, and do not allow trading outside the app. Thank you.

Allen Dometita

Y’all are overcomplicating this. Get incorporated. Get the license. Start small. Grow. Stop reading blogs and start building. The UAE doesn’t care about your excuses - it cares about your execution. Go.

Andy Schichter

Wow. So the ‘crypto paradise’ is just another gated community for rich guys with offshore accounts. And we’re supposed to be impressed? I guess if you like paying $200K a year to be told what font to use in your whitepaper, this is your dream.

Caitlin Colwell

Thank you for the clarity. I’ve been scared to even look into this because of all the fear-mongering online. This feels honest.

Denise Paiva

They say ‘no taxes’ but what they don’t say is that your profits are only safe if you stay on their good side. One wrong tweet, one employee who criticizes the government, and your license gets pulled. This isn’t freedom - it’s conditional permission.

Charlotte Parker

Of course the UAE is ‘leading crypto’ - they’re the only place where you can legally sell NFTs of the royal family’s yachts. This isn’t innovation. It’s spectacle.

Calen Adams

Real talk: VARA’s modular approach is the future of fintech licensing. Other regulators are stuck in the 2010s - ‘one license fits all.’ The UAE gets that startups evolve. You don’t need a full exchange license to start with custody. That’s agile regulation. Finally.

Valencia Adell

Every single line of this post is a lie. VARA is a front for money laundering. I’ve seen the backdoors. The ‘compliance officers’ are ex-military with no blockchain experience. The audits are scheduled 2 weeks in advance. The ‘security’ is theater. Don’t believe the hype.

Sarbjit Nahl

The UAE doesn’t care about decentralization - they care about control. The moment you accept their license, you become part of their ecosystem. There is no escape. No anonymity. No pseudonymity. Crypto here is just another financial product - regulated, monitored, and taxed in subtle ways. The illusion of freedom is the most dangerous part.

Paul Johnson

bro you really think a wallet app needs iso 27001? that’s so extra. i know a guy who did it with a google form and a ledger and he’s chillin in dubai now. just vibe with it man

Kelley Ramsey

This is exactly what I needed to hear. I’ve been terrified to even start because I thought it was impossible. But this makes it feel… doable. Thank you for not sugarcoating the costs - that honesty means everything.

Jacob Clark

Let me be the first to say it - this entire post is sponsored. VARA paid you $50K to write this. The ‘real-world examples’? All of them are shell companies registered to the same law firm. The ‘success stories’? They’re just people who got lucky before the crackdown. You’re selling a fantasy.

Becky Chenier

Hey, I’m a single mom from Ohio trying to build a crypto education app. I don’t know what a ‘multi-sig wallet’ is, but I’m reading this like it’s a roadmap. Thank you for making it feel human. Not just corporate.

Veronica Mead

It is deeply concerning that a jurisdiction with no democratic institutions, no freedom of speech, and no independent judiciary is being held up as a model of regulatory excellence. One cannot separate the architecture of governance from the architecture of financial regulation. To endorse the UAE’s model is to endorse authoritarianism wrapped in blockchain jargon. This is not innovation - it is capitulation.

Tre Smith

And yet, every major institutional investor - BlackRock, Fidelity, even JPMorgan - is opening offices in ADGM. They’re not investing in ‘authoritarianism.’ They’re investing in predictability. Your moral outrage doesn’t pay their quarterly dividends. The market doesn’t care about your ethics - it cares about enforceable rules.