Proof-of-Work Ban: What It Means for Bitcoin, Miners, and Crypto's Future

When people talk about a proof-of-work ban, a regulatory move to eliminate energy-intensive blockchain consensus mechanisms, they’re not just talking about technology—they’re talking about money, power, and who controls it. Proof-of-work is the system that keeps Bitcoin secure by rewarding miners for solving complex math puzzles. But it uses massive amounts of electricity. In places like the European Union and parts of the U.S., regulators are pushing hard to limit or ban it, arguing it’s environmentally unsustainable. The real question isn’t whether it’s possible to ban proof-of-work—it’s whether the crypto world can survive without it.

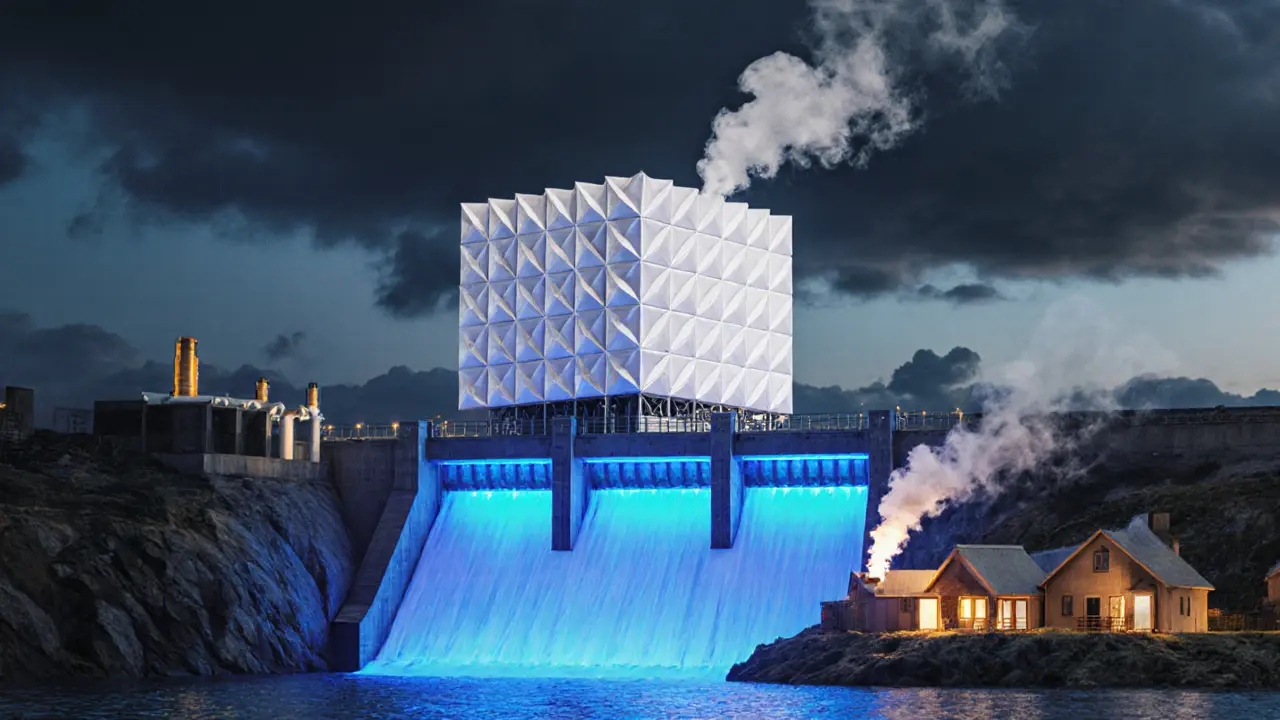

Related to this are Bitcoin mining, the process of validating transactions and adding them to the blockchain using computational power, and proof-of-stake, a more energy-efficient alternative where validators are chosen based on how much crypto they hold and are willing to "stake" as collateral. Proof-of-stake doesn’t need thousands of tons of hardware running 24/7. Ethereum switched to it in 2022 and cut its energy use by over 99%. That’s why regulators see it as the future. But Bitcoin miners—many of them small operators using second-hand GPUs or cheap hydro power—don’t have that luxury. A proof-of-work ban would hit them hardest, not the big mining farms that can afford to move to places like Texas or Kazakhstan.

It’s not just about the environment. Governments are also worried about crypto’s role in sanctions evasion and unregulated capital flows. Blockchain forensics can trace transactions, but if proof-of-work networks keep growing, they become harder to monitor. That’s why some countries are already moving to restrict mining licenses or tax energy use for crypto operations. Russia, for example, allows crypto for cross-border trade but bans personal mining. India taxes crypto at 30% and monitors every transaction. A proof-of-work ban isn’t just an environmental policy—it’s a financial control tool.

What does this mean for you? If you’re a miner, you’re facing an existential choice: adapt, relocate, or shut down. If you’re an investor, you need to ask whether Bitcoin can keep its value if its security model is legally challenged. And if you’re just trying to understand crypto’s direction, you’re watching a battle between decentralization and regulation—one that’s already changing how networks are built. The posts below cover real cases: from how altcoin mining still makes sense for everyday people, to how exchanges like BitMEX are affected by regulatory crackdowns, to why quantum-resistant security and blockchain forensics are becoming just as important as the mining hardware itself. This isn’t theory. It’s happening now, and the choices made in the next two years will define crypto for the next decade.