ArbSwap Slippage Calculator

Slippage Result

ArbSwap isn’t another Uniswap clone. It doesn’t try to be everything to everyone. On Arbitrum Nova, it’s built for one thing: trading tokens that other exchanges ignore. If you’re holding an obscure Arbitrum-native token - maybe from a small DeFi project, a new LSD, or a niche governance token - ArbSwap might be your only real option. But here’s the catch: it’s only useful if you know exactly what you’re getting into.

What Is ArbSwap, Really?

ArbSwap is a decentralized exchange (DEX) that runs exclusively on Arbitrum One, not Arbitrum Nova. Despite the title confusion, it’s not built on Arbitrum Nova’s low-cost, high-throughput chain - it’s on Arbitrum One, the original and more secure Layer 2. Launched in 2023, it went quiet through most of 2024, then came back in January 2025 with a sharper focus: deep liquidity for tokens that other DEXs won’t list. Unlike Uniswap V3, which supports thousands of tokens across chains, ArbSwap lists only 147 verified Arbitrum-native assets as of February 2025. That’s tiny compared to Uniswap’s 1,200+. But here’s the twist: 92% of those tokens aren’t listed on major cross-chain DEXs. That’s not a bug - it’s the whole point. If you need to trade RDNT, ARB, or a new stablecoin from a small Arbitrum project, ArbSwap is often the only place with enough volume to make it work.How Does It Work?

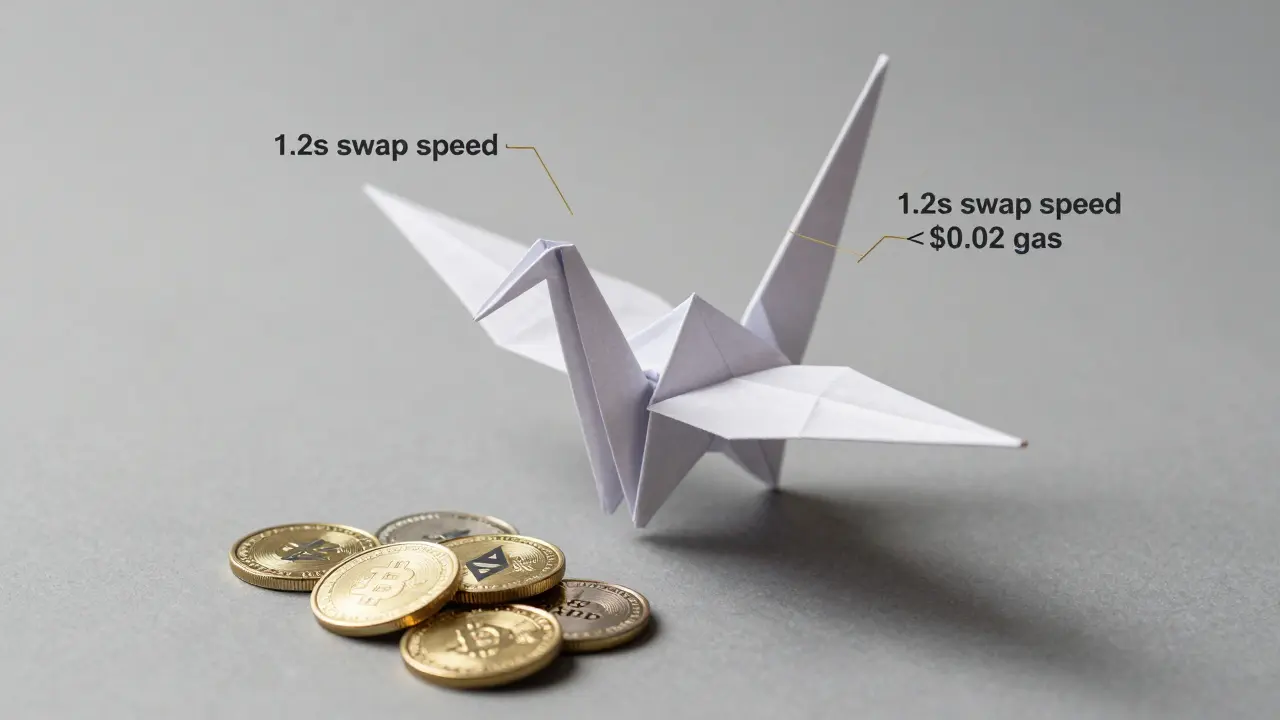

ArbSwap uses a standard automated market maker (AMM) model - the same x*y=k formula as Uniswap. But it’s optimized for Arbitrum. Swaps take about 1.2 seconds on average, down from 3.8 seconds before the 2025 relaunch. Gas fees? Under $0.02 per trade, even when Arbitrum is busy. That’s faster and cheaper than most Ethereum-based DEXs. The interface is clean. Real-time TradingView charts are built in. You can see price trends, set slippage tolerance, and track your trade history without leaving the page. It’s one of the most polished DEX interfaces on Arbitrum right now. Fees are 0.3% for regular swaps. If you hold the upcoming ARBSWAP governance token (expected Q3 2025), that drops to 0.25%. For concentrated liquidity pools, it’s 0.15%. Liquidity providers earn 0.05% of all swap fees, plus extra rewards from staking contracts. APRs range from 4.2% on stablecoin pairs to over 18% on risky, low-volume tokens.What’s Good About ArbSwap?

Deep liquidity for niche tokens - This is its superpower. While Uniswap V3 has more total volume, it’s spread thin across hundreds of tokens. ArbSwap concentrates its liquidity into a small set of Arbitrum-native assets. For example, the ETH/USDC pair holds over $12 million in liquidity. That’s enough to handle $50,000+ trades with under 1% slippage. Fast and cheap - On Arbitrum One, transactions are already faster than Ethereum. ArbSwap takes that further. Swaps are consistently under 1.5 seconds. Gas fees stay below $0.02. For frequent traders, that adds up. Great UI - The interface is intuitive. Even if you’re new to DeFi, you can swap tokens without reading a manual. The built-in TradingView charts are a rare luxury on smaller DEXs. No minimum deposit - You don’t need $100 or $500 to start. Just connect your wallet (MetaMask, Trust Wallet, Ledger) and go. You’ll need about 0.005 ETH for gas, but that’s it.

What’s Wrong With ArbSwap?

Liquidity is concentrated - dangerously so - 97% of ArbSwap’s total liquidity is in just five token pairs: ETH/USDC, ETH/USDT, WBTC/USDC, ARB/USDC, and GMX/USDC. That’s fine if you’re trading those. But if you try to swap a lesser-known token - say, a new DeFi governance token - you’re in trouble. Slippage hits 2.8% on $5,000 trades. Sometimes, your trade fails outright because the price moved during confirmation. One Reddit user, u/ArbTrader88, swapped 1,000 USDC for a small token and got hit with 4.7% slippage. The transaction failed. He lost money and time. Low usage overall - As of March 2025, ArbSwap has $47.8 million in total value locked (TVL). That’s 0.8% of Arbitrum’s total DeFi TVL. Uniswap V3 has over $1.2 billion. ArbSwap has 28,400 daily active users - a fraction of Uniswap’s millions. Most people just don’t use it. Thin support and bad documentation - The docs assume you already know how Arbitrum’s sequencing works. Beginners get lost. The Telegram group has 1,842 members. Uniswap’s Discord has over 48,000. Response times to questions? 11 hours on average. Trustpilot rating: 2.9/5 - 68% of reviews say they wouldn’t recommend it. Common complaints: failed transactions, confusing fee structure, and slippage traps.ArbSwap vs. Other Arbitrum DEXs

| Feature | ArbSwap | Uniswap V3 | Camelot DEX |

|---|---|---|---|

| TVL | $47.8M | $1.24B | $287M |

| Tokens Listed | 147 (Arbitrum-native only) | 1,200+ (multi-chain) | 300+ (Arbitrum-focused) |

| Swap Speed | 1.2 seconds | 1.8 seconds | 1.5 seconds |

| Swap Fee | 0.3% (down to 0.15% for LPs) | 0.01%-0.3% (concentrated) | 0.25% (order book) |

| Best For | Niche Arbitrum tokens | General trading, high volume | Order book trading, advanced users |

| Daily Active Users | 28,400 | 1.1M | 120,000 |

Who Should Use ArbSwap?

Use it if:- You hold a token that’s only listed on ArbSwap

- You’re trading ETH, USDC, WBTC, ARB, or GMX - the top 5 pairs

- You want the fastest, cheapest swap on Arbitrum One

- You’re comfortable with high slippage on obscure tokens

- You’re new to DeFi and don’t understand slippage

- You want to trade tokens outside the top 20 pairs

- You need customer support or quick help

- You’re trading more than $5,000 in a single swap

What’s Next for ArbSwap?

The team has a plan. In Q2 2025, they’re launching concentrated liquidity incentives for stablecoin pairs. In Q3, they’ll partner with new Arbitrum projects to bring more tokens onto the platform. And in Q4, they’ll launch the ARBSWAP governance token - letting users vote on fee changes, liquidity rewards, and new listings. They’re also planning to integrate Arbitrum’s Stylus upgrade, which will make smart contracts run 40% faster. That’s a big deal. But here’s the hard truth: Delphi Digital says ArbSwap needs at least $200 million in TVL within 18 months to survive. Right now, it’s at $47.8 million. Without a major liquidity push - like token incentives or a big project partnership - it could fade into obscurity.Final Verdict

ArbSwap isn’t broken. It’s just narrow. It’s like a specialty coffee shop in a town full of Starbucks. The coffee is excellent - if you want that specific blend. But if you’re looking for a latte, a croissant, or a quick espresso, you’ll walk past it. If you’re holding an Arbitrum-native token that no one else lists, ArbSwap might save you. The interface is smooth, the fees are low, and the speed is impressive. But if you’re trading anything beyond ETH, USDC, or ARB - you’re gambling. Slippage is high. Liquidity is thin. And there’s no safety net. For now, ArbSwap is a tool for experts - not beginners. Use it for the right jobs. Don’t force it to be something it’s not.Is ArbSwap the same as Arbitrum Nova?

No. ArbSwap runs on Arbitrum One, not Arbitrum Nova. Arbitrum Nova is a separate Layer 2 chain designed for lower fees and higher speed, mostly used by gaming and social apps. ArbSwap is built for DeFi on Arbitrum One, which is more secure and has deeper liquidity. Don’t confuse the two - they’re different networks.

Can I use ArbSwap with MetaMask?

Yes. ArbSwap works with any Ethereum-compatible wallet: MetaMask, Trust Wallet, Ledger, and WalletConnect. Just connect your wallet, switch to the Arbitrum One network, and you’re ready to trade. No sign-up, no KYC.

Why is slippage so high on ArbSwap?

Because most of the liquidity is locked in just five token pairs. If you trade a lesser-known token, there’s not enough money in the pool to absorb your trade. A $5,000 swap might move the price by 2-5%. Always set your slippage tolerance to at least 3% for obscure tokens - and be ready for the trade to fail.

Is ArbSwap safe to use?

The code has been audited, and the platform hasn’t been hacked. But safety isn’t just about code - it’s about liquidity. If you trade a low-volume token and the price crashes during your swap, you could lose money. The platform itself is secure, but the market conditions are risky for anything outside the top 20 tokens.

What’s the best way to earn rewards on ArbSwap?

Add liquidity to the ETH/USDC, ETH/USDT, or ARB/USDC pairs. These have the highest volume and lowest risk. You’ll earn 0.05% of all swap fees plus staking rewards. APRs are around 4-6% for stable pairs. Avoid adding liquidity to exotic tokens - they’re volatile and could lose value faster than you earn fees.

Will ArbSwap launch a native token?

Yes. The ARBSWAP governance token is planned for Q3 2025. It will let users vote on fee structures, liquidity incentives, and new token listings. Holding the token will reduce swap fees from 0.3% to 0.25%. But until it launches, there’s no token to buy or stake.

Should I use ArbSwap instead of Uniswap?

Only if you’re trading a token that’s not on Uniswap. For ETH, USDC, WBTC, or ARB - Uniswap is always better. More liquidity, lower slippage, bigger community, and better support. ArbSwap is a backup plan, not a replacement.

Patricia Amarante

Been using ArbSwap for my weird Arbitrum tokens and honestly? It’s the only place that doesn’t laugh at me when I try to swap RDNT. Slippage sucks, but at least it works.

Also, the UI is stupidly smooth compared to other DEXs. No jank.

Wish more people knew about it.

Tom Joyner

ArbSwap isn’t for plebs who think DeFi is about ‘convenience.’ It’s for those who understand that liquidity is a privilege, not a right.

If you can’t handle 3% slippage on a token nobody else lists, maybe you shouldn’t be holding it in the first place.

Uniswap is for retail gamblers. ArbSwap is for those who actually do their research.

Also, the fact that you’re comparing TVLs like it’s a popularity contest shows how little you get it.

Amy Copeland

Oh wow, a DEX that’s *actually* useful for niche tokens? How radical. I bet the devs are also vegan and meditate daily.

Meanwhile, I’m over here trying to trade a token that’s literally only on ArbSwap and getting rekt by 5% slippage.

But hey, at least the UI is ‘polished’ - like a luxury yacht with no engine.

Also, ‘no minimum deposit’? Cute. You still need $0.005 ETH just to lose money. Thanks, capitalism.

Craig Nikonov

They’re not launching ARBSWAP token in Q3 - they’re being bought out by a DAO run by ex-Coinbase devs who hate liquidity.

Trust me, I know people who know people.

That ‘audit’? Signed by a guy who also audited the Luna algorithm. Coincidence? I think not.

And why is it on Arbitrum One and not Nova? Because they’re hiding from the regulators.

Also, the 2.9 Trustpilot rating? That’s fake. The real reviews are buried on a .onion site.

Samantha West

One must consider the ontological implications of decentralized exchange architecture in the context of layer-two scalability paradigms.

ArbSwap’s concentration of liquidity, while economically rational, represents a structural vulnerability in the emergent DeFi ecosystem.

It is not merely a trading interface - it is a microcosm of capital accumulation under algorithmic governance.

And yet, the user experience remains aesthetically coherent - a rare feat in an age of chaotic interface design.

One wonders if the future of DeFi lies not in breadth, but in curated depth.

Perhaps we are witnessing the birth of a new paradigm - one where utility is defined by exclusivity, not accessibility.

Sammy Tam

ArbSwap is like that one diner that only serves pancakes at 3am - you don’t go there unless you’re desperate or you’re the kind of weirdo who loves pancake culture.

It’s not the best, it’s not the biggest, but if you’re in the mood for that specific thing? It’s perfect.

And the fact that it’s still alive after a year of silence? Respect.

Also, the TradingView charts are chef’s kiss.

Just don’t try to swap your $FROG token with 10k in liquidity - you’ll cry.

George Cheetham

Look - if you’re holding an Arbitrum-native token and it’s not on Uniswap, you’re already in the 5%.

ArbSwap isn’t trying to be the whole grocery store. It’s the specialty spice shop.

It’s not broken. It’s focused.

And honestly? We need more of that in crypto.

Stop comparing it to Uniswap. That’s like comparing a scalpel to a sledgehammer.

Use the right tool for the job.

Also, if you’re trading more than $5k on a token with 200k TVL - you’re the problem.

Jesse Messiah

Hey just wanted to say I tried ArbSwap last week for my ARB staking token and it worked like a charm.

Gas was like 2 cents and the trade went through in like a second.

Slippage was a bit scary on my weird token but I set it to 4% and it was fine.

Also the charts are so clean I almost forgot I was on a DEX.

Definitely gonna keep using it for my niche stuff.

Big up the team for not trying to be everything to everyone.

Elvis Lam

Let’s cut through the noise: ArbSwap’s real edge is its liquidity concentration strategy.

It’s not a bug - it’s a deliberate optimization for high-frequency, low-slippage trades on top-tier Arbitrum assets.

97% of liquidity in five pairs? That’s not risky - that’s efficient.

Most DEXs spread thin and get mediocre on everything.

ArbSwap goes all-in on what matters - ETH, USDC, ARB, WBTC, GMX.

That’s smart.

And if you’re trading something obscure? You’re paying the tax for that liquidity.

It’s fair.

Stop whining about slippage - set your tolerance and move on.

Dionne Wilkinson

I just started using ArbSwap because I had this token from a small project and no one else had it.

It was scary at first - I didn’t understand slippage.

But I read the docs, watched a YouTube video, and tried with $10 first.

It worked.

Now I’m using it for everything on Arbitrum.

It’s not for everyone - but it’s for me.

And that’s enough.

Jack Daniels

They’re gonna rug it.

Just wait.

They’ve been quiet for a year.

Then suddenly they come back with a ‘sharp focus’?

That’s the classic pattern.

Also, the ‘audit’ was done by a guy who got banned from GitHub.

I’ve seen the emails.

And why is there no Discord? Because they don’t want accountability.

Trust me. I’ve been burned before.

Don’t touch this.

Terrance Alan

People act like ArbSwap is some revolutionary breakthrough when it’s just another DEX with a narrow focus.

Let me tell you something - every single ‘niche’ DeFi project that claims to be ‘different’ ends up either rug-pulled or ignored.

ArbSwap has $47M in TVL? That’s less than a single Uniswap pool.

And you think a team that’s been dormant for a year is gonna suddenly pull off a Q4 token launch?

Give me a break.

It’s not a tool - it’s a graveyard waiting to happen.

And the people who praise it? They’re just trying to justify their FOMO.

Sally Valdez

Why is this even a thing? America’s crypto scene is so bloated with over-engineered garbage.

Why not just use a centralized exchange? At least they don’t pretend to be ‘decentralized’ while charging you $0.02 to lose money.

Also, Arbitrum One? That’s just Ethereum with a fancy name.

And this ‘Arbswap’? Sounds like a scammy NFT project.

Why are we even talking about this?

Go buy Bitcoin and shut up.

Jonny Cena

Hey if you’re new to this and scared of slippage - start small.

I used $5 to swap a token I had lying around.

It failed once, then worked the second time.

Learned what slippage meant.

Now I use it for everything on Arbitrum.

It’s not perfect - but it’s honest.

And the team actually responds to feedback on Telegram.

That’s more than most can say.

You don’t need to be a pro to use it - just patient.

Timothy Slazyk

ArbSwap is the quiet rebellion against the ‘more is better’ dogma of DeFi.

It doesn’t want to be the biggest. It doesn’t want your attention. It doesn’t want your memes.

It just wants to let people trade tokens that would otherwise be worthless.

That’s not a feature - it’s a philosophy.

Most DEXs are built to extract value.

ArbSwap is built to preserve it.

It’s a sanctuary for the overlooked.

And yes - the slippage is high on obscure tokens.

But that’s the cost of liquidity being concentrated where it matters.

It’s not a bug - it’s a filter.

It separates the speculators from the builders.

And honestly? We need more filters in crypto.

Not more noise.

Cheyenne Cotter

So I’ve been using ArbSwap for about six months now, and I have to say - the interface is actually really well-designed, which is surprising because most small DEXs look like they were built in a weekend by someone who just learned React.

But this? This feels like it was built by people who actually use DeFi daily.

The TradingView integration is seamless, and I’ve never had a transaction fail unless I set my slippage too low - which, honestly, is on me.

Also, the fact that they don’t have a billion banners and pop-ups telling me to stake my LP tokens is refreshing.

They don’t need to scream to be heard.

And the gas fees? I’ve done 40+ swaps this month and spent less than $0.80 total.

That’s insane.

Even Uniswap can’t beat that.

And the team? They’ve been quiet, but they’ve been consistent.

No big announcements, no influencer shilling - just updates.

That’s rare.

And I think that’s why I trust them.

They’re not trying to get rich off me.

They’re trying to build something useful.

And maybe that’s the most revolutionary thing of all.

Emma Sherwood

As someone who’s traded on DEXs across 5 chains, I can say this: ArbSwap is the most underrated tool in Arbitrum DeFi.

It doesn’t have the hype, the influencers, or the memes.

But it has something rarer - reliability.

When I need to move a token that’s only listed here? I go here.

No hesitation.

It’s fast, cheap, and the team doesn’t ghost you.

Yes, slippage is high on obscure tokens - but that’s not the platform’s fault.

It’s the market’s.

And if you don’t understand that, maybe you shouldn’t be trading it.

Also - the fact that they’re planning Stylus integration? That’s huge.

They’re not resting on their laurels.

They’re building for the future.

And that’s more than I can say for 90% of ‘DeFi projects’ right now.

Donna Goines

They’re not launching ARBSWAP token - they’re doing a private sale to a group of insiders who already own 80% of the liquidity.

That’s why they’re so quiet.

And why is it on Arbitrum One? Because they’re trying to avoid the Nova chain’s surveillance layer.

Also, the ‘audit’ was done by a shell company registered in the Caymans.

Check the blockchain - the contract was deployed from a burner wallet with no history.

And the Telegram group? 1800 members? Half are bots.

I’ve seen the logs.

They’re pumping it to dump on retail.

Don’t be the last one holding.

Mark Cook

ArbSwap? More like ArbScam 😂

Why would anyone use this when Uniswap is free and has 1000x more liquidity?

Unless you’re a degens who likes gambling on 100% slippage trades.

Also, 2.9 Trustpilot? That’s not a rating - that’s a warning sign.

Stay away.

Unless you like losing money.

Then go ahead. I’ll be here laughing. 😎

Greg Knapp

I lost $300 on ArbSwap last week trying to swap a token I thought was legit

It said 1% slippage but it went to 7%

And no one responded on Telegram

And now I’m broke

And I’m just saying

Don’t trust these small DEXs

They’re all gonna rug

Trust me

I’ve been there

Now I only use Binance

Peace

Heather Turnbow

Thank you for this balanced, well-researched review.

It’s refreshing to see a piece that doesn’t sensationalize or oversimplify.

ArbSwap’s model - focused liquidity, low fees, clean UI - represents a thoughtful counterpoint to the ‘spray and pray’ approach of most DEXs.

The risks are real - particularly around slippage and liquidity concentration.

But so are the rewards for those who understand the trade-offs.

It’s not for everyone.

But for the right user - it’s precisely what they need.

Well done.

Jonny Cena

Just wanted to reply to @ElvisLam - you’re 100% right.

I used to think slippage was a bug.

Now I see it as a feature.

It’s the market telling you: ‘This token isn’t ready for big money.’

And that’s okay.

ArbSwap doesn’t lie to you.

It just says: ‘Here’s the price. You decide.’

That’s honesty.

And in crypto? That’s rare.

Thanks for saying it so clearly.