AUSTRAC Registration Eligibility Checker

Determine Your Registration Requirements

Answer these questions to find out if your crypto business needs to register with AUSTRAC in Australia. This tool is based on current regulations as of October 2025, with important updates coming March 2026.

Answer the questions above and click "Check Eligibility" to see if you need AUSTRAC registration.

If you're running a crypto exchange in Australia, you must register with AUSTRAC-or you're breaking the law. It’s not a suggestion. It’s not a gray area. As of October 2025, any business that exchanges Australian dollars for Bitcoin, Ethereum, or any other digital currency-and vice versa-needs official approval from AUSTRAC. No exceptions. No delays. No "we’ll do it later."

What Exactly Is AUSTRAC?

AUSTRAC stands for the Australian Transaction Reports and Analysis Centre. It’s not a bank. It’s not a tax office. It’s Australia’s financial intelligence unit, created under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006. Its job? To stop criminals from using money-especially digital money-to hide illegal activity. That includes drug trafficking, fraud, and even funding terrorism.Before 2018, crypto exchanges in Australia operated in a legal gray zone. Now, if you’re swapping fiat for crypto, you’re legally required to register. And if you don’t? You could face criminal charges, fines up to $21 million, or even jail time for company directors.

Who Needs to Register?

Not every crypto business needs to register. Only those offering digital currency exchange (DCE) services. That means:- Buying Australian dollars with Bitcoin (or any crypto)

- Selling Bitcoin for Australian dollars

- Operating a crypto ATM that cashes out crypto to cash

- Running a platform where users trade crypto for AUD or other fiat currencies

If you’re only trading crypto for other crypto-like swapping Ethereum for Solana-you’re not required to register yet. But that’s changing fast.

The Big Change Coming in March 2026

On March 31, 2026, AUSTRAC’s rules will expand dramatically. After that date, you’ll need registration if you do any of these:- Exchange one cryptocurrency for another (e.g., BTC for ETH)

- Hold or manage crypto assets for clients (custody services)

- Transfer crypto on behalf of users

- Help issue or sell tokens-like running an ICO or token sale

This change isn’t random. It’s Australia catching up to global standards set by the Financial Action Task Force (FATF). Countries like the U.S., UK, and EU already regulate these activities. Australia is closing the loopholes that let bad actors slip through.

What You Need to Register

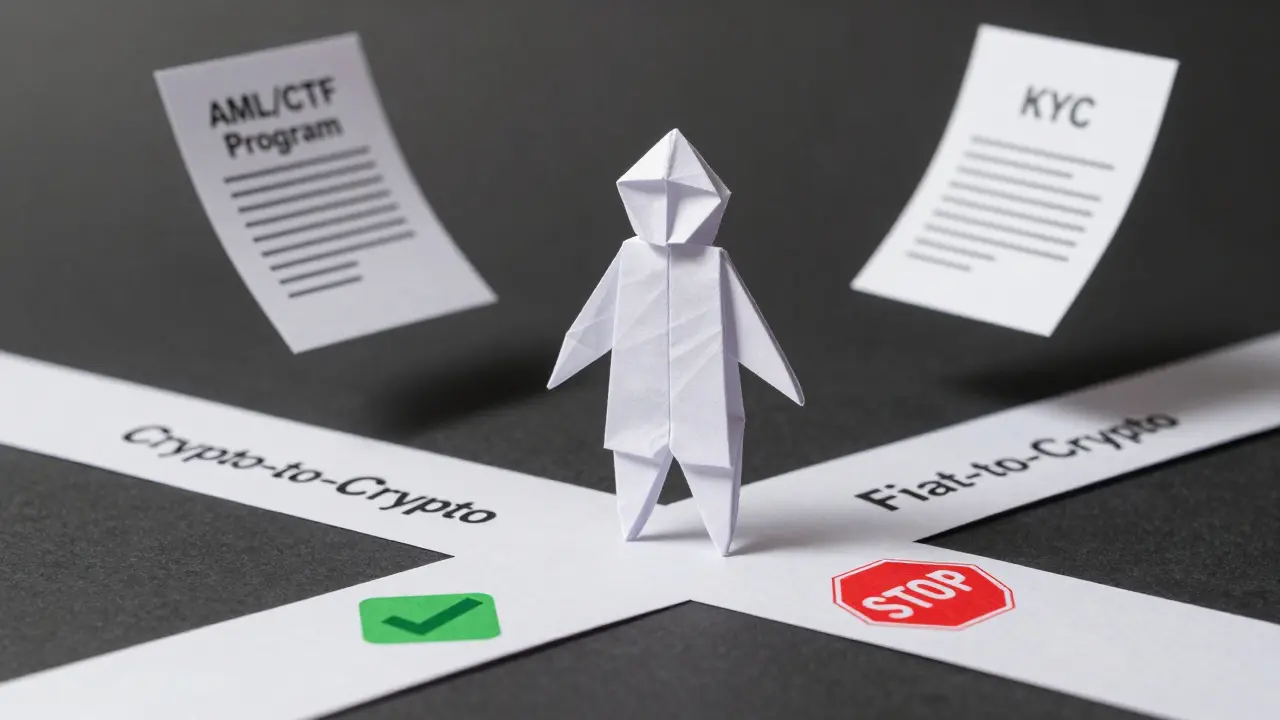

You can’t just fill out a form and pay a fee. AUSTRAC demands proof you’ve built real systems to stop money laundering. Here’s what you need before you even hit submit:- AML/CTF Program - A written plan showing how you’ll detect, prevent, and report suspicious activity. This isn’t a one-page document. It’s a full operational manual covering customer onboarding, transaction monitoring, staff training, and reporting procedures.

- Money Laundering and Terrorism Financing Risk Assessment - You must prove you understand your risks. Who are your customers? Where are they from? What types of transactions do you handle? How often do you see large, unusual transfers? This assessment must be updated every two years.

- Complete Application Form - Available through AUSTRAC’s online portal. You’ll need company details, director information, business structure, and contact info for your compliance officer.

- Supporting Documents - Articles of incorporation, proof of business address, identification for all directors and significant shareholders, and evidence of your AML/CTF program.

Many companies fail because they skip the risk assessment or slap together a generic AML program. AUSTRAC doesn’t want templates. They want proof you’ve thought about your business, your customers, and your risks.

Know Your Customer (KYC) Isn’t Optional

Your AML/CTF program must include full KYC procedures. That means:- Verifying every customer’s identity with government-issued ID (passport, driver’s license)

- Confirming their residential address

- Understanding the source of their funds-where did they get the money they’re depositing?

- Monitoring transactions for red flags: rapid deposits and withdrawals, unusually large amounts, transactions from high-risk countries

You can’t rely on third-party tools alone. You need internal controls. Staff training. Audit trails. If someone deposits $50,000 in cash via crypto and immediately withdraws it to an offshore wallet? That’s a reportable suspicious matter. You have 24 hours to file it with AUSTRAC.

Record Keeping and Reporting

Once registered, you’re on the hook for ongoing compliance:- Keep records of all transactions for at least seven years

- Report all transactions over $10,000 (in AUD equivalent) within 10 business days

- File a Suspicious Matter Report (SMR) if anything looks off-even if you’re not sure

- Submit an annual compliance report to AUSTRAC

These aren’t suggestions. AUSTRAC audits registered businesses. They can demand access to your systems, customer files, and internal logs. If you’re not ready? You’ll get hit with penalties, suspension, or cancellation of your registration.

AUSTRAC vs. ASIC: Don’t Confuse Them

Many businesses think if they’re registered with AUSTRAC, they’re done. Not true. AUSTRAC handles AML/CTF. ASIC (Australian Securities and Investments Commission) handles financial products.If your crypto asset is classified as a financial product-like a token that gives ownership, dividends, or profit-sharing-you might also need an Australian Financial Services License (AFSL) from ASIC. This applies to tokenized shares, security tokens, or derivatives. Most utility tokens (like those used for access to a platform) don’t require an AFSL. But if you’re unsure? Get legal advice.

Bottom line: AUSTRAC registration is mandatory for all crypto exchanges. ASIC licensing is only for certain types of crypto assets. You might need both.

What Happens If You Don’t Register?

The penalties are severe:- Up to $21 million in fines for corporations

- Up to 10 years in prison for individuals

- Reputational damage that kills customer trust

- Bank accounts frozen, payment processors cut off

- Public listing on AUSTRAC’s enforcement register

And it’s not just about getting caught. AUSTRAC actively monitors crypto transactions. They work with banks, payment providers, and international agencies. If your exchange is operating without registration, they’ll find you.

Real-World Consequences

In 2023, a Melbourne-based crypto ATM operator was fined $1.2 million for operating without registration. They didn’t verify customers. They didn’t report large transactions. They thought they were "just a machine." They were wrong.Another exchange in Sydney shut down abruptly in 2024 after AUSTRAC discovered they were using fake IDs to onboard users. Their directors were investigated for money laundering. Their customers lost access to their funds.

These aren’t rare cases. They’re warnings.

How to Get It Right

Don’t try to do this alone. The paperwork is complex. The rules change fast. Most successful exchanges hire compliance consultants or legal firms specializing in Australian crypto regulation.Here’s what works:

- Use AUSTRAC’s online assessment tool to confirm if you need to register

- Build your AML/CTF program with expert help-don’t copy-paste from a website

- Conduct a real risk assessment tailored to your business model

- Train your team on KYC and reporting procedures

- Prepare for the March 2026 expansion-don’t wait until the last minute

There’s no shortcut. But there is a path. Thousands of exchanges have done it. You can too.

Consumer Protection Still Applies

Even if your crypto isn’t a financial product, you still have to follow the Australian Consumer Law. That means:- No false claims about returns or security

- No misleading advertising

- No hiding fees or risks

If you say "100% secure" or "guaranteed profits," you’re breaking the law. Plain and simple.

What’s Next for Crypto in Australia?

Australia is moving toward a full licensing regime for crypto exchanges. Draft laws are being reviewed that would require all exchanges to hold financial services licenses-like banks. That’s still months away, but the direction is clear: tighter controls, more oversight, higher standards.If you’re starting now, you’re ahead of the curve. If you’re waiting, you’re already behind.

Do I need AUSTRAC registration if I only trade crypto for crypto?

As of December 2025, no-you don’t need to register if you only exchange one cryptocurrency for another. But that changes on March 31, 2026. After that date, crypto-to-crypto exchanges will require AUSTRAC registration. If you plan to offer this service in 2026, start preparing now.

Can I operate while my AUSTRAC application is being reviewed?

No. You cannot legally offer digital currency exchange services until your registration is approved. Operating without registration-even while waiting-is a criminal offense. Many businesses delay launch until approval is confirmed to avoid penalties.

How long does AUSTRAC registration take?

The process typically takes 4 to 12 weeks if your application is complete and accurate. Delays happen when documents are missing, unclear, or poorly prepared. Many applicants take longer because they submit incomplete AML/CTF programs or risk assessments. Getting help from a compliance expert can cut your processing time in half.

What if my business is based overseas but serves Australian customers?

If your platform allows Australian residents to trade fiat for crypto-or vice versa-you’re subject to AUSTRAC rules, regardless of where you’re based. Many offshore exchanges have been blocked from operating in Australia because they ignored this rule. If you want Australian users, you need AUSTRAC registration.

Do I need to register if I’m just a crypto ATM operator?

Yes. Crypto ATMs that allow users to buy crypto with cash or sell crypto for cash are classified as digital currency exchanges under AUSTRAC rules. You must register, implement KYC, and report transactions over $10,000. Failure to comply has led to multiple enforcement actions against ATM operators since 2023.

Can AUSTRAC cancel my registration after it’s approved?

Yes. Registration isn’t permanent. AUSTRAC can suspend or cancel your registration if you fail to meet ongoing compliance obligations-like not reporting suspicious activity, failing KYC checks, or being linked to criminal activity. They can also impose conditions, like requiring you to upgrade your systems or limit transaction volumes.

Yzak victor

Just read this whole thing and honestly? I’m impressed. AUSTRAC isn’t playing around anymore. I thought crypto was this wild west, but turns out Australia’s been quietly building fences around it. Good call. Safety first, especially when people’s life savings are involved.

Holly Cute

Oh please. Another government overreach disguised as 'consumer protection.' You know what’s worse than crypto scams? Government bureaucracies that charge $20k to review your 'AML program' and then ignore it when a bank does the same thing with $500M in dirty cash. This is performative regulation. They want to look tough, not actually fix anything. 🙄

Billye Nipper

Hey everyone-just wanted to say if you’re reading this and thinking ‘I’ll just wait till the last minute’… PLEASE DON’T. I’ve seen too many small operators panic in the final weeks, submit half-baked docs, and get rejected. It’s not just about fines-it’s about your peace of mind. Take it slow. Build it right. You’ve got time. You’ve got support. You’ve got this 💪

Roseline Stephen

It’s not just about legality. It’s about trust. If you’re running an exchange, your users need to know you’re not just another sketchy site. Registration isn’t a burden-it’s a signal that you care. I’ve seen users walk away from platforms that didn’t have it. They’re not stupid. They know the difference.

Richard T

Wait-so if I swap ETH for SOL, I’m fine now? But in 2026, I’m not? So the government is basically saying ‘wait until we catch up to tech’? That’s not regulation, that’s reactive chaos. What’s next-do I need a permit to use a wallet? 🤔

rita linda

Anyone who thinks this is ‘too much’ hasn’t lived in the real world. The U.S. is already cracking down. The EU has MiCA. Australia’s just being responsible. If you’re running a crypto exchange and you don’t want to comply, maybe you shouldn’t be in business. This isn’t oppression-it’s basic accountability. Get with the program.

Frank Cronin

Oh wow. So now we need a lawyer, a compliance officer, a risk assessment consultant, and a therapist just to buy Bitcoin? Brilliant. The only thing more ridiculous than crypto scams is the industry’s obsession with turning every simple transaction into a corporate audit. Congrats, Australia-you’ve turned the future of finance into a PowerPoint deck.

Tom Van bergen

Regulation is just capitalism’s way of pretending it’s not a free-for-all. The market will sort itself. If you’re scamming people, you’ll fail. If you’re honest, you’ll thrive. All this paperwork? It just protects the big players. The little guy gets crushed under the weight of compliance. The real crime is pretending bureaucracy equals safety.

Ben VanDyk

They say ‘no exceptions’-but then they make exceptions for banks. Banks move billions in crypto-linked transactions without registering. Why? Because they’re ‘financial institutions.’ Meanwhile, a guy running a crypto ATM gets fined $1.2M. Double standards aren’t just annoying-they’re hypocritical.

Jonathan Sundqvist

Australia’s got the right idea. If you’re doing business here, you play by our rules. No exceptions. No ‘but I’m offshore.’ If you want our customers, you respect our laws. This isn’t nationalism-it’s sovereignty. And if you don’t like it? Go operate in Venezuela. They’ll let you do whatever you want.

Thomas Downey

Let us not forget: this is not merely regulatory compliance-it is the moral imperative of financial stewardship in the digital age. The sanctity of economic integrity must be preserved against the anarchic tides of decentralized chaos. To neglect this duty is not merely negligence-it is a betrayal of the social contract. The future demands discipline. Will you rise to it?

Annette LeRoux

Wow… this is actually really well written. I’m not even in crypto, but I felt like I learned something. 🙌 Also, the part about crypto ATMs? That’s wild. I saw one in a 7-Eleven last week and had no idea it was basically a financial institution. Mind blown. 🤯

Jerry Perisho

Most people don’t realize the AML/CTF program needs to be custom. I’ve seen 50+ applicants submit the same template from some blog. AUSTRAC rejects them instantly. If you’re doing this, hire someone who’s done it before. It’s not expensive. The penalty is.

Manish Yadav

Why do they care so much? In India we just do crypto and no one cares. Why Australia make so many rules? It’s too much. I just want to buy Bitcoin. Why do I need a lawyer?

Vincent Cameron

It’s ironic. The whole point of crypto was to escape centralized control. Now we’re being forced to beg a government agency for permission to do what we’ve always done. The system didn’t change. We just gave it a new name: ‘compliance.’

Krista Hewes

i just read this and i think… wow. i had no idea it was this serious. like, i thought it was just like taxes or something you kinda do later. but no. this is legit jail time stuff. i’m gonna share this with my friend who runs a little exchange. he’s gonna freak out. lol