Iranian crypto: What's really happening with cryptocurrency in Iran

When people talk about Iranian crypto, the widespread use of Bitcoin and other digital assets in Iran despite international sanctions and government restrictions. Also known as crypto in Iran, it's not just a workaround—it's a financial lifeline for millions. While Western media often frames it as a rebellion, the truth is more practical: Iranians use crypto to protect savings, pay for imports, and bypass banking blockades.

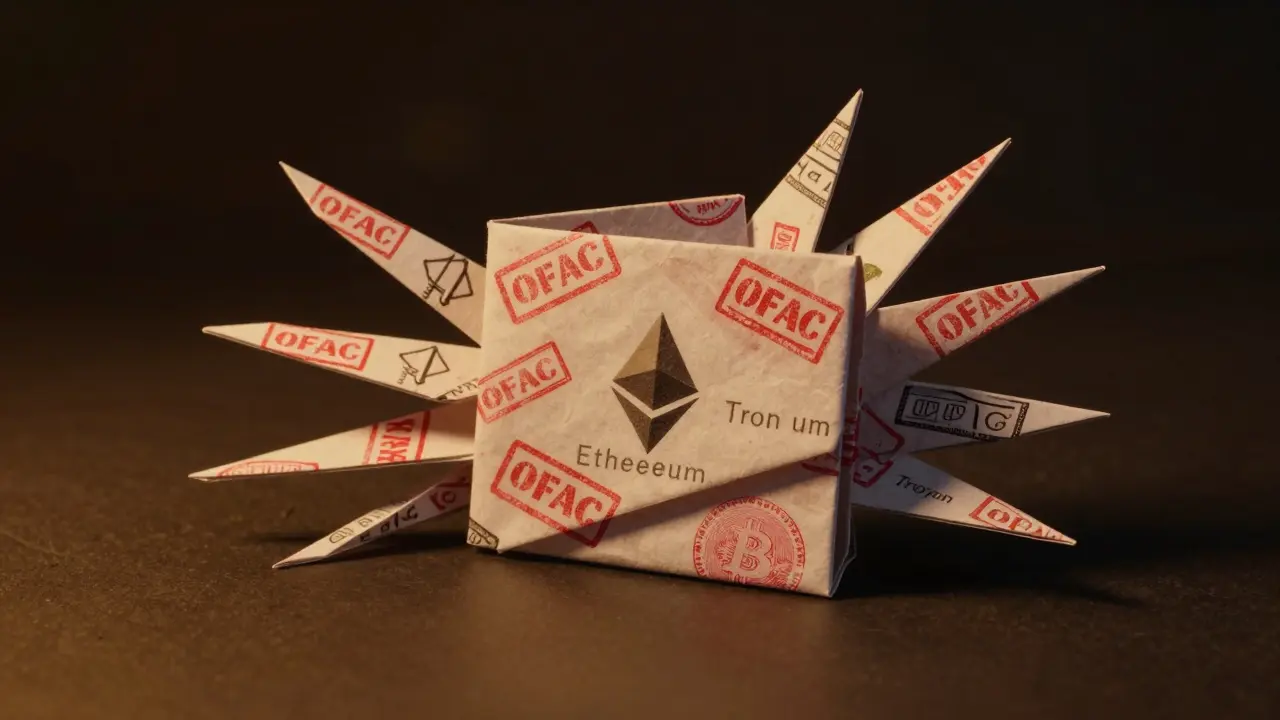

Bitcoin mining became a national phenomenon because of cheap electricity and high energy subsidies. In 2021, Iran briefly became the world’s second-largest Bitcoin miner after the U.S., with thousands of small farms running in homes and warehouses. The government didn’t shut them down—it started taxing them. Now, miners must register, pay fees, and sell their output to the central bank at fixed rates. It’s not freedom—it’s control dressed as regulation. Meanwhile, ordinary users trade on peer-to-peer platforms like LocalBitcoins and P2P sections of Iranian exchanges, using Tether (USDT) as the de facto currency for daily transactions. The Central Bank of Iran doesn’t recognize crypto as legal tender, but it doesn’t stop people from using it either. That gray zone is where Iranian crypto thrives.

What you won’t hear in headlines is how crypto is helping small businesses survive. A Tehran-based importer might use USDT to pay a supplier in Turkey, avoiding the 90-day wait for official forex approval. A freelancer in Shiraz gets paid in Bitcoin from a client in Germany, then cashes out through a local exchange with minimal paperwork. Even crypto airdrops and DeFi tools are creeping in—not because they’re trendy, but because they work when the banking system doesn’t. This isn’t speculation. It’s survival.

And it’s not just Bitcoin. Stablecoins like USDT and USDC are the real workhorses here. Altcoins? Rarely. DeFi protocols? Almost nonexistent. The focus is simple: store value, move money, avoid inflation. The government’s crackdowns on unlicensed exchanges don’t stop the flow—they just push it underground. What you’ll find in the posts below are real stories: how Iranians navigate crypto regulations, why mining hubs popped up in the north, how local platforms handle KYC without government oversight, and why some projects claiming to serve Iranian users are outright scams. This isn’t about hype. It’s about what’s actually happening on the ground—and what you need to know if you’re trying to understand crypto in one of the world’s most complex financial environments.