OFAC Sanctions: What They Are and How They Impact Crypto

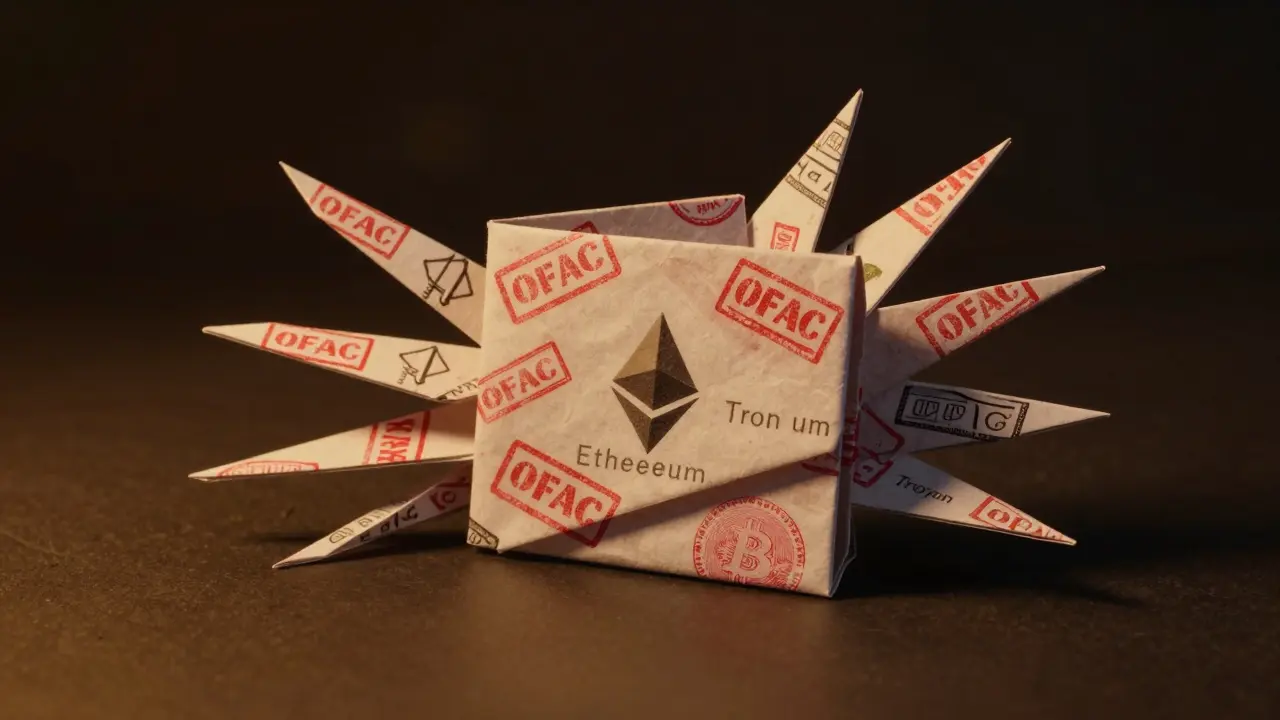

When you hear OFAC sanctions, the U.S. government’s financial restrictions targeting individuals, companies, and countries to enforce foreign policy and national security goals. Also known as financial blacklists, these rules don’t just apply to banks—they now extend to crypto wallets, exchanges, and DeFi protocols. If a wallet address, exchange, or token is flagged by OFAC, any transaction involving it can be frozen or blocked, even if you didn’t know it was linked to a sanctioned party.

Blockchain forensics companies like Chainalysis and Elliptic help governments trace crypto flows back to these blacklisted addresses. Tools like this make it harder than ever to hide funds using mixers or cross-chain bridges. For example, if someone sends Bitcoin from a wallet tied to a sanctioned Russian entity to a U.S.-based exchange, that exchange must freeze it—or risk losing its license. This is why platforms like BTSE and Nanu Exchange got shut down: they either ignored compliance or couldn’t prove they were tracking bad actors. Even decentralized projects aren’t safe. If a DeFi protocol lets users interact with a sanctioned address, regulators can pressure developers or ban the protocol outright.

It’s not just about avoiding criminals. OFAC sanctions also affect legitimate users. If you hold a token that got added to the list—like a meme coin tied to a founder later sanctioned—you might suddenly find your wallet frozen. That’s why projects like Trusta.AI and BaseX focus on identity and compliance features: they’re building systems that can verify users before they trade. Meanwhile, countries like Russia and Jordan are reacting differently. Russia now lets companies use crypto for cross-border trade under strict oversight, while Jordan banned it entirely. These shifts show that crypto compliance, the process of ensuring digital asset activity follows legal rules isn’t optional anymore—it’s the baseline for survival.

What you’ll find below isn’t a list of banned coins or a guide to bypassing rules. It’s a collection of real cases: exchanges that vanished after ignoring sanctions, tokens that died because they were tied to bad actors, and protocols trying to build transparency into the system. You’ll see how OFAC sanctions aren’t just policy—they’re changing how crypto works, who can use it, and what happens when things go wrong.