XDC Network: What It Is, How It Works, and Why It Matters in DeFi

When you hear about XDC Network, a high-performance, proof-of-stake blockchain designed for institutional use and DeFi applications. Also known as XinFin Digital Contract, it combines the speed of private blockchains with the openness of public networks—making it one of the few platforms trusted by banks and supply chain firms to move real assets. Unlike Ethereum, which struggles with slow transactions and high fees, XDC Network processes over 2,000 transactions per second with near-zero costs. That’s not theory—it’s what’s happening right now in trade finance and cross-border settlements.

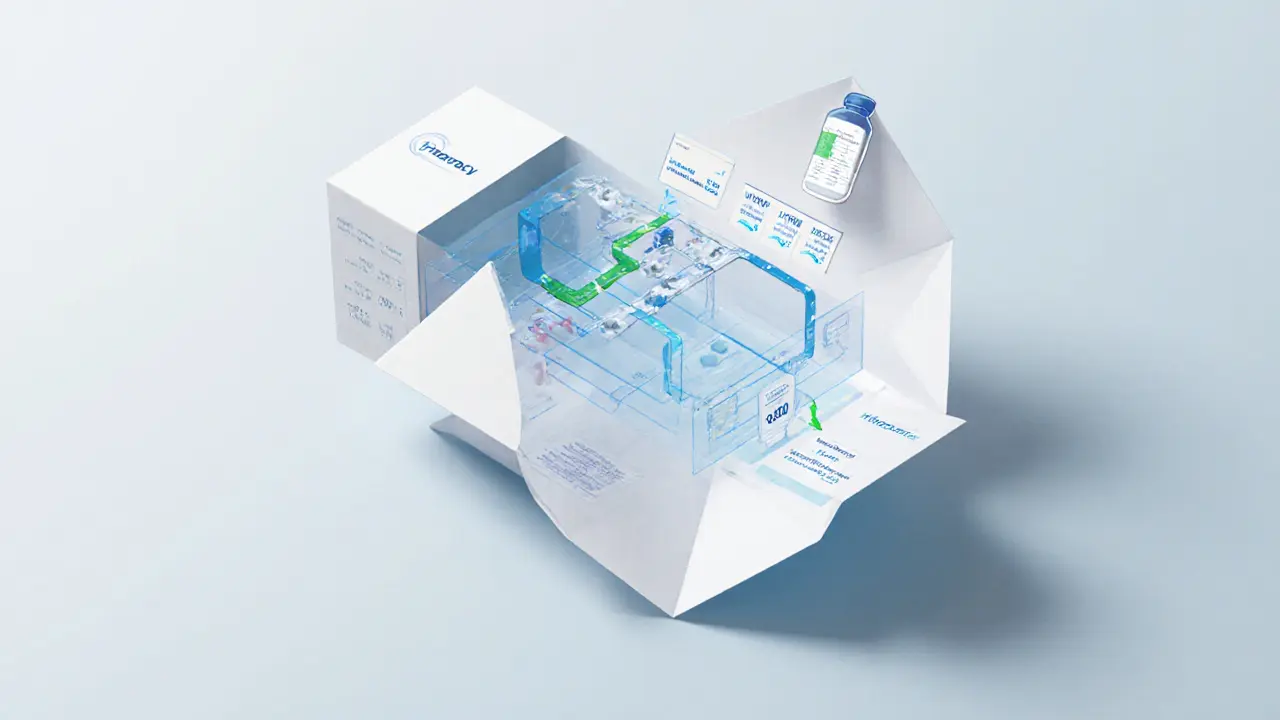

What makes XDC Network different isn’t just speed. It’s built on a hybrid architecture: part public, part private. This lets companies keep sensitive data off the public chain while still benefiting from blockchain transparency. Institutions like the World Bank and several Asian banks have tested it for trade finance because it cuts processing time from days to minutes. The native token, XDC, the utility and governance token of the XDC Network, used for transaction fees, staking, and smart contract execution, isn’t traded like a speculative coin—it’s the fuel that keeps enterprise applications running. And unlike many Layer 1s that chase hype, XDC has stayed focused: no NFTs, no meme tokens, just real-world use cases.

Behind the scenes, XDC uses a consensus mechanism called Proof of Stake (PoS), a secure, energy-efficient validation method that replaces mining with staking, making it ideal for institutional adoption. Validators are selected based on stake size and reputation, reducing centralization risks. This design makes it harder for bad actors to manipulate the network—and easier for regulators to audit transactions. That’s why it’s gaining traction in markets like India, Singapore, and the Middle East, where compliance is non-negotiable.

While most blockchains try to be everything to everyone, XDC Network does one thing well: connecting finance systems that were never meant to talk to each other. Whether it’s a supplier in Vietnam getting paid by a buyer in Germany, or a bank settling a letter of credit in real time, XDC cuts out the middlemen. And because it’s compatible with Ethereum’s tooling (EVM), developers can easily port DeFi apps over without rewriting everything.

Below, you’ll find reviews and deep dives on platforms and projects tied to XDC Network—some legitimate, some risky. You’ll see how it’s being used in real trading environments, where it’s gaining adoption, and where scams are trying to ride its name. No fluff. Just what you need to know before you interact with anything built on XDC.