xExchange Fee Calculator

Base Fee

Flat 0.3% fee on all trades

Early Withdrawal Penalty

1% penalty if funds withdrawn within 24h

Total Estimated Cost

About xExchange Fees

xExchange charges a flat 0.3% fee on all trades. If you withdraw funds within 24 hours of a trade, an additional 1% early withdrawal penalty applies. Gas fees are minimal due to the state sharding architecture.

Quick Summary

- xExchange is a privacy‑focused DEX built on the MultiversX blockchain.

- It uses state sharding for fast, low‑cost trades at a flat 0.3% fee.

- No mobile app, limited coin list, and no margin trading.

- Security was rebuilt after a $113M breach; new safeguards are in place.

- Best for experienced DeFi users who value anonymity over convenience.

When you hear the name xExchange is a decentralized crypto exchange built on the MultiversX blockchain, offering privacy‑focused trading and the unique Energy token mechanism. it immediately signals a shift away from the comfort of centralized platforms. This review breaks down what makes xExchange tick, how its tech stack works, what you pay to trade, and whether the platform lives up to its hype in 2025.

What is xExchange?

xExchange is the second generation of Maiar DEX, often called Maiar DEX2.0. Developed by the team behind MultiversX (formerly Elrond), the exchange aims to bring “mass‑adoptable DeFi” to users who prefer complete on‑chain anonymity. Unlike traditional centralized exchanges, xExchange does not hold user funds in a custodial wallet; every trade happens directly between smart contracts on the blockchain.

Technical Architecture

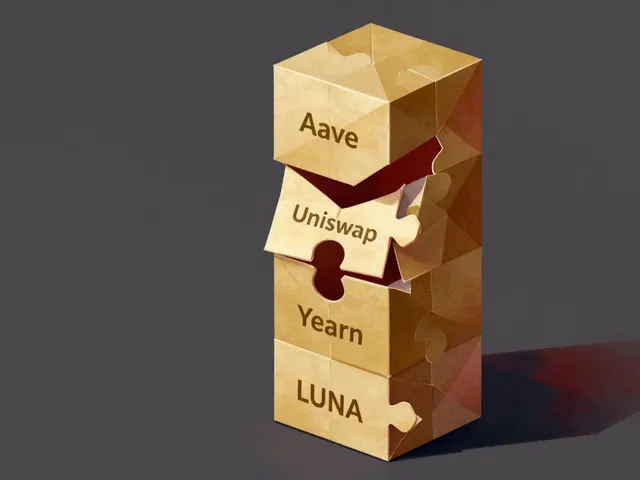

The core of xExchange rests on three technical pillars:

- State Sharding - MultiversX’s sharding splits the network into 3,200 nodes, allowing parallel processing of transactions. The result is sub‑second confirmation times even when network demand spikes.

- Energy Token - The platform’s native governance token introduces a “time lock” mechanism that rewards users for staking their token while also powering fee discounts.

- Smart Contract Upgrades - xExchange contracts are upgradeable via a multi‑sig DAO, meaning security patches can be deployed without a hard fork.

These components make it possible to charge a flat 0.3% transaction fee regardless of volume, a clear advantage over fee‑tiered structures on centralized sites.

Supported Assets and Trading Pairs

The exchange focuses on a curated list of assets that are native to the MultiversX ecosystem. Currently you can trade:

- EGLD - the native MultiversX coin.

- Wrapped versions of popular tokens like USDC, USDT, and BUSD.

- Emerging DeFi projects built on MultiversX such as Maiar and Klyb.

This limited selection keeps the UI clean but can feel restrictive for traders who like to hop between hundreds of altcoins.

Fees, Penalties, and Cost Structure

Beyond the 0.3% maker‑taker fee, xExchange applies a 1% early‑withdrawal penalty if you move funds out of the platform within 24hours of a trade. The penalty discourages rapid “pump‑and‑dump” behavior and helps maintain liquidity. There are no hidden network fees; gas costs are covered by the sharding model and are usually a fraction of a cent.

Pros and Cons

| Pros | Cons |

|---|---|

| High transaction speed thanks to state sharding | No native mobile app - desktop only |

| Flat 0.3% fee, transparent cost model | Limited cryptocurrency selection |

| Strong focus on anonymity and user privacy | Lack of margin or futures products |

| Energy token offers staking rewards and fee discounts | Steep learning curve for newcomers |

| Post‑breach security upgrades from MultiversX labs | Removed built‑in wallet - must connect external wallet |

User Experience & Support

Signing up is a matter of connecting a supported wallet (e.g., Ledger, xWallet) and approving the smart‑contract permissions. The onboarding flow is praised for its clean UI and clear “phishing protection” banner at the top of the site. Documentation lives on the xExchange docs portal and covers everything from basic swaps to Energy staking.

Support, however, is largely self‑service. There are community channels on Discord and Telegram, but no 24/7 ticketing system. Users accustomed to live chat on Coinbase or Kraken may find this lacking.

Security History

In late 2023, a vulnerability in an older version of the Maiar DEX contracts led to a loss of roughly $113million worth of EGLD. MultiversX responded by shutting down the affected contracts, conducting a forensic audit, and rebuilding the platform from scratch. xExchange launched in early 2024 with new guardrails:

- Multi‑sig DAO governance for contract upgrades.

- Enhanced on‑chain analytics to detect anomalous transaction patterns.

- Regular third‑party security audits (the latest from CertiK, dated March2025).

How Does xExchange Stack Up Against Mainstream Exchanges?

| Feature | xExchange (DEX) | Coinbase (CEX) | Binance US (CEX) |

|---|---|---|---|

| Asset Variety | ~15 tokens (MultiversX focus) | 235+ cryptocurrencies | 158+ cryptocurrencies |

| Mobile App | No | Yes (iOS/Android) | Yes |

| Fee Structure | 0.3% flat + 1% early withdrawal | 0%‑0.5% tiered | 0%‑0.1% tiered |

| Privacy | On‑chain anonymity | KYC required | KYC required |

| Customer Support | Community Discord/Telegram | 24/7 live chat & phone | Live chat & email |

| Security Model | Non‑custodial, smart‑contract audits | Custodial, insurance funds | Custodial, SAFU fund |

Clearly, xExchange trades off breadth and convenience for privacy and lower fees. If you need fiat on‑ramps, extensive token lists, or mobile trading, a centralized exchange remains the practical choice.

Ideal Users for xExchange

- DeFi veterans who already hold EGLD or other MultiversX assets.

- Privacy‑conscious traders who dislike KYC and want on‑chain anonymity.

- Developers building on MultiversX who need a native swap router.

- Stakers seeking Energy token rewards and reduced fees.

Novices should expect a steep learning curve; the platform assumes familiarity with wallets, smart contracts, and the MultiversX ecosystem.

Future Outlook

Upcoming roadmap items hinted by MultiversX labs include:

- Integration of a cross‑chain bridge to bring non‑MultiversX assets.

- Launch of a native mobile web interface (still in beta as of July2025).

- Expanded Energy token utilities, such as voting on protocol upgrades.

Bottom Line

If you value speed, low fees, and anonymity above a polished mobile experience, xExchange is a solid pick. Its state‑sharding backbone ensures fast swaps, and the post‑breach security upgrades give a sense of safety. However, the limited token roster, absence of margin tools, and requirement to navigate the MultiversX ecosystem make it a niche platform rather than a go‑to exchange for the average crypto hobbyist.

Frequently Asked Questions

Do I need to create a new account on xExchange?

No traditional account is required. You simply connect a compatible wallet (e.g., xWallet, Ledger) and approve the smart‑contract permissions.

Can I trade fiat on xExchange?

No. xExchange is a non‑custodial DEX, so only crypto‑to‑crypto swaps are supported. For fiat on‑ramps you’ll need a centralized platform.

What is the Energy token and why should I care?

Energy is xExchange’s governance token. Staking Energy reduces your trading fee by up to 0.1% and grants voting rights on protocol upgrades. It also incorporates a time‑lock feature that rewards long‑term holders.

How safe is my money after the 2023 breach?

The breach affected an older Maiar DEX version. xExchange launched with new contracts, multi‑sig governance, and quarterly audits. While no system is 100% risk‑free, the current security posture is considered robust by industry analysts.

Is there a way to use xExchange on my phone?

A full‑featured mobile app is not available yet. You can access the web UI through a mobile browser, but the experience is not optimized for small screens.

Narender Kumar

In the evolving arena of decentralized finance, the allure of non‑custodial platforms such as xExchange cannot be overstated. Their commitment to on‑chain anonymity aligns with a broader ethos of sovereign financial agency. Moreover, the deterministic flat‑fee structure offers a predictability that is often absent in tiered models. Yet, one must also acknowledge the inherent trade‑offs, notably the constrained token repertoire and lack of mobile accessibility. Consequently, discerning traders ought to weigh these dimensions with meticulous deliberation.

Anurag Sinha

Listen, there's more under the surface than the glossy UI suggests – the state‑sharding tech is a double‑edged sword, and I suspect the elites are quietly funneling control through the Energy token while pretending it's just a fee discount. The 1 % early‑withdrawal penalty feels like a sneaky throttle to keep liquidity locked, which could be a ploy to manipulate market depth. Also, the breach last year wasn't just a random bug; it's a reminder that even the most polished DeFi projects can be weaponized by shadow actors. If you aren't vigilant, you might end up financing a covert operation without even realizing it.

Raj Dixit

The platform’s lack of fiat on‑ramps betrays a disdain for ordinary users, and that is unacceptable. Only those already entrenched in the ecosystem should be allowed to trade here.

Darrin Budzak

xExchange offers impressive transaction speeds thanks to its sharding architecture, which is a refreshing change from congested networks. The flat 0.3 % fee is transparent and easy to calculate, making budgeting straightforward. However, the absence of a mobile app could be a hurdle for traders who prefer on‑the‑go access.

Andrew McDonald

While the speed is commendable, the decision to omit a dedicated mobile interface seems short‑sighted, especially in a market that values convenience. Users may find themselves navigating a cramped browser UI on small screens, which undermines the otherwise sleek experience. 😐

karsten wall

From an architectural perspective, the implementation of state sharding on MultiversX fundamentally restructures transaction throughput by parallelizing consensus across thousands of nodes. This leads to sub‑second finality, a metric that rivals centralized order books while preserving decentralization guarantees. Coupled with the Energy token's time‑lock incentive mechanism, users can earn modest yields that offset the modest 0.3 % trading fee. The upgradeable smart contracts, governed via a multi‑sig DAO, also introduce a level of resilience uncommon in legacy DEX deployments. Together, these components create a synergistic environment where privacy, speed, and economic incentives align. It’s a compelling proposition for anyone seeking a DeFi solution that doesn’t compromise on security or performance.

Rahul Dixit

The narrative you present glosses over the fact that the Energy token could become a centralized lever of influence, especially if large whales dominate staking. Moreover, the purported resilience may mask hidden backdoors that only the core developers understand. This is a classic scenario where the façade of openness hides deeper control.

Michael Ross

I appreciate the balanced overview provided earlier, and I agree that the security upgrades post‑breach are a positive development. Nonetheless, potential users should remain cautious and conduct their own due diligence.

Aman Wasade

Oh sure, because nothing says “user‑friendly” like a desktop‑only interface that expects you to be a blockchain wizard. If you enjoy reading dense documentation while sipping coffee, you’ll fit right in. Otherwise, good luck navigating without a proper guide.

Ron Hunsberger

xExchange’s fee model is straightforward, charging a flat 0.3 % on all executions regardless of volume. This simplicity reduces the cognitive load associated with tiered fee structures common on centralized platforms. The early‑withdrawal penalty of 1 % is applied only when funds exit the protocol within the first 24 hours after a trade, acting as a deterrent to speculative churn. Gas costs are effectively negligible due to the underlying state‑sharding implementation, which distributes transaction processing across numerous shards. Because the platform operates on a non‑custodial basis, users retain full control of their private keys at all times. The Energy token introduces an optional staking mechanism that can lower fees by up to 0.1 % for participants who lock their holdings. Stakers also receive governance voting rights, allowing them to influence protocol upgrades and parameter adjustments. Security audits conducted by CertiK in March 2025 confirmed that the current contract suite passes all critical vulnerability checks. The multi‑sig DAO governance model further mitigates single‑point‑of‑failure risks by requiring multiple approvals for any contract change. Despite these safeguards, the platform’s history includes a notable breach in 2023 that resulted in a substantial loss of assets. The incident prompted a complete redesign of the smart‑contract architecture, addressing the root cause of the exploit. Since the redesign, there have been no reported major incidents, indicating that the remediation measures have been effective. Users should nevertheless employ hardware wallets and enable multi‑factor authentication where possible to enhance personal security. The lack of a native mobile application may inconvenience traders who require on‑the‑go access, but the responsive web UI remains functional on modern smartphones. Overall, for experienced DeFi participants who prioritize transparency, speed, and privacy, xExchange presents a compelling alternative to traditional exchanges.

Lana Idalia

While the technical merits are impressive, one must also consider the psychological toll of navigating a constantly evolving protocol without the comforting presence of a support hotline. The endless documentation can feel like a maze, draining the enthusiasm of even the most resilient trader. In the end, the experience may leave you yearning for the simplicity of a centralized platform.

Henry Mitchell IV

Cool concept 😎

Kamva Ndamase

The bold ambition of building a privacy‑first DEX on MultiversX is a breath of fresh air in a space dominated by surveillance‑heavy services. By stripping away KYC requirements, the platform empowers users to reclaim financial sovereignty. However, the limited asset lineup may frustrate those who thrive on diversity and experimentation. Still, the community‑driven roadmap promises to broaden horizons, which is an exciting prospect for innovators.

karyn brown

Love the vibe! 🚀 but i think the limited coins are a real bummer, especially when you want to dip into newer alts. the roadmap sounds cool, yet the pace feels kinda sluggish. hope they speed it up! 😅

Rachel Kasdin

This platform is a great example of how we can build our own financial future without bowing to foreign tech giants. The focus on home‑grown blockchain tech is exactly what we need.

Nilesh Parghi

In the grand tapestry of decentralized finance, each protocol contributes a unique thread, and xExchange weaves a pattern of privacy and speed. Its design choices reflect a philosophy that values user autonomy over convenience. While the limited token roster may seem restrictive, it also ensures a tighter security model. Ultimately, the platform invites us to reflect on what we truly value in our financial interactions.

Keith Cotterill

Indeed, the dialectic presented herein underscores a profound juxtaposition-a veritable symbiosis of decentralized ethos and centralized efficiency; however, one must recognize that the paucity of asset diversity, whilst ostensibly a security measure, simultaneously curtails the expansive potential inherent to a truly open market; consequently, the platform straddles an ambiguous liminality between avant‑garde innovation and constrained practicality; nevertheless, the overarching narrative persists, championing sovereignty whilst navigating the inevitable trade‑offs.