Oracle Network Reliability Calculator

How Secure Is Your Oracle Network?

Calculate the reliability of your oracle network based on number of nodes, data sources, and required consensus.

Oracle Network Reliability

Probability of reliable data

How This Works

Based on the article, Chainlink uses 7+ nodes with 7+ data sources to achieve high reliability. The calculator estimates the probability that malicious nodes won't affect your data.

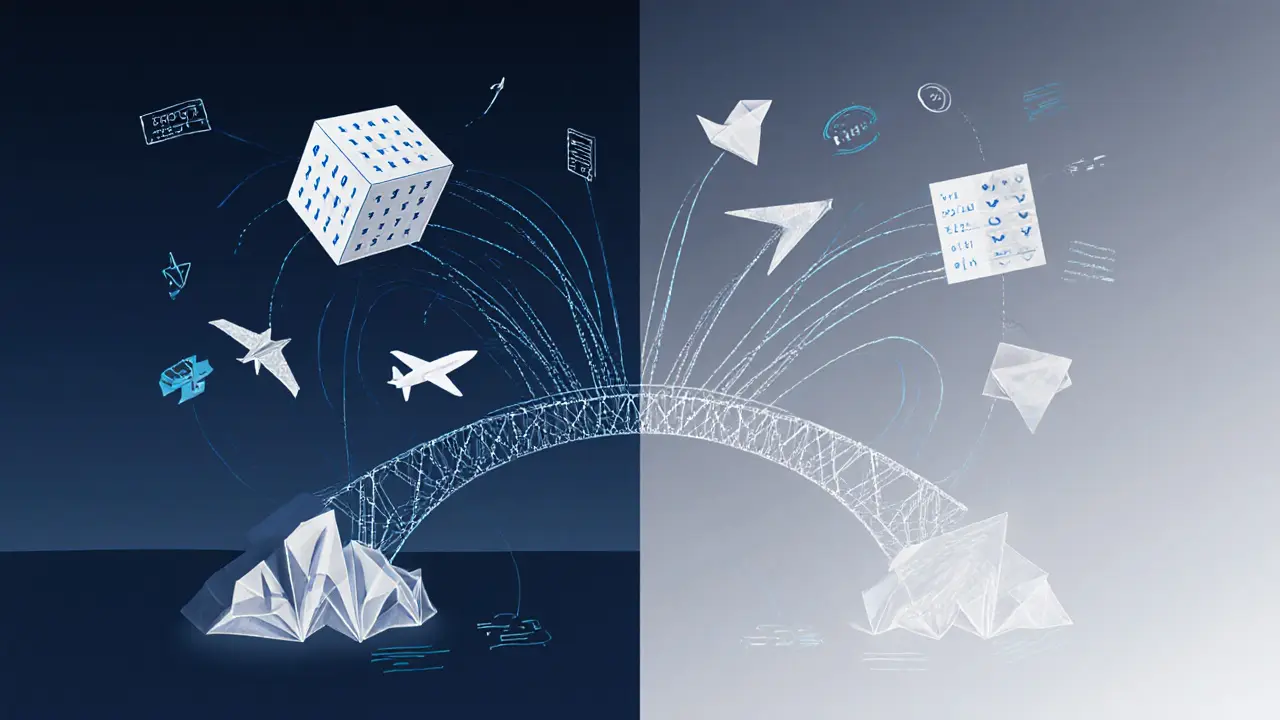

Smart contracts on blockchains like Ethereum are designed to run exactly as programmed-no exceptions, no human interference. But here’s the catch: they can’t see the outside world. They don’t know the current price of Bitcoin, whether a flight was delayed, or if a warehouse shipment arrived on time. That’s where oracles come in. They’re the bridge between blockchain logic and real-world data. Without them, most smart contracts would be useless in practical applications.

Why Blockchains Need Oracles

Blockchains are built to be isolated. That’s by design. If a blockchain could freely pull data from the internet, it would open the door to manipulation. Imagine a smart contract paying out insurance money based on a weather report-if that report could be changed by a single server, the whole system loses trust. Oracles solve this by bringing external data in securely, without breaking the blockchain’s core promise: immutability and consensus. The problem is called the “oracle problem,” first named by Sergey Nazarov in 2014. It’s not about whether data exists-it’s about how to trust it once it crosses into the blockchain. A centralized oracle, like one that pulls data from a single API, is risky. In March 2020, during “Black Thursday,” a single price feed from an exchange showed ETH at $0.01 for a few minutes. That triggered automatic liquidations worth $8 million in MakerDAO because the smart contract took the data at face value.How Oracles Work: The Step-by-Step Process

Oracles don’t just fetch data-they verify, aggregate, and deliver it in a way the blockchain can trust. Here’s how it typically works:- Define the need: A developer writes a smart contract that needs specific data-say, the current price of ETH in USD.

- Configure the oracle: They choose which data sources to use (e.g., CoinGecko, Binance, Kraken) and how many independent nodes should retrieve it.

- Retrieve data: Multiple independent oracle nodes call APIs, scrape websites, or connect to IoT sensors to gather the same data point.

- Aggregate and verify: The oracle network compares all the responses. If 7 out of 10 nodes report ETH at $3,200, it ignores outliers. This prevents manipulation from any single source.

- Deliver to blockchain: The verified result is sent as a transaction to the smart contract, which then executes its logic-like triggering a loan repayment or paying out an insurance claim.

Centralized vs. Decentralized Oracles

Not all oracles are created equal. There are two main types:- Centralized oracles: Use one data source and one provider. Simple, but vulnerable. If that provider’s server goes down or gets hacked, the smart contract fails. Early DeFi projects used these-and paid the price.

- Decentralized Oracle Networks (DONs): Use dozens or hundreds of independent nodes, each pulling data from multiple sources. Chainlink, Pyth Network, and Band Protocol are the leaders here. Chainlink alone connects to over 1,400 node operators and aggregates data from at least seven sources for its price feeds.

Real-World Use Cases

Oracles aren’t just for crypto traders. They’re powering real businesses:- DeFi lending: Aave and Compound use oracles to track collateral values. If ETH drops too far, loans get automatically liquidated to protect lenders.

- Insurance: Etherisc pays out flight delay claims automatically using flight data from airport APIs. They process $2.3 million in payouts monthly.

- Supply chain: Maersk and IBM’s TradeLens uses IoT sensors connected via oracles to track shipping containers. Shipment tracking accuracy hit 99.7%.

- NFTs: Some NFTs change appearance based on real-world data-like weather or stock prices-thanks to oracles.

Challenges and Risks

Even decentralized oracles aren’t foolproof. In October 2021, a hacker used a flash loan to temporarily inflate the price of a token on a decentralized exchange. The oracle picked up the fake price, and the smart contract lent out far more than it should have. The result? A $34 million loss on Cream Finance. The Cornell University 2022 study showed that flash loan attacks remain a top vulnerability. Oracles can be tricked if they rely on price data from illiquid markets. That’s why top networks now use volume-weighted averages and time-delayed feeds to smooth out spikes. Another issue? Cost. Using Chainlink on Ethereum can add 0.5% to 1.2% in gas fees to each transaction. For small payments, that’s a dealbreaker. Developers are now exploring Layer 2 solutions and cheaper chains like Polygon to reduce this burden.The Future: More Power, More Privacy

Oracles are evolving fast. Chainlink 2.0, rolled out in late 2023, lets oracles do more than just fetch data-they can run complex computations off-chain and send back the results. Think: “Calculate the average temperature in Tokyo over the last 7 days and return only the result.” This reduces blockchain bloat. The Cross-Chain Interoperability Protocol (CCIP), launched in September 2023, lets oracles move data securely between 12 different blockchains. That’s huge for users who want their smart contract on Solana to trigger based on data from Ethereum. Enterprise-grade tools are getting smarter too. Oracle’s Blockchain Platform now includes AI-powered anomaly detection that flags suspicious data feeds with 99.2% accuracy. Meanwhile, researchers at Cornell’s IC3 are testing “zero-knowledge oracles”-systems that prove data is real without revealing where it came from. That could be a game-changer for banks and governments that need privacy.

What Developers Need to Know

If you’re building on blockchain, here’s what matters:- Don’t trust one source. Always use multi-source aggregation.

- Check node count. Chainlink’s default is 7+ nodes. For high-value contracts, go higher.

- Use time-weighted data. Avoid last-second price spikes by using averages over minutes, not seconds.

- Test for edge cases. What happens if a data source goes offline? What if it returns an error? Your contract must handle it.

Regulation Is Catching Up

The EU’s MiCA regulation, effective in 2024, requires DeFi platforms to use “reliable data sources” for pricing. That means oracles aren’t optional anymore-they’re legally required for regulated services. Other regions are likely to follow. Market research firm MarketsandMarkets estimates the oracle market will hit $2.1 billion by 2027. Right now, DeFi uses 58% of oracle capacity, but enterprise adoption is growing fastest. By 2026, Forrester predicts 90% of enterprise blockchain projects will use multi-chain oracle networks.Final Thought

Oracles are the unsung heroes of blockchain. They turn static code into dynamic systems that interact with the real world. Without them, blockchain would be a beautiful but isolated machine. With them, it becomes a platform for insurance, supply chains, finance, and beyond. The challenge isn’t just technical-it’s about trust. And the best oracles don’t just deliver data. They prove it’s real.What is the main purpose of a blockchain oracle?

The main purpose of a blockchain oracle is to securely connect smart contracts with real-world data sources, like stock prices, weather reports, or flight statuses. Since blockchains can’t access external data on their own, oracles act as trusted bridges that bring off-chain information into on-chain smart contracts so they can execute based on actual events.

Are blockchain oracles safe?

Decentralized oracles are much safer than centralized ones. Single-source oracles can be hacked or manipulated, as seen in the 2020 Black Thursday incident. Decentralized Oracle Networks (DONs), like Chainlink, use multiple independent nodes and data sources to cross-verify information. This reduces the risk of manipulation by over 87%, according to Consensys. However, no oracle is 100% immune-flash loan attacks and poorly configured thresholds can still cause issues.

How does Chainlink differ from other oracle networks?

Chainlink is the largest and most widely adopted oracle network, securing over $75 billion in on-chain value. It uses over 1,400 independent node operators and aggregates data from at least seven sources for critical feeds like crypto prices. It also supports advanced features like verifiable randomness (VRF) and decentralized computation. Pyth Network focuses on speed (sub-500ms updates) and uses financial institutions as direct data publishers. Band Protocol is lighter and cheaper but has less market share. Chainlink leads in reliability, adoption, and enterprise integration.

Can oracles be used outside of cryptocurrency?

Yes, absolutely. Oracles are already used in supply chain (Maersk’s TradeLens tracks shipments with IoT sensors), insurance (Etherisc pays flight delay claims automatically), and even agriculture (smart contracts that release payments when soil moisture levels drop). Any real-world event that can be measured digitally-weather, temperature, delivery status, payment confirmation-can trigger a smart contract through an oracle.

What happens if an oracle goes down?

In a decentralized oracle network, if one node fails, others keep running. Chainlink, for example, requires data from at least seven independent sources before delivering a result. If one or two nodes go offline, the network still functions. However, if too many nodes fail simultaneously or if the entire network is compromised, the smart contract may stop working until the oracle is restored. That’s why redundancy and node diversity are critical.

Do oracles increase gas fees on Ethereum?

Yes, using an oracle typically adds 0.5% to 1.2% in gas fees per transaction because it requires an on-chain data update. This can be expensive for small payments. Developers often mitigate this by using Layer 2 networks like Polygon or Arbitrum, where gas costs are much lower. Some oracles also batch multiple updates into a single transaction to reduce overhead.

Ankit Varshney

Oracles are the quiet backbone of DeFi. Without them, smart contracts are just fancy calculators with no eyes. The fact that we can now trust weather data to trigger insurance payouts is wild.

Ann Ellsworth

Let’s be real-most oracle implementations are just glorified API wrappers with a blockchain sticker on them. The ‘decentralized’ claim is a marketing fantasy until you audit the node operators’ KYC docs. Chainlink’s 1,400 nodes? Half of them are shell companies registered in the Caymans.

And don’t get me started on the gas fees. You’re paying $12 to update a price feed that changes by 0.3%? That’s not innovation-it’s rent-seeking dressed up as decentralization.

Real trust isn’t about node count-it’s about cryptographic proof of data provenance. Until oracles implement ZK-proofs natively, we’re just moving the trust problem from banks to crypto bros with AWS accounts.

Reggie Herbert

Stop pretending decentralized oracles are safe. That 87% stat? It’s from Consensys-the same people who built the contracts that got hacked. You think having 7 nodes means anything when 5 of them pull from the same CoinGecko API? Pathetic.

Real solution? No oracles. Just use real-world contracts. Humans sign stuff. Paper. Ink. Not magic code.

Murray Dejarnette

Y’all are overcomplicating this. Oracles are the reason DeFi isn’t just a bunch of dumb contracts that crash when the price dips. I’ve seen it happen-$8M liquidated because one feed glitched. That’s not a bug, that’s a feature of centralized garbage.

Chainlink is the only one that matters. Period. If you’re not using it, you’re building on quicksand. And yes, gas fees suck-but you want safety or cheapness? Pick one.

Catherine Williams

As someone who’s helped onboard 3 small insurance startups onto blockchain, I can tell you: oracles are the make-or-break piece. We used Chainlink + a backup Pyth feed. One time, a node went down during a market crash-our contract kept running because the other 6 nodes agreed. That’s resilience.

Don’t fear the gas fees. Use Polygon. Use Arbitrum. The tech is here. The real barrier is mindset. Stop thinking blockchain = crypto. Think: trustless automation. That’s what oracles enable.

Shari Heglin

The assertion that decentralized oracles reduce failures by 87% is statistically invalid. The Consensys report fails to account for correlated failures across node operators who share infrastructure providers. The sample size is also skewed toward high-value DeFi contracts, which are not representative of the broader market.

Furthermore, the claim that enterprise adoption is growing rapidly is contradicted by Gartner’s own 2024 update, which notes that 61% of enterprise blockchain pilots were shelved due to oracle reliability concerns.

Mani Kumar

Oracles are the Achilles heel of blockchain. The entire edifice rests on a single point of failure: data integrity. No amount of node redundancy fixes the fundamental flaw-blockchains cannot verify external truth. That’s not engineering. That’s theology.

Tatiana Rodriguez

I just want to say how much I love how far we’ve come. Remember when we thought smart contracts could only handle simple transfers? Now they’re paying for flight delays, tracking shipping containers across oceans, even changing NFT art based on real-time stock prices. It’s like magic-but it’s real, and it’s happening right now.

I’ve been in blockchain since 2017, and I still get chills when I see a contract execute flawlessly because an oracle delivered the right temperature from a farm sensor in Iowa. That’s not just tech. That’s hope.

To everyone scared of gas fees or flash loans: yes, it’s messy. But we’re learning. Every hack teaches us. Every improvement makes it safer. We’re building the future, one verified data point at a time.

Philip Mirchin

For folks in India or Nigeria or Brazil: don’t think this is just for Wall Street. My cousin in Lagos uses a smart contract to get paid when her solar panels produce over 5kWh/day. Oracle pulls data from the inverter via SMS. No bank. No middleman. Just clean energy → fair pay.

That’s the real power. Oracles aren’t about crypto. They’re about access. About fairness. About cutting out the people who used to control the flow of value.

Britney Power

Let’s expose the truth: oracles are a Trojan horse for centralized control. Chainlink’s node operators are vetted by a private consortium. Their data sources are curated. Their pricing models are opaque. This isn’t decentralization-it’s institutional capture under the banner of ‘trustless’ systems.

And the AI anomaly detection? That’s just a black box trained on historical data that ignores geopolitical events. What happens when a war breaks out and the feed doesn’t reflect reality? You get another Cream Finance disaster. And they’ll blame the ‘bad data’-not their flawed architecture.

Don’t be fooled. The same players who ran Wall Street are now running the oracles. They just added a blockchain logo.

Maggie Harrison

Oracles = 🌉✨ The bridge between cold code and warm reality. I cried when I saw a smart contract pay out a farmer’s drought insurance because the soil sensor said ‘too dry.’ No paperwork. No waiting. Just truth, automated.

Yes, there are risks. Yes, gas fees hurt. But we’re learning. We’re fixing. We’re building something that actually helps people. And that’s worth fighting for. 💪🌱

Lawal Ayomide

Oracles are the reason African startups can now access global DeFi. My friend in Lagos uses Chainlink to get loans against his livestock. Sensors on the animals trigger repayment when they’re sold. No bank needed. That’s power.

justin allen

Chainlink is a socialist propaganda tool disguised as tech. Why should a bunch of anonymous nodes decide the price of ETH? That’s not freedom-that’s mob rule. Real markets are set by real people with skin in the game. Not some API scraper in a basement in Estonia.

USA first. Oracles should be American-owned. Or none at all.

ashi chopra

I work with small farmers in rural India. We’re testing a contract that pays out when rainfall drops below a threshold. The oracle uses satellite data from ISRO. No middlemen. No corruption. Just truth. It’s not perfect-but it’s the first time these farmers have ever had reliable insurance. Thank you for writing this. It matters.

samuel goodge

It’s worth noting that the ‘oracle problem’ is fundamentally a problem of epistemology-not just cryptography. How do we know a data point is true? In philosophy, this is the ‘problem of external world.’ Oracles, even decentralized ones, rely on a shared assumption of reliability. But what if the shared assumption is wrong?

For example: if all oracle nodes are fed data from a single weather service that’s been compromised by a state actor, the blockchain will still execute faithfully. The system is trustless, but the inputs are not. The real challenge is not scaling, but verifying the veracity of verification itself.

alex bolduin

Oracles are the unsung heroes. No one talks about them but they’re the reason any of this works. I built a contract that pays out when my dog’s smart collar detects he’s been walking more than 10km a day. It’s dumb. But it works. Because of oracles.

Vidyut Arcot

Don’t let the hype scare you. Start small. Use Chainlink’s testnet. Try pulling a weather API. See how it feels. You don’t need to be a genius-just curious. And if you mess up? You learn. That’s how we grow.

Blockchain isn’t about being perfect. It’s about being persistent.

Jay Weldy

Every time someone says ‘oracles are a single point of failure,’ I think of the 12-year-old in Kenya who got her first payment from a crop insurance contract because the oracle confirmed drought. That’s not a flaw. That’s a breakthrough.

Yes, the tech is imperfect. But the impact? Real. Let’s fix it together-not tear it down.

Melinda Kiss

My mom used to say, ‘Trust but verify.’ Oracles do that. They don’t just give you data-they prove it’s real. I work in compliance, and I’ve never seen a system this transparent. Even the audit logs are on-chain.

Gas fees? Yeah, annoying. But we’re moving to Layer 2. And honestly? The peace of mind? Priceless.

❤️

Sarah Locke

If you’re building on blockchain and you’re not using multi-source oracles, you’re not building-you’re gambling. I’ve audited 47 contracts. 12 got hacked because they trusted one feed. 35 survived because they asked three sources.

Don’t be the one who says ‘I didn’t know.’ You know now. Go fix it. Your users are counting on you.

Darlene Johnson

Chainlink is owned by the same people who ran the 2008 crisis. They’re using oracles to create a new financial cage. They’ll lock you in with ‘trustless’ contracts while they manipulate the data behind the scenes. The Fed will soon require all oracles to be compliant. That’s not regulation-it’s control.

They’re coming for your assets. Don’t let them trick you with ‘decentralized’ buzzwords.

Ivanna Faith

Oracles are the future… 🌐✨ But honestly? I still don’t get how they work. Like, do they just… scrape websites? And then what? Magic?

Also why do I have to pay for this? Can’t it just be free? 😅

Akash Kumar Yadav

India’s Aadhaar system could replace 90% of oracles. Biometric identity + real-time government data feeds. Why pay for Chainlink when your own state provides verified data? This is Western tech fetishism.

Ziv Kruger

What is truth? If a tree falls in the forest and no oracle is there to report it, does it make a sound? If a smart contract pays out based on data that was never truly verified, is it justice-or just code acting out a lie?

Oracles don’t solve the oracle problem. They mask it. They make us feel safe while the foundation remains sand.

Perhaps the real innovation isn’t in how we bring data on-chain-but in how we stop needing it at all.

Reggie Herbert

Exactly. And that’s why the only real solution is to avoid oracles entirely. If you can’t trust the data, don’t automate it. Let humans decide. It’s messy. It’s slow. But it’s honest.