Crypto Compliance: What It Means and How It Affects Your Trading

When we talk about crypto compliance, the set of legal and operational rules that crypto businesses must follow to avoid fines, shutdowns, or criminal charges. Also known as virtual asset regulation, it’s what separates legitimate platforms from scams that vanish overnight. This isn’t about government overreach—it’s about survival. If a crypto exchange doesn’t follow KYC, AML, or reporting rules, it gets blocked by banks, frozen by regulators, or shut down by law enforcement. Look at Nanu Exchange or My1Ex.com—both disappeared because they ignored compliance. Meanwhile, BTSE and the Central Bank of Jordan’s new rules show how serious this has become.

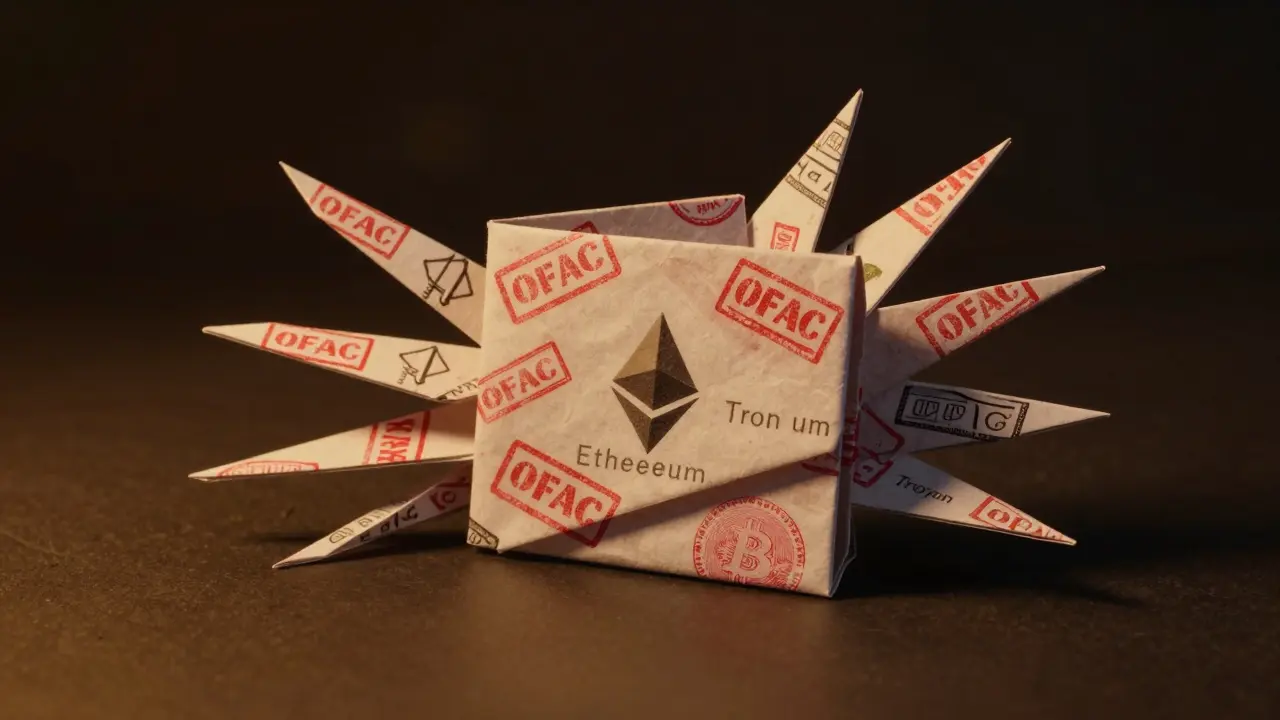

Blockchain forensics, the technology that traces crypto transactions to identify illegal activity. Also known as cryptocurrency tracing, it’s the backbone of modern crypto compliance. Tools from Chainalysis and Elliptic don’t just track hackers—they flag suspicious wallets, detect mixers, and help governments enforce sanctions. That’s why Russia’s new Bitcoin trade law works: it forces companies to use compliant gateways that report every transaction. Same goes for Sweden’s mining restrictions—they’re not just about energy, they’re about controlling who can operate and how. Even meme coins like DOGS or CATCOIN aren’t safe from scrutiny. If a project doesn’t disclose its team or liquidity, regulators see it as a red flag.

AML blockchain, anti-money laundering systems built directly into crypto protocols to prevent fraud and illicit flows. Also known as crypto AML, these aren’t optional anymore. India’s 30% crypto tax and TDS rules? That’s AML in action. Jordan’s 2025 law? It’s AML with teeth. Even decentralized exchanges like FairySwap get flagged—not because they’re decentralized, but because they have zero transparency, no audits, and no way to verify users. Compliance doesn’t mean giving up privacy. It means proving you’re not hiding anything. The projects that thrive now are the ones that build compliance into their DNA: Trusta.AI verifies real humans, IEMGon backs tokens with real ETF assets, and BaseX integrates with Coinbase’s regulated infrastructure.

You’ll find posts here that show you exactly how this plays out in the real world—from dead coins like Francs that never followed rules, to exchanges like Fides that were pure scams, to platforms like BTSE that thrive because they play by the book. Some of these stories are warnings. Others are blueprints. Either way, if you’re trading, holding, or investing in crypto today, you’re already inside the system. The question isn’t whether compliance matters—it’s whether you know how to navigate it.