Cryptocurrency Exchanges: What They Are, How They Work, and Which Ones to Avoid

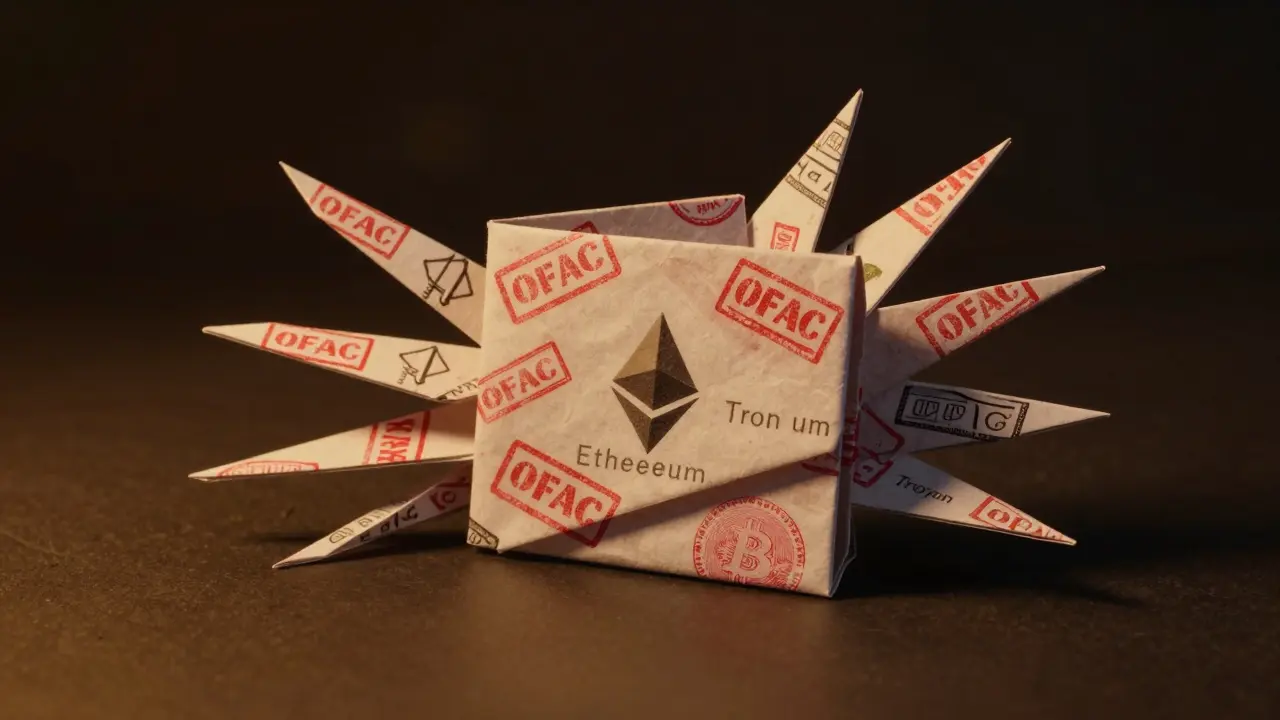

When you buy or trade cryptocurrency exchanges, platforms that let users trade digital assets like Bitcoin, Ethereum, and altcoins. Also known as crypto trading platforms, they’re the gateways between fiat money and the blockchain world. But not all of them are created equal. Some are fast, secure, and built for pros. Others? They vanish overnight with your money.

There are two main types: centralized exchanges, like BTSE or Binance, where a company holds your coins and handles trades, and decentralized exchanges, like FairySwap or BaseX, where you trade directly from your wallet without a middleman. Centralized ones are easier for beginners but require trust in the operator. Decentralized ones give you full control but demand more tech know-how—and often come with zero trading volume or hidden risks.

Many people don’t realize how many fake exchanges exist. Platforms like CryptloCEX, a known scam with no real operations or user base, or My1Ex.com, a platform with zero volume and 100% negative reviews, look real until you try to withdraw. Then you’re locked out. Even some that sound legit—like Fides, a fake exchange with no regulatory license or audits—are designed to steal funds before disappearing. The red flags? No transparency, no user data, no licensing, and promises that sound too good to be true.

On the other side, real exchanges like BTSE serve serious traders with high-leverage futures, multi-asset collateral, and fast execution—but they’re not for new users. Meanwhile, privacy-focused DEXs like FairySwap claim to use zero-knowledge proofs but have no trading activity to prove it. And then there are platforms that shut down without warning, like Nanu Exchange, leaving users with nothing.

This collection doesn’t just list exchanges. It cuts through the noise. You’ll find deep dives into platforms that actually work, warnings about scams hiding in plain sight, and breakdowns of obscure tools that claim to be exchanges but aren’t—like cross-chain bridges or identity protocols that get mislabeled. You’ll learn why some exchanges thrive while others collapse, how regulation shapes the market in places like India and Jordan, and what makes a crypto platform trustworthy—or deadly.

Whether you’re looking for the best place to trade derivatives, trying to avoid a scam that looks like a startup, or just want to know why a platform with no trading volume even exists—this is where you’ll find the truth, not the hype.