Arbitrum DEX

When working with Arbitrum DEX, a set of decentralized trading platforms that run on the Arbitrum layer‑2 network. Also known as Arbitrum-powered exchanges, it offers faster transactions and lower fees compared to Ethereum‑only alternatives. In the same breath, a decentralized exchange lets users trade crypto directly from their wallets without a central custodian is the broader category that Arbitrum DEXs belong to. The underlying Arbitrum is a layer‑2 scaling solution that bundles many transactions into a single rollup, making the whole ecosystem more affordable and responsive.

Why layer‑2 scaling matters for decentralized trading

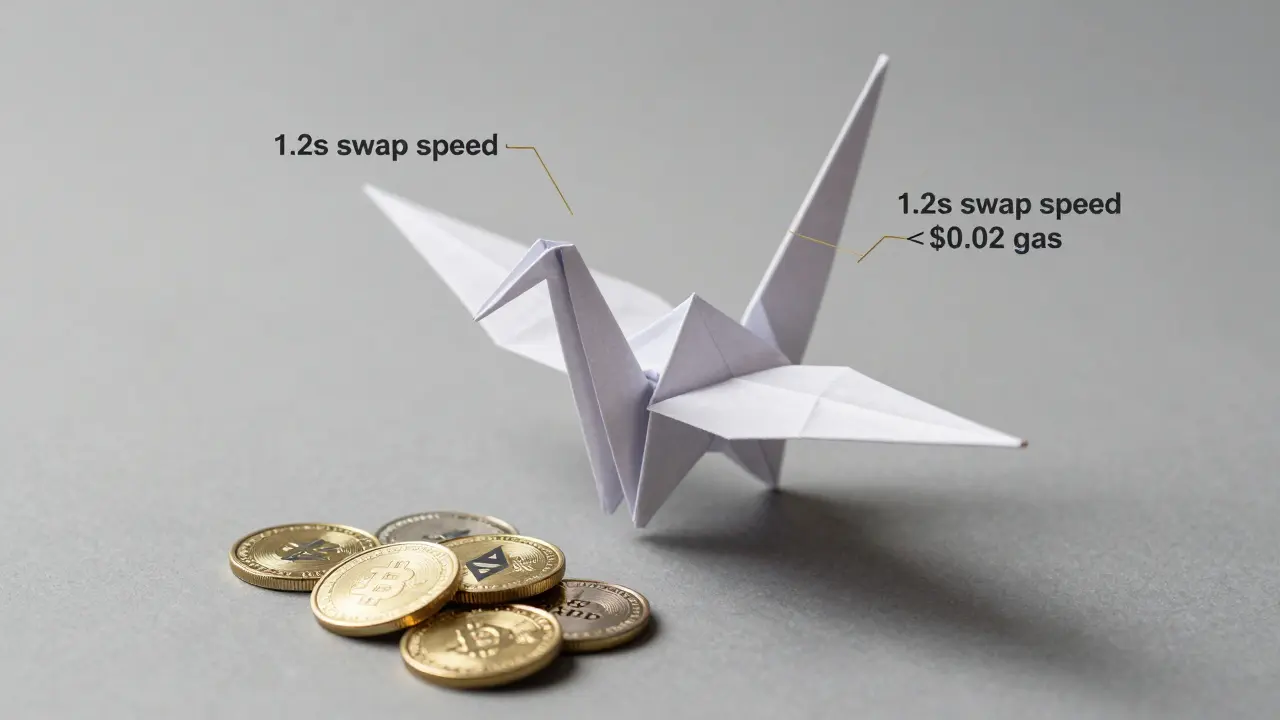

The key to Arbitrum DEX performance is layer 2 scaling technology that processes transactions off the main Ethereum chain while preserving security through rollups. This approach reduces gas costs and speeds up order execution, which is a big win for traders who hate waiting for confirmations. Because Arbitrum inherits security from Ethereum the original smart‑contract platform that secures the network, users still benefit from the same level of trust while enjoying layer‑2 efficiency. The relationship can be summed up as: Arbitrum DEXs utilize layer‑2 scaling to lower fees, and layer‑2 scaling relies on Ethereum for finality. This triple—Arbitrum DEX, layer‑2 scaling, Ethereum—creates a sweet spot for DeFi users who want speed without sacrificing safety.

Beyond speed, liquidity is the lifeblood of any exchange. On Arbitrum DEXs, liquidity providers (LPs) can earn fees in a lower‑cost environment, which often translates into better yield compared to their Ethereum‑only peers. The liquidity pool a collection of token pairs supplied by users to enable trades operates the same way as on other DEXs, but the reduced transaction overhead means LPs see less slippage and higher net returns. Traders also notice tighter spreads because the market makers don’t need to factor in high gas expenses. This creates a feedback loop: cheaper trades attract more volume, which in turn draws more LP capital, further tightening spreads. The result is a more vibrant trading environment that benefits both casual swappers and serious arbitrageurs.

Security and user experience round out the picture. Because Arbitrum DEXs inherit Ethereum’s security model, they are resistant to many attacks that plague older, less‑secure chains. Yet they also bring newer tooling, such as built‑in gas‑price estimators and UI widgets that hide the complexity of layer‑2 bridges. Users can move assets from Ethereum to Arbitrum with a single click, and many DEX interfaces now display real‑time rollup status so you know exactly when your funds are safe. Moreover, most Arbitrum DEXs support popular wallets like MetaMask, Rainbow, and Trust Wallet, meaning you don’t need a new setup to start trading. This ease of entry lowers the barrier for newcomers, while advanced features like custom routing and multi‑hop swaps satisfy power users.

Below you’ll find a curated list of articles that dig deeper into these topics. From detailed reviews of SushiSwap V3 and SpiritSwap on Arbitrum, to step‑by‑step guides on providing liquidity and claiming airdrops, the collection covers everything you need to navigate the Arbitrum DEX landscape confidently. Whether you’re hunting the lowest fees, comparing yield opportunities, or just want to understand how layer‑2 tech reshapes DeFi, these posts have you covered.