2025 Crypto Archives: DeFi, Airdrops, Exchanges, and Blockchain Trends

When looking at the crypto landscape in October 2025, a month marked by regulatory shifts, airdrop fatigue, and real-world blockchain adoption. Also known as the tail end of the 2025 crypto cycle, this period saw users move past hype and focus on what actually works: secure exchanges, verifiable token utility, and clear governance. The biggest stories weren’t about price spikes—they were about who got left behind, who followed the rules, and who built something real.

Crypto airdrops, token distributions tied to community activity or platform milestones. Also known as free crypto giveaways, it became harder to tell real drops from scams. Posts like the one on xSuter (XSUTER), a BNB Chain-based token with a structured claim process. Also known as XSUTER airdrop, it and PNDR (Pandora Protocol), a CoinMarketCap-backed community token. Also known as PNDR airdrop, it gave users clear steps, while others, like the fake FaraLand (FARA), a play-to-earn game that claimed an airdrop but had no active distribution. Also known as FARA 2025, it served as a warning. People learned: if it sounds too easy, it’s probably a trap.

Crypto exchanges, platforms where users buy, sell, or trade digital assets. Also known as crypto trading platforms, they faced new pressure. Japan’s BICC Exchange, a regulated platform competing with BitFlyer and Coincheck. Also known as Japanese crypto exchange, it stood out for compliance. Meanwhile, U.S. users dug into SEC exemptions, legal pathways allowing certain crypto projects to avoid registration. Also known as Regulation D crypto, it under the Howey Test. And for beginners, guides on picking the right exchange focused on fees, security, and ease of use—not just token listings.

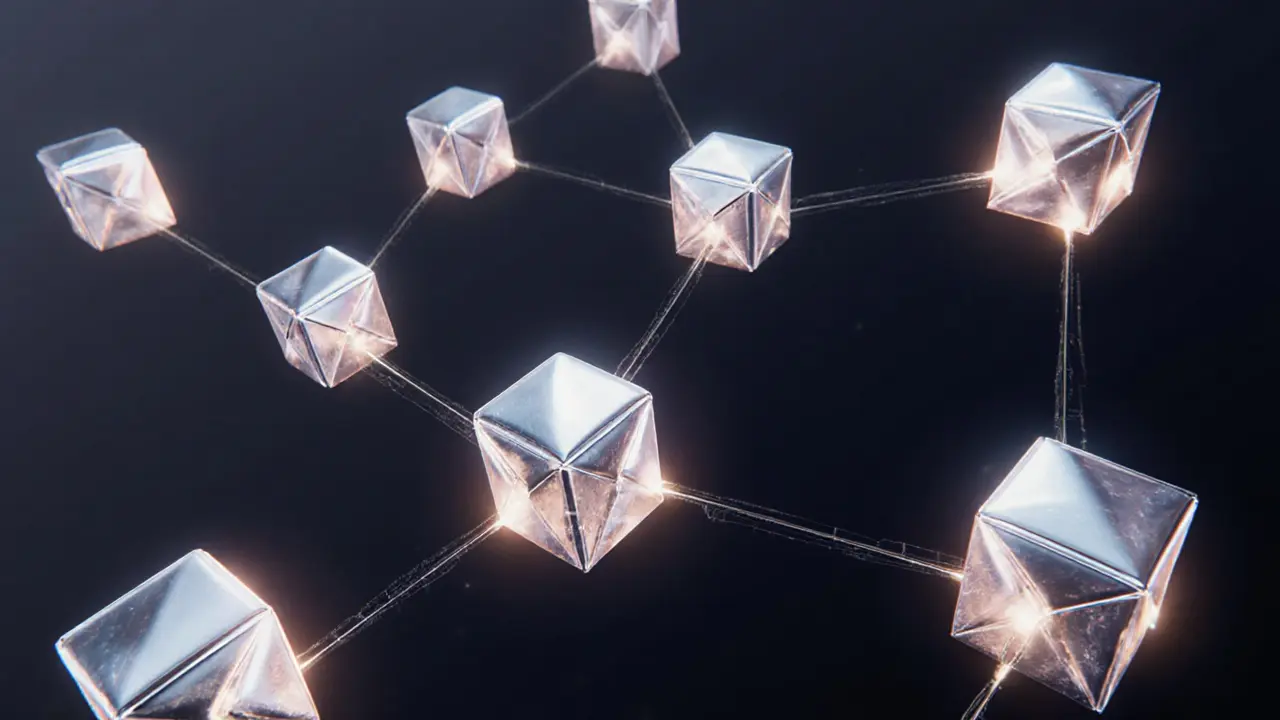

DeFi kept evolving, too. DAO voting methods like quadratic and conviction voting got real-world tests. Tools like Snapshot became standard. But participation stayed low—proving that governance isn’t just about tech, it’s about incentives. At the same time, blockchain moved beyond finance. Real examples showed it tracking medicine supply chains, verifying digital IDs, and even managing energy grids. These weren’t prototypes—they were live deployments.

And then there was Bitcoin. Not as a price chart, but as a system. Posts broke down how the 32-bit nonce range forces miners to use clever workarounds. How mining difficulty isn’t just a number—it’s a self-correcting mechanism keeping the network secure. And how memecoins, fueled by TikTok and Reddit, still moved markets, even if they had no real utility.

By October 2025, the crypto space had shed its wild west image. It wasn’t gone—just quieter. The survivors were the ones who built with transparency, followed the rules, or at least knew when to walk away. Below, you’ll find the posts that captured that shift: the airdrops you could actually claim, the exchanges you could trust, the blockchain uses that mattered, and the risks you couldn’t ignore.